Independent Thinking®

Estate Tax Planning: Act Now, Before It’s Too Late

October 19, 2021

When it comes to estate planning, the best advice is to plan early and often. Not only are the current estate and gift tax rules set to expire after 2025, but, depending on Congress, we could see some significant changes much sooner. Families looking to pass on intergenerational wealth in the most tax-efficient manner should consider taking action as soon as possible.

The proposed changes are significant. Following a 1,633% rise in the estate tax exemption over the past 20 years, President Biden earlier this year proposed multiple tax changes as part of the American Families Plan. More recently, the House Ways and Means Committee, the chief tax-writing committee of the House of Representatives, proposed to cut the estate tax exemption roughly in half, subject grantor trusts to estate taxes, and eliminate tax-free sales to intentionally defective grantor trusts.

Each individual currently has an $11.7 million exemption amount, which means a married couple can give $23.4 million to loved ones during life or after death without owing any gift, estate or generation-skipping transfer, or GST, tax. That exemption amount is a use-it-or lose-it benefit, so if the exemption amount goes down in the future, any prior gifts will receive grandfathered protection. The Treasury Department issued final regulations in 2019 confirming that there will be no so-called clawback for tax purposes if an individual makes a tax-free gift under the current law and the government reduces the exemption amount in a future year.

The other change that could occur is an increase in the gift, estate and GST tax rate, which currently is 40 percent. From a historical perspective, the highest rates ranged from 55% to 77% for almost 70 years before 2002. Therefore, not only could the exemption amount be reduced, but the gift, estate and GST tax rate also could be significantly increased in the future.

Given the potential reduction in the exemption amount and possible increase in tax rates, there is a narrow window of opportunity remaining in 2021 for families to transfer substantial wealth to future generations permanently free of gift, estate and GST tax. Let’s look here at three planning strategies that can effect this transfer, keeping in mind that any big decision should be made in the context of each family’s long-term wealth plan and in close consultation with advisors.

DYNASTY TRUSTS

One of the most popular wealth transfer strategies is to create a Dynasty Trust in Delaware or in other states with strong asset protection laws, for children, grandchildren and future generations.

A Dynasty Trust could not only prevent future gift, estate and GST tax, but could also help protect assets for family members from future creditors in the wake of any number of potential events, such as a car accident or divorce. For instance, a married couple could transfer $23.4 million tax-free into a Dynasty Trust. Those assets and all the future growth would be permanently set aside for family members without ever being subject to gift, estate or GST tax.

As an example of the potential future benefit provided by Dynasty Trusts, a $23.4 million Dynasty Trust growing at 7% per year would set aside potentially $176 million in 30 years for future generations free of gift, estate and GST tax. Moreover, Delaware eliminated the common-law rule against perpetuities in 1995, which means the Dynasty Trust can support multiple generations of a family for hundreds of years.

Dynasty Trusts are often set up as grantor trusts, allowing the grantor to pay all the income tax for the trust without any gift tax consequences. In other words, the Dynasty Trust’s assets grow free of income tax, and the payment of income tax by the grantor further reduces the grantor’s taxable estate.1 On the other hand, wealthy families in high income tax states may want to consider creating a non-grantor trust, where the trust pays its own tax, in a jurisdiction where the Dynasty Trust would not be subject to any state income tax. As a non-grantor trust in a state without a state income tax, the Dynasty Trust could continue to grow free of estate, gift and GST tax, as well as state income tax for generations – subject to potential state sourcing rules and throwback tax, for example, in California and New York.

SPOUSAL LIFETIME ACCESS TRUSTS

Not all wealthy parents are comfortable permanently setting aside millions of dollars for children and future generations, especially if they might need or want the assets back in the future. In that case, a spousal lifetime access trust, or SLAT, could be the optimal solution to maximize the gift, estate and GST tax savings while still protecting assets for the spouses for the rest of their lifetimes. With a SLAT, one spouse would create an $11.7 million irrevocable trust with their separate property to benefit the second spouse. After the second spouse dies, the SLAT protects future generations, free of gift, estate and GST tax. It is important to remember that SLATs are irrevocable trusts, which could be a big issue if spouses get divorced in the future.

It may also be possible for the second spouse to create a similar $11.7 million SLAT for the first spouse. However, the two SLATs would need to be independent and different enough to avoid what is known as the “reciprocal trust doctrine” and “step transaction doctrine.” Accordingly, the first spouse is taking a real risk that the second spouse might not necessarily fund a second SLAT for the first spouse. Suppose there is concern about the reciprocal trust or step transaction doctrine. In that case, instead of the second spouse creating a similar SLAT for the first spouse, another option could be for the second spouse to utilize their individual $11.7 million exemption by creating an entirely different type of trust, such as a Dynasty Trust, for future generations.

Typically, SLATs are grantor trusts, similar to Dynasty Trusts. As an alternative, careful drafting may make it possible to create a spousal lifetime access non-grantor trust, or SLANT. As a non-grantor trust, the SLANT would grow free of state income tax in a jurisdiction such as Delaware, subject to potential state sourcing rules and throwback tax, for example, in California and New York.

