Independent Thinking®

Decoding Illiquid Alternatives

October 27, 2015

Many of the portfolios that we manage have a 5%-10% allocation to illiquid alternatives, as these investments are expected to generate strong returns relative to traditional asset classes. We seek opportunistic funds and managers that we believe have the potential to outperform public markets by at least 500 basis points, to provide a premium that compensates investors for their lack of liquidity.

Risk is managed through manager selection and selective allocations.

An optimal allocation will have exposure to multiple sub-classes and strategies, and diversification across vintage years, industry sector, stage of investment and geography. As with any investment, including illiquid alternatives should be evaluated in the context of individual risk tolerance, liquidity needs and investment horizon. Two of the critical factors are (I) investment strategy and (II) vehicle structure.

I. Investment Strategy

Illiquid alternatives is an umbrella term for different types of investment strategies that can range from private equity, to illiquid credit, to investments in real assets such as real estate and infrastructure projects. Strategies are generally categorized based on the stage of investment or types of underlying assets.

Private Equity

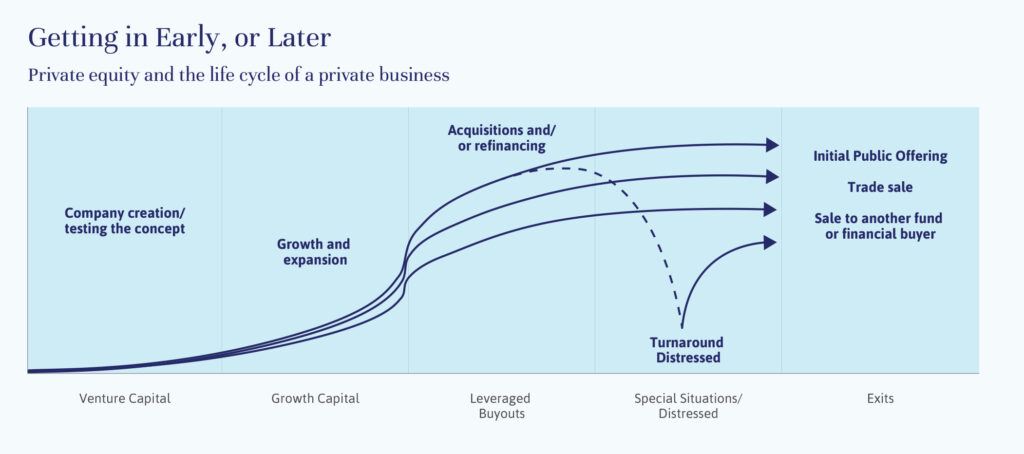

Venture Capital

- Venture Capital, or VC, funds provide capital for promising start-up companies with high growth potential that have a new technology, product, concept, or business model. Investments can be in seed stage, early stage, late stage, and pre-IPO stage businesses. Facebook, which became public in 2012, is a classic example.

- Capital funding can be used to test a concept or to launch, develop or expand a business.

- VC firms generally take a minority ownership position (10%-30%) in companies.

- VC is a high risk/high potential reward investment, and the percentage of failures among venture-backed firms is very high. VC funds typically invest in a large number of deals (10-15+) in the hopes that one or two will drive the overall fund’s returns.

Growth Capital

- These are investments in slightly later stage companies, usually with proven concepts/products that are looking to grow their operations. Most growth companies already generate revenue and may be cash flow positive, but need additional funding to expand.

- Capital can be used to scale-up operations, enhance distribution, expand geographically, develop a new product, or finance an acquisition. Growth capital is generally a minority equity investment (10%-40%).

- The general partner typically provides financial capital as well as strategic guidance and operational support.

Buyout

- These invest in mature companies that already generate significant cash flow. Equity capital is often used for acquisitions and/or refinancing transactions.

- Buyout firms acquire a controlling interest, generally 100%. Most transactions are made using both debt and equity, with the debt portion usually accounting for 50%-85% of the purchase price.

- The general partner has significant influence over the timing, terms and conditions of their investment. Many general partners are also active in trying to create value in the businesses, serve on the Board of Directors, and are involved in all major strategic decisions for the company.

Illiquid Credit

Special Situations/Distressed

- These are investments in financially or operationally distressed companies through the purchase of debt or equity as part of restructuring.

- Distressed companies are often fundamentally good businesses but are undergoing challenges, such as out-of-control expenses, a new or formidable competitor, or an unsound capital structure.

- There are typically two approaches in distressed investing:

- Control-oriented approach – A fund acquires a large position in the debt securities of a distressed company to secure a control position in bankruptcy proceedings. The general partner takes an active role in the restructuring.

- Restructuring/turnaround approach – A fund infuses new equity into a company to take control of and restructure the company. American Apparel, for example, is currently a private equity target.

Mezzanine Debt

- These are subordinated debt or preferred equity investments. They provide high-yield debt to reasonably mature companies that generally have positive earnings and cash flow, but need additional capital for acquisition or refinancing transactions.

- Mezzanine debt is a hybrid instrument that usually has an equity component (e.g., a warrant) attached.

Real Assets

Real Estate

- Equity and/or debt investments in office, retail, residential and other properties. Strategies include:

- Core Properties: Funds generally invest in stable, fully leased multitenant properties within strong, diversified metropolitan areas.

- Core Plus: Funds generally invest in core properties, although many of the properties will require some form of enhancement or value-added element.

- Value Added: This strategy involves buying a property, improving it in some way, and selling at an opportune time for a gain. Properties are considered value-added when they exhibit management or operational problems, require physical improvement, and/or suffer from capital constraints.

- Opportunistic: A high-risk/high-return strategy. The properties will require a high degree of enhancement. They may also involve investments in development, raw land, mortgage notes, and niche property sectors.

Energy

- These are investments in the energy sector at various stages.

- Targets include oil and gas, power generation, pipelines, energy services, and renewables.

Infrastructure

- These are investments in public infrastructure, such as roads, bridges, tunnels, toll roads, airports and mass transportation.

- These investments are popular in emerging markets due to the high demand for infrastructure.

II. Vehicle Structure

Equally important to selecting the investment strategy is the structure of the investment vehicle. Most illiquid alternative investments are structured as privately managed pools of long-term capital. These pools then invest in companies or securities that are privately held and/or illiquid. Certain structures, such as a single fund investment or co-investment, can be highly focused on a particular niche sector, while others, such as fund-of-funds or secondary funds, are broadly diversified across strategies.

Single Fund Investment

- Investors, known as the limited partners, commit capital to a fund, which then deploys the capital over a multiyear period.

- The fund manager, known as the general partner, has specialized areas of expertise, such as a particular strategy, industry or geography. General partners add value to the companies that they invest in by monitoring management, serving on the Board of Directors, and contributing to major strategic decisions.

- The typical holding period for each company investment is 4-6 years. Invested capital plus any gains are distributed to the limited partners after investments are sold.

- Private equity and real estate funds typically invest in 8-10 companies, while venture and credit strategy funds usually invest in a more diversified portfolio of 10-25 companies/securities.

- General partners typically raise a new fund every 3-5 years.

- Funds usually take 8-10 years to return all capital to limited partners.

- Fees range from 1.5%-2.5% management fee plus 15%-25% carry.

Fund-of-Funds Investment

- A fund-of-fund invests in a pool of other private equity funds, or a combination of funds, secondaries and co-investments.

- This approach allows for diversification across sectors, stage of investment, and geography. A fund-of-fund often has access to top-tier fund Managers. Fund-of-funds raise new funds every 1-3 years. A fund-of-fund usually takes 8-12 years to return all capital to limited partners.

- Fees include the management fees and carry of the underlying funds, plus an additional 1.0%-1.5% management fee and 5%-15% carry for the fund-of-funds manager.

Co-Investments

- Co-investments in a privately held company allow investors to participate alongside a general partner in a portfolio company. Some general partners offer co-investment rights to their limited partners on select portfolio companies, typically for larger deals that require more capital than the fund can provide. The typical holding period is 4-5 years.

- There is usually no management fee, and a carry of 0%-10%.

Secondary Investments

- Fund interests are purchased from existing limited partners who are seeking liquidity from primary commitments.

- Secondary interests are often sold at a discount to current net asset value. The discounts vary based on supply/demand of the market and the complexity of the transaction.

- Secondary funds are often broadly diversified across strategy, sector, geography and vintage year. They usually return all capital in 4-8 years.

- Fees include the management fees and carry of the underlying funds, plus an additional 1.0%-1.5% management fee and 5%-15% carry for the secondary fund manager.

At Evercore Wealth Management, we are currently focused on illiquid alternative managers or funds that have broad, diversified platforms and are adept at allocating across multiple strategies where they see the most attractive opportunities. We also prefer to invest with select managers who can actively add value to the businesses they invest in by providing strategic advice and guidance, rather than simply providing passive capital and/or financial leverage. We believe these managers will be better positioned to generate attractive returns in uncertain economic landscapes.

Stephanie Hackett is a Managing Director and Portfolio Manager at Evercore Wealth Management. She can be contacted at [email protected].