Oscar Sloterbeck

Editor’s note: Oscar Sloterbeck is Head of Company Surveys at Evercore ISI, one of the sources of research considered by Evercore Wealth Management. The surveys are used by ISI macro and fundamental research teams to measure the evolving strengths and weaknesses of the U.S. economy. Executives, typically CFOs and Treasurers, at 325 companies across 29 industries provide an index rating based on their evaluation of the strength or weakness of recent sales adjusted for the time of year.

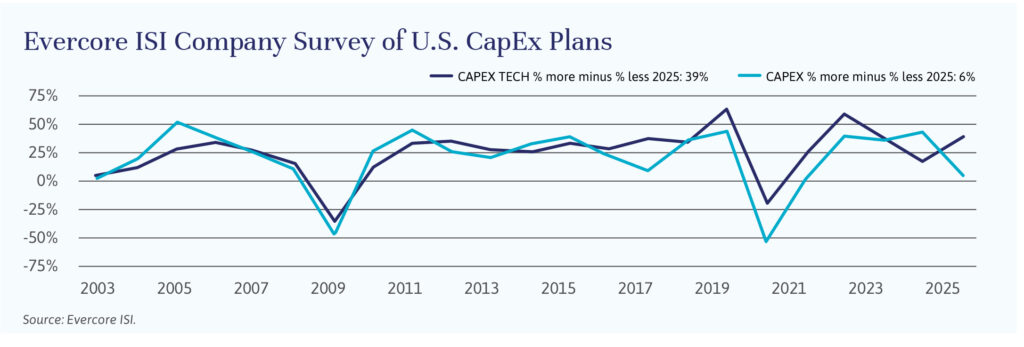

Company capital expenditure, or CapEx, on technology is rising again, albeit at a moderate pace, according to our 2025 CapEx & Hiring Plans Survey, conducted after the U.S. presidential election.1 This outlook is consistent with solid U.S. economic growth.

Following the pandemic-driven decline in 2020, nominal CapEx growth was strong in 2022 and 2023, before moderating in 2024. Structural investment in data centers, industrial, tech, infrastructure, and pharmaceutical facilities has been strong, as has the upgrade of existing plant and equipment, as companies focus on boosting domestic production and increasing productivity. Spending remains high in these areas, but growth is moderating. We continue to see most U.S. multinationals increasing the U.S. share of their global CapEx budget as companies work to derisk their supply chains.

One variable that could change 2025 CapEx plans is a cut to the U.S. corporate tax rate. Companies are telling us that reinvestment will be the top use of funds if a U.S. corporate tax rate reduction occurs in 2025.

While overall CapEx is expected to slow, companies plan to increase tech spending in 2025. The focus of spending includes cybersecurity and AI, as well as CRM and ERP systems. (Editor’s note: Artificial Intelligence, Customer Relationship Management and Enterprise Resource Planning systems, respectively.)

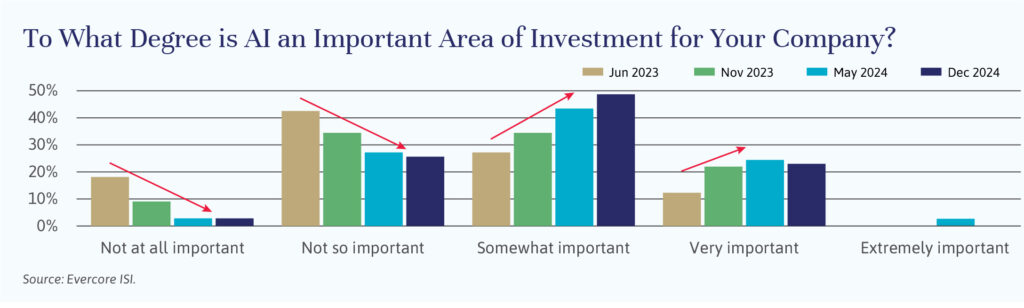

In our 2025 survey, 71% of respondents categorized their AI investment as important, up from 56% in November 2023. Large companies view their AI investment as particularly important relative to companies with less than $1 billion in annual revenues. Firms expect to see the greatest value in their AI investment from internal efficiencies, with additional value deriving from customer service and sales and marketing. Many are focused on the potential impact on labor markets from the increased use of AI. Currently, roughly one-third of companies report that AI is already augmenting their human labor; the majority see any replacement of labor from AI as more than a year away. Recent productivity data has been good, enabling the U.S. economy to sustain solid growth while inflation has moderated. Our survey shows the funds for investing in AI are coming from other areas of spend, and for this year, it appears the funds allocated to AI are coming from traditional areas of CapEx, as opposed to the tech budget.

Companies do have concerns that are limiting the use of AI and are restraining investment. The most common gating factors include accuracy and reliability, followed by cleaning and preparing internal data, as well as cybersecurity and legal concerns.

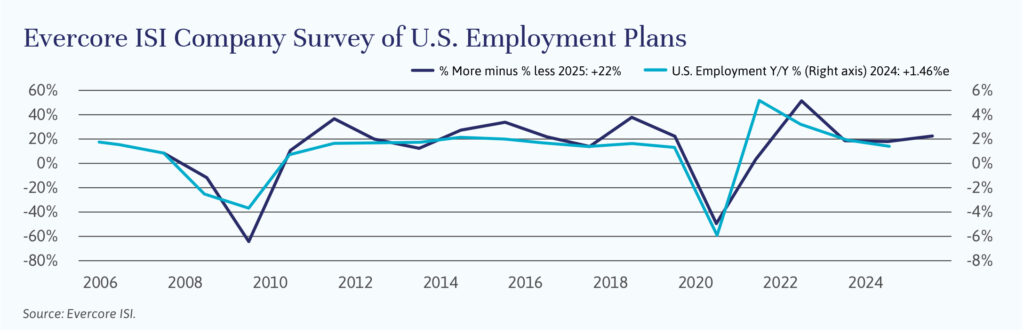

Turning to labor markets, companies told us that hiring plans for 2025 are ticking up modestly, after decelerating from their all-time high in 2022 when job growth surged out of the pandemic. This improvement is broad across industries from consumer to industrials. Real estate companies are the one area showing softness, as the housing market remains mixed. Labor availability in the United States is improving, but labor is still viewed as somewhat hard to get, while availability remains pretty good in Asia and Europe where economic growth has generally lagged. The latest data shows signs of stabilizing nominal growth, and our 2025 CapEx & Hiring Plans Survey suggests the new year will see an increase in tech CapEx and stabilization in employment.