Independent Thinking®

Concentrating on High-Quality Businesses

June 30, 2022

After years of easy money, aggressive monetary tightening raises important questions for investors. What’s the best way to be positioned in such a challenging investment environment? And, more hopefully, what are the investment opportunities?

A focus on quality seems to us a reasonable response in these circumstances. Although high-quality companies also decline in turbulent markets, these companies generally have withstood the test of time by successfully enduring economic downturns and rebounding strongly once the economy and stock market eventually recover.

While there is no universally accepted definition of quality, we find that high-quality businesses can be identified in terms of five key attributes: high profitability, a sustainable competitive advantage, attractive long-term growth prospects, capable management teams, and strong balance sheets. In our view, these characteristics should enable such companies to achieve sustained investment performance over a full market cycle.

Let’s take a look at each of these components:

High Profitability: A defining characteristic of high-quality businesses is their ability to earn sustainably high returns on invested capital over time. (Return on invested capital measures the after-tax operating income of a business relative to the total capital employed in the business.) High-profit businesses, such as Apple, MasterCard, and Home Depot, can consistently earn strong returns on invested capital, exceeding the cost of capital demanded by shareholders and creditors. These rare businesses often possess pricing power or, alternatively, utilize their resources more efficiently to generate strong returns and strong, predictable cash flows.

Sustainable Competitive Advantage: A sustainable competitive advantage enables a business to earn higher compounded rates of return over time than its competitors. Primary sources of competitive advantage often include intangible assets such as brand names like Nike, intellectual property protected by patents or copyrights such as Walt Disney, or licensing and franchising agreements like McDonald’s. Other sources of competitive advantage include economies of scale or cost leadership (e.g., Amazon), products or services with high switching costs (such as Microsoft), industries with high barriers to entry (e.g., FedEx), and network effects where the business becomes increasingly valuable as the number of participants in the network increases.

Attractive Long-Term Growth Prospects: High-quality businesses also have significant opportunities to grow by increasing market share, expanding into new markets, or by introducing new products and services (as Alphabet has done with cloud computing services, artificial intelligence, and autonomous driving). In their widely acclaimed book on corporate valuation, McKinsey & Co. consultants found strong empirical evidence that long-term revenue growth – particularly organic revenue growth – is the most important driver of shareholder returns for companies with high returns on invested capital.2 Furthermore, they found that investments in research and development correspond powerfully with long-term shareholder returns.1 In other words, it is the ability to grow the business by reinvesting capital at high rates of return that drives the strong long-term compounding effects of high-quality companies.

Capable Management Teams: A business that exhibits several quality characteristics could nonetheless underperform if it is led by an ineffective management team. Ineffective management teams often destroy, rather than create, shareholder value through imprudent use of company resources or by diminishing the company’s competitive advantage through poor decision-making. Indications of strong management teams include candor in communicating business results, a clearly articulated business strategy, a demonstrated track record of success, a history of deploying capital effectively, and a strong commitment to shareholder interests, as evidenced by JP Morgan Chase, for example.

Strong Balance Sheets: Companies with strong balance sheets (i.e., low-to-moderate debt levels) have greater financial flexibility and can withstand economic downturns or external shocks better than firms with weaker balance sheets. Strong balance sheets are particularly important during periods of heightened market volatility. Companies with this attribute like Morgan Stanley can use their financial resources to increase dividends, repurchase shares at depressed prices or take advantage of attractive business opportunities.

What about valuations? One practical challenge of investing in high-quality businesses is that, as a group, they are often more expensive relative to lower-quality peers and the overall market because of their superior characteristics. Interestingly, financial economists have found that returns from quality stocks may be abnormally high on a risk-adjusted basis even after accounting for their more expensive valuations. A plausible explanation for this anomaly is that analysts and investors systematically underestimate the future returns of high-quality businesses relative to lower-quality firms.3

Although high-quality businesses can outperform despite higher valuations, investors should hesitate to overpay at the cost of reducing long-term compounding benefits. We believe a market downturn provides long-term investors with an opportunity to add to existing high-quality businesses at more attractive valuations. Furthermore, businesses with extended valuations or deteriorating fundamentals should be sold and replaced with higher-quality businesses with more compelling valuations and longer-term prospects.

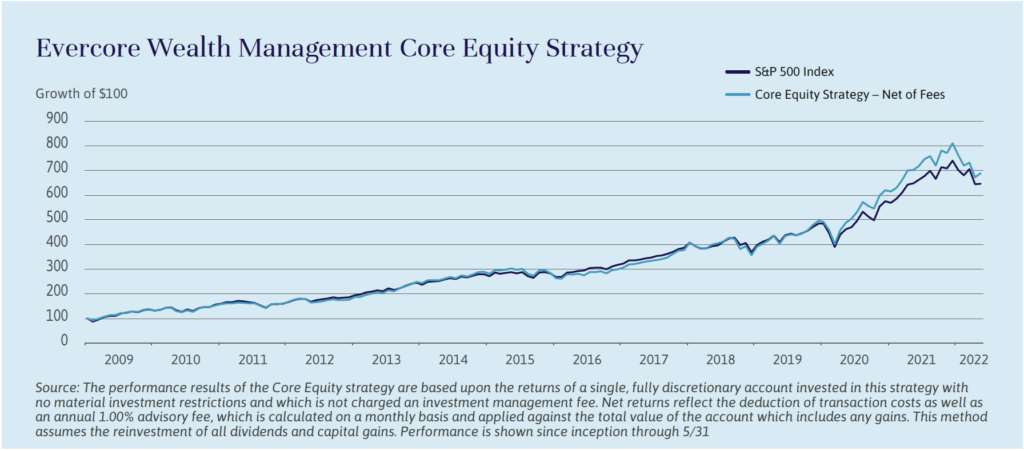

Evercore Wealth Management strives to purchase shares of high-quality businesses at attractive valuations and hold them for the long term. As illustrated below, this approach has enabled our clients to benefit from the economic advantages of these stable businesses and capture their long-term compounding effects.

Aldo Palles is a Managing Director and Portfolio Manager at the Evercore Wealth Management office in Palm Beach, Florida. He can be contacted at [email protected].

1 B. Jiang and T. Koller, “How to Choose Between Growth and ROIC,” McKinsey on Finance, no. 25 (Autumn 2007): 19-22, www.mckinsey.com.

2 Tim Koller, Marc Goedhart, and David Wessels, Valuation: Measuring and Managing the Value of Companies, 7th ed., (Hoboken, NJ: John Wiley, 2020).

3 Jean-Philippe Bouchaud, Stefano Ciliberti, Augustin Landier, Guillaume Simon, and David Thesmar, “The Excess Returns of ‘Quality’ Stocks: A Behavioral Anomaly,” 2016.