Independent Thinking®

What Happened to Value Investing?

August 1, 2019

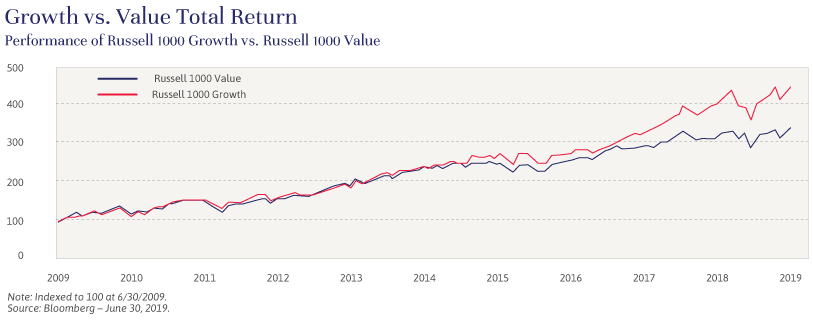

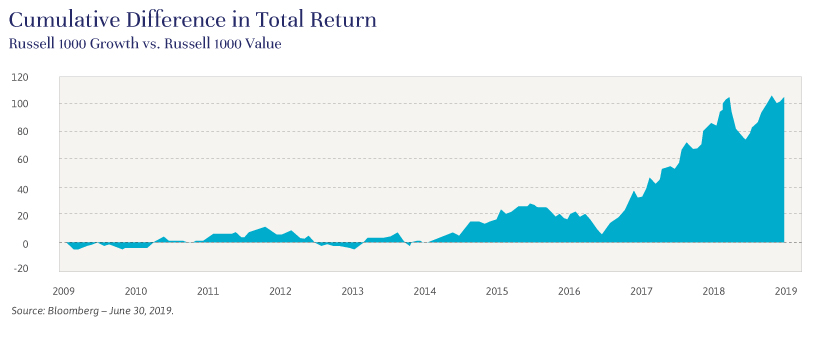

Many investors are understandably questioning the merits of value investing. For 10 years, the approach – picking stocks that appear to be trading for less than their perceived intrinsic value – has failed to keep pace with investing for growth. And the gap has been widening, as illustrated in the chart below.

The Russell 1000 Value Index has averaged a five-year annualized return of only 7.5%, little more than half the 13.4% corresponding return on the Russell 1000 Growth Index. A $10,000 investment made in 2014 in value stocks, as measured by the index, is now worth $14,330, or almost 25% less than the $18,744 cumulative return on the same $10,000 investment in the stocks of companies expected to grow more rapidly than their sector or the overall market.

Some of the discrepancy between value and growth performance can be attributed to differences in the underlying industry weightings comprising each index. The Russell 1000 Value Index has only a 5.9% weighting to information technology, compared with a 37.3% weighting in the growth index. Large-cap technology stocks, such as Amazon, Apple and Microsoft, have been among the best performing stocks since the 2009 financial crisis low.

Similarly, financial and energy stocks account for 23.4% and 9.2%, respectively, of the Russell 1000 Value Index. Many financial stocks have recovered from their financial crisis nadirs in 2009 but have struggled to appreciate due to stricter capital requirements, heightened regulatory oversight and low interest rates. Although the United States is now a major exporter of energy, the energy industry as a whole continues to struggle with profitability due to excessive supply relative to global demand. In contrast, financial stocks account for 3.2% and energy stocks just 0.4% of the Russell 1000 Growth Index.

Although the differences in industry weightings explain the disparity in investment performance between these two popular indices, it does not address the full scope of underperformance at the individual stock level. Value stocks are underperforming growth stocks for both secular, or long-term, and cyclical, or short-term, reasons.

On the secular front, many industries have been subjected to increasing disruption from technological innovation over the past decade. Technological disruption comes in many forms, including innovative products and services, alternative distribution channels, and reduced barriers to entry for new competitors. Examples of disruptive technological innovations include e-commerce, enhanced connectivity through social media and the Internet of Things, artificial intelligence and machine learning, robotics, electric and autonomous vehicles, cloud computing, blockchain technology, and the coming introduction of 5G wireless communications networks. Many industries, including retail, media, advertising, manufacturing and financial services, are transforming as a result of these disruptive forces. Technological innovations will continue to exert a powerful influence on these and other industries for the foreseeable future.

At the same time, changing consumer preferences, particularly among Millennials, has adversely affected many legacy businesses with well-established brands. As a group, Millennials demonstrate less loyalty to existing brands and a greater willingness to change consumption patterns. Frequent switching by consumers to new products and services based on near-instant and continuous feedback from social media networks is increasingly the norm.

Cyclical forces have also pressured stocks in many industries. Many companies within the traditional value sectors of manufacturing, shipping, banking and energy are facing near-term pressures as a result of weakening global economic growth, low interest rates, trade uncertainties and other geopolitical concerns. However, unlike secular forces, cyclical forces are short term and can be reversed with improved geopolitical conditions and pro-growth economic policies.

So, is this the time to sell growth companies and replace them with underperforming value stocks? Not necessarily. When assessing individual companies, focusing just on distinctions between growth and value is often misguided. As Warren Buffett noted years ago, “Growth is always a component in the calculation of value, constituting a variable whose importance can range from negligible to enormous and whose impact can be negative as well as positive.”1 We agree.

Our investment approach at Evercore Wealth Management is informed by elements of both value and growth. We are long-term, fundamental investors, analyzing each prospective equity investment on its own terms to develop an understanding of how the business operates, how profits are generated, and whether those profits are utilized to benefit shareholders. Our goal is to determine what we think a business is worth today and what we believe it could be worth in the future. We seek out attractively valued companies benefiting from positive catalysts for change. At the same time, we avoid purchasing low-quality businesses simply because they are historically cheap. Cheap doesn’t mean they won’t get cheaper still.

Identifying high-quality companies with durable competitive advantages, sustainable economics, and innovative business models that deliver compelling value will be key in this rapidly changing investment landscape.

Aldo Palles is a Managing Director and Portfolio Manager at Evercore Wealth Management in Palm Beach. He can be contacted at [email protected].

1 Berkshire Hathaway letter to shareholders, 1992.