SALE TO INTENTIONALLY DEFECTIVE GRANTOR TRUSTS

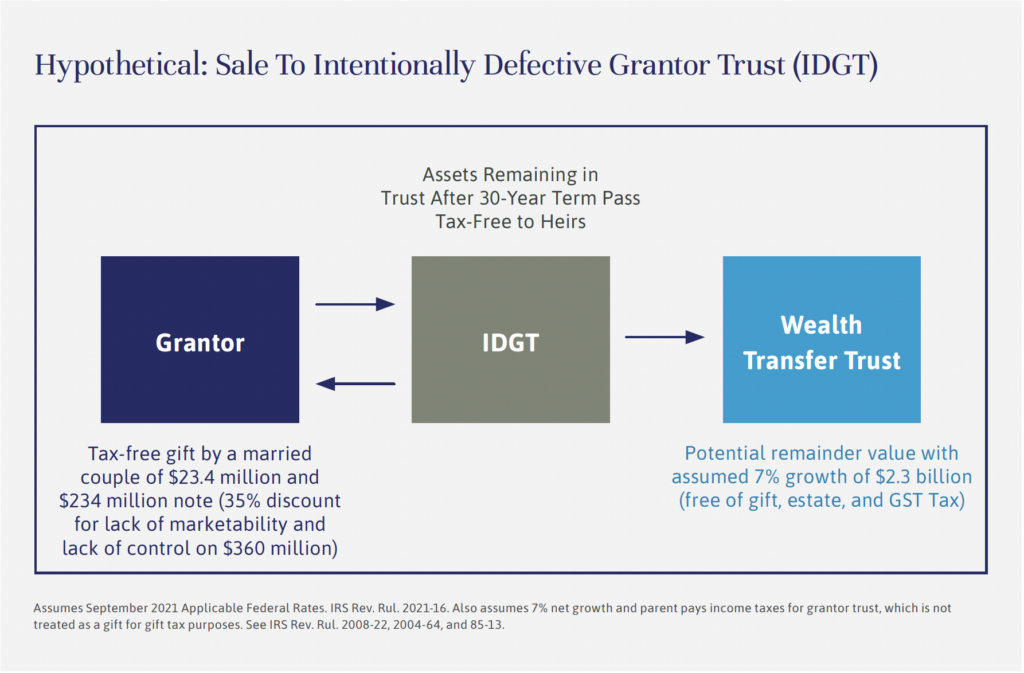

Families looking to maximize the amount they can leave to future generations free of gift, estate and GST tax can consider several strategies that maximize use of the current high exemption amounts. A sale to an intentionally defective grantor trust, or IDGT, which could be a Dynasty Trust or SLAT, is one of the most powerful strategies to set aside substantial amounts of assets for future generations. Typically, the first step is to fund the IDGT with an amount equal to 10% of the assets that the IDGT will be acquiring. The initial gift is often referred to as seeding the trust, although some practitioners are comfortable eliminating this step if there are adequate beneficiary guarantees.

For example, a married couple who are parents could gift $23.4 million to an IDGT, and the IDGT would then buy $234 million worth of assets from the parents for a promissory note. The IRS publishes applicable federal rates monthly; the minimum interest-only payment that the parents would need to charge on a promissory note for 30 years would be 1.73%.2 To make the sale to IDGT strategy even more effective, wealthy families often sell assets, such as closely held business interests, to the IDGT at a discount due to their lack of marketability and control.3 For example, families could create a family limited partnership, or FLP, or a family LLC to manage the family’s investments. It is essential that the entity has a legitimate business purpose and that the family respects both the form and substance of the structure.4

Of course, the government could eliminate discounts for family-controlled entities in the near future – which has been proposed by the House Ways and Means Committee – so there might be limited time to transfer discounted interests in a family-controlled entity before the rules change. The Treasury Department issued proposed regulations under section 2704(b) in 2016, which would have limited the ability of families to claim valuation discounts for gifts and bequests of interests in family-controlled entities to family members. However, in response to President Trump’s Executive Order 13789 in 2017, the Treasury withdrew those proposed regulations. With the change in presidency and political shift in Congress, intrafamily discounts once again could be a target for change.

As an example of the substantial amount of assets that parents can transfer to future generations with a sale to IDGT strategy, let’s assume two wealthy parents create an FLP. The parents could then seed an IDGT with $23.4 million and sell a $234 million discounted limited partnership interest to the IDGT. Assuming a 35% aggregate discount for lack of marketability and control, that $234 million discounted limited partnership could have an undiscounted value of $360 million. The IDGT could purchase the interests from the parents with a $234 million interest-only promissory note using, for example, the September 2021 IRS section 7520 interest rate of 1.73% for 30 years. The IDGT is a grantor trust, so the parents would not owe any income tax on the sale, as the tax rules do not treat it as a sale for income tax purposes.5 If the assets grow at an illustrative 7% rate for the next 30 years, the partnership liquidates, and then the note is paid off, there will be potentially approximately $2.3 billion in the IDGT for future generations that could be permanently free of gift, estate and GST tax. If future estate tax rates eventually go back to the historical norm of 55%, planning in 2021 would save the family almost $1.3 billion in tax.

Every family has unique characteristics and dynamics, and again, any plan should reflect the collaborative counsel of advisors, including a wealth manager, attorney and accountant. A professional appraiser also should be included to value assets other than cash or publicly traded securities. And don’t forget to file Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return, to report any gifts that take advantage of the exemption amount.

Justin Miller is a Partner and National Director of Wealth Planning at Evercore Wealth Management. He can be contacted at [email protected].

1 See Rev. Rul. 2008-22, 2004-64 and 85-13.

2 As of September 2021. Rev. Rul. 2021-16.

3 See International Glossary of Business Valuation Terms, as adopted in 2001 by the American Institute of Certified Public Accountants, American Society of Appraisers, Canadian Institute of Chartered Business Valuators, National Association of Certified Valuation Analysts, and The Institute of Business Appraisers.

4 For two recent examples, see Nelson v. Commissioner, T.C. Memo 2020-81 (June 2020), and Estate of Moore v. Commissioner, T.C. Memo. 2020-40 (April 2020).

5 See Rev. Rul. 85-13.