Independent Thinking®

Gray Divorce: Dividing Assets in Middle Age

August 1, 2019

Jeff and Mackenzie Bezos married in their 20s, probably without a thought for a prenuptial agreement, worked very hard, raised four children, and accumulated some wealth along the way. Now, in common with soaring numbers of middle-age and older Americans, they are ending their marriage.

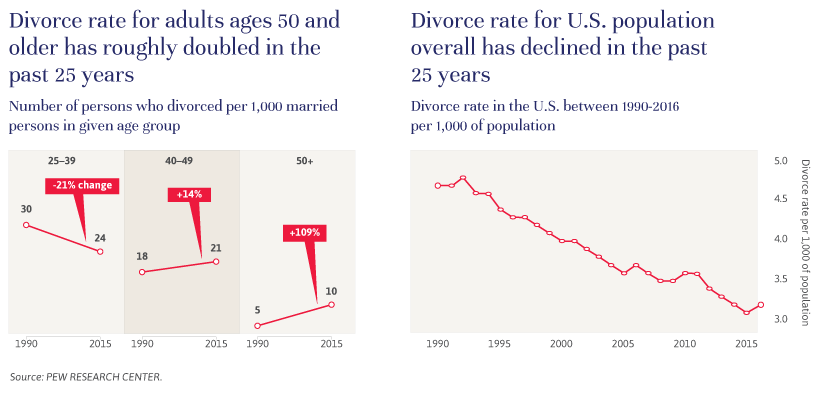

The rate for so-called gray divorces is soaring, even as the rate for the U.S. population as a whole declines, as illustrated in the charts below. When we think about how much change Baby Boomers have experienced, it’s perhaps not surprising that many marriages contracted in very different times aren’t staying the distance. The vanguard of this enormous demographic, born in 1945, typically married young, at age 23 for men and 21 for women, according to the U.S. Census Bureau. Since those first Boomers’ marriages in the 1960s, women have entered higher education and the workforce in record numbers, the number of children per family has declined (to 1.9 from 2.33), and lifespans have extended, especially for the high net worth. Along the way, our attitudes toward just about everything have changed too. Divorce, once taboo, has become commonplace.

That doesn’t make it easy. The laws concerning property rights in divorce are complicated, and even those with the mildest seven- or 70-year itch should seek advice from a matrimonial attorney and wealth advisor. In the 40 states with equitable distribution, equitable doesn’t always mean equal; courts can take property that was earned during the marriage and owned by one spouse and, along with all of the other assets, divide it in what they determine is a fair and equitable manner. In the 10 community property states, all property earned during the marriage is divided equally.

Marital laws vary from state to state. In some states, property brought by one spouse into the marriage or from inheritances or gifts received by one spouse during the marriage may or may not be treated as separate property. This is a growing issue as Baby Boomers inherit their own parents’ assets. Taking joint possession of that much-loved family vacation home on the beach may be a cause for regret if the marriage doesn’t survive the stresses of an empty nest and retirement. The best protection for marital property rules and state differences are properly drawn and executed pre- and post-nuptial agreements.

Discretionary trusts, again if properly drawn, also provide good protection for assets at risk, including from divorce. They aren’t sacrosanct, as courts are increasingly considering trusts in determining a division of assets, but they can provide a substantial line of defense. An independent trustee can determine who receives distributions of income and principal from the group of potential beneficiaries identified by the creator of the trust. Generally, the greater the latitude given to the trustee, the greater the degree of protection afforded the trust in a divorce. Also, trusts can be created decades before the beneficiaries contemplate marriage and consider – or fail to consider – the advisability of prenuptial agreements.

As wealth managers, we help our clients navigate life’s transitions. For most high net worth and even ultra high net worth couples (if not the Bezos with their respective billions), dividing assets in middle age or later is a big adjustment, possibly the biggest financial drawdown that any of us could experience.

If you are thinking about divorce, think hard. Personal reasons carry the day, but the financial consequences are certain to be significant. If you would be astonished to be asked for a divorce, think again. There is no harm in keeping your eyes wide open. It is our observation that the happiest and most secure couples make their financial decisions together, and the family as a whole benefits when both spouses are fully engaged.

Jeff Maurer is the CEO of Evercore Wealth Management and Evercore Trust Company, N.A. He can be contacted at [email protected].