Independent Thinking®

Charting a Path Through Market Downturns

November 1, 2018

Falling market values didn’t bother me much when I was younger. I figured everything would get better, sooner or later. Now that I no longer have the luxury of a long-term personal investment horizon, I more fully understand why so many people feel deeply unsettled during market downturns. It’s the way we act when we experience panic – our own and in the markets – that often determines the outcome.

In the almost 10 years since the start of this bull market, there have been 62 market panics, or sizable downturns. These include five outright corrections with the S&P 500 down by 10% or more, but not a drop of 20% or more that would have taken us into bear market territory.1 Most were almost immediately followed by relief rallies; investors who had sold and relegated themselves to the sidelines had reason for regret as the market continued its climb. But someday – and no one knows exactly when – the start of what looks like another panic will instead herald a turn in the cycle. Prior to our current bull market, the longest period without a 20% drawdown was the 113 months ending in March 2000. We are now at 115 months and counting.

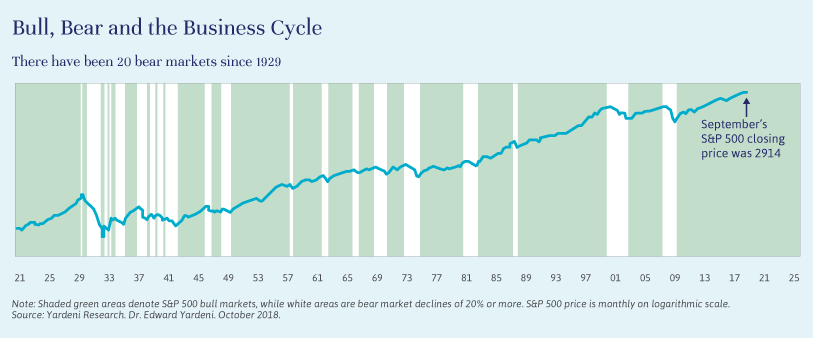

Bear markets are inevitable and painful. There have been 20 bear markets since 1929, as illustrated below, with an average drawdown peak-to-trough of 37% and the average 3.3-year recovery time. Investors, particularly older investors, should have portfolios positioned to ride out hard times, to avoid forced sales at depressed prices.

That’s why we evaluate each asset class based on their likely returns over the next 10 years (their return characteristics), on their riskiness (volatility), on how they fit together with other assets (correlation), on how easily can they be sold (liquidity), and how they are taxed. As I’ve noted before, if allocations are kept intact, investors generally should be ahead of the game again within 40 months of a drawdown.

For most people, spending really is key, particularly for those in or approaching retirement. The old rule of thumb, that you only need 70% or so of your preretirement income to live on, is being rethought as life spans lengthen and we enjoy far more active – and expensive – leisure years than those of our parents or grandparents. Travel, hobbies, philanthropy, and the sky-high costs associated with aging mean that we may actually need more, even significantly more, of our pre-retirement income to spend in retirement.

Indeed, a recent Wall Street Journal article found that retirees are likely to spend 130% of their pre-retirement income.2 Those of us who are accustomed to living well may find that proportion on the conservative side, as inflation for many luxury goods and services continues to rise at about twofold the general rate.3

With a well thought-out budget in hand, we can judge whether we have sufficient assets to fund our spending. For those of us who wish to leave a legacy to children and charities, as well as support our own lifestyles, we can confidently spend approximately 3% of the value of the assets every year after taxes and inflation. If the intent is to spend the assets down, that proportion could be higher, of course, although anxiety levels may rise accordingly.

Many of our balanced portfolios have a current allocation of between 20% and 25% of cash or defensive assets, which should cover at least three to five years of spending. If that’s not going to be enough, we should consider changing the asset allocation mix to increase cash and defensive assets – and take a hard look at spending.

Personally, I always want to have sufficient cash or defensive assets available to cover three to five years of my current spending. On that basis, I can afford to be more aggressive with my other assets, depending on circumstances, investing in illiquid private equity and real estate where I expect higher returns. When the drawdown does occur, I can tap my reserves for spending and to fund capital calls for my other investments as I wait for the market to recover.

That doesn’t mean I won’t feel at least some sense of panic. Heck, I feel a little anxious even writing about it. But I’ll be ready to ride it out and to take advantage of the opportunities it might afford, as I hope all of our clients will as well. With proper planning, carefully constructed portfolios and controlled spending, we should be able to take downturns in stride.

Jeff Maurer is the CEO of Evercore Wealth Management and the Chairman and CEO of Evercore Trust Company, N.A. He can be contacted at [email protected].

1 Yardeni Research.

2 Wall Street Journal September 23, 2018.

3 Coutts Luxury Price Index Inflation.