Independent Thinking®

Having it all – and Keeping it

July 30, 2018

Financially successful young people have it all: money, fame, talent and youth. But many soon find themselves struggling to make ends meet. Sports Illustrated estimated a while ago that 78% of NFL players experience financial hardship within two years of retirement, and 60% of NBA players experience similar issues within 5 years of retirement.* Anecdotal evidence suggests that MLB players are also not immune from financial problems – nor are young artists or entrepreneurs.

Why is it so hard for young wealth to establish long-term financial responsibility; after all, this may be the one chance to secure the future. But those who make it big early in life are absorbed in their own profession. They often don’t have the financial education or the experience to manage the proceeds of a big deal or contract. Some do, of course. Taylor Swift bought her parents a house at age 21 without any apparent injury to her wealth plan. But those who made other, more frivolous choices have not fared as well. Johnny Depp allegedly spent $3 million to fire author Hunter S. Thompson’s ashes out of a cannon, and rapper 50 Cent turned a $155 million fortune into a multimillion-dollar debt – and a bankruptcy filing.

As for requests, there will be many, and they will be frequent. Indeed, young stars are often surrounded by those who would happily help them spend; who see them, as one entrepreneur put it, as a “walking ATM