Independent Thinking®

ESG: Tough Love in a Changing Environment

June 30, 2022

It still isn’t easy being green. Some environmental and, for that matter, social and governance investing practices are under attack, as regulators and the financial press question the aggressive marketing of ethical principles to attract trillions of dollars in global capital. This scrutiny is long overdue and should ultimately benefit investors who hope to help create a better world. In the interim, current events are refining how individuals and institutions feel about ESG investing.

For example, inquiries regarding how ESG scoring integrates gun control skyrocketed after mass shootings, as one might expect, so much so that some large ESG investment solutions changed their methodology. More recently, however, many investors are reconsidering technology company exposures, hitherto the darlings of many ESG portfolios, over concerns about the risks associated with social media and the companies’ own governance issues.

The most dramatic changes in sentiment apply to U.S. domestic energy and defense contractors, two sectors that have traditionally scored very poorly on the screens of ESG data providers. But now the thinking goes something like this: Should a domestic natural gas producer sending liquefied natural gas to Europe now be considered socially responsible? What about a defense contractor that sells weapons to a country fending off an invasion? And should ESG scores for companies with high levels of exposure in revenues to countries run by autocratic or totalitarian dictators begin to negatively impact scoring?

There are many lenses by which to view ESG. With high inflation, driven by a combination of monetary and fiscal stimulus and myriad supply chain disruptions, as described by John Apruzzese in his article here, underlying changes are even – and controversially – taking place to the area historically viewed as the least ESG-friendly: the global fossil fuel and energy sector. Proponents note that some of the companies in this sector are leaders in building out renewable infrastructure, looking for and finding new and more sustainable forms of energy, and adding technology components to traditional energy production to improve the carbon footprint.

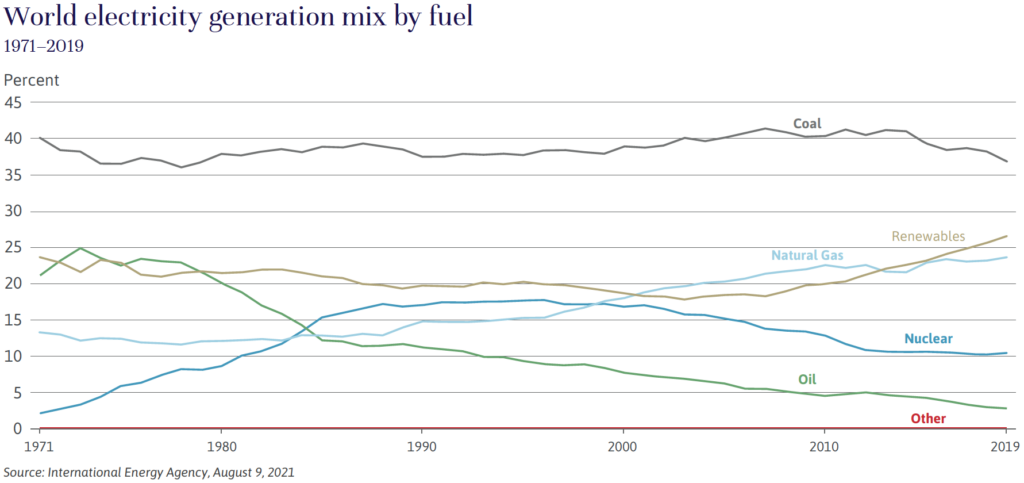

All of the energy markets have been significantly disrupted by the war in Ukraine, and as a result, much of the globe is reconfiguring its energy infrastructure. It has become clear that access to natural resources that are either domestically produced or produced by a trustworthy geopolitical partner is important. As a result, this reconfiguration is likely to take years, not months or quarters, as countries work to ensure a stable energy supply through a combination of fossil fuel and renewable power. This means tighter supplies, more energy scarcity, and likely higher prices for the foreseeable future. Renewable power sources are responsible for just 27% of the global electricity generation at the International Energy Agency’s last count in 2019, significant progress from 2011 when it represented only 20 percent. But even this tremendous growth has only served to keep fossil fuel usage stable, not shrink it at a global level. This may require continued investment in methods to transition to a cleaner economy alongside, not just at the expense of, the fossil fuel industry.

In the interim, the focus of governments everywhere is on getting reasonably priced energy to those that need it to heat their homes and offices, fuel their cars, plows, trains and planes, and power their factories and hospitals. This is likely to involve the use of traditional fossil fuels, natural gas, oil and perhaps even coal, which, while losing energy market share, unfortunately still remains the dominant fuel input in many countries and represents over 35% of global electricity generation.1

None of this is to say that fossil fuel or renewables are inherently bad or good investments. The fundamental quality of any investment is a function of both its future cash flows and the price paid for those cash flows. Many fossil fuels-focused investments did relatively poorly over the past decade, the result of investors’ expectations that cash flows would soon diminish. That’s changed, at least in the short term, with the realization that the horizon for change is receding.

Clearly, investors must use their judgment in determining if and how to balance the desire to participate in the eventual transition to a more sustainable global carbon footprint with the realities of the current energy needs of the global economy. ESG means very different things to different people, and that decision will be very personal. We remain focused on viewing ESG portfolios as investments first, building individual, fully customized portfolios to meet each client’s unique long-term financial and ESG goals.

Brian Pollak is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].

1 https://www.iea.org/reports/world-energy-balances-overview/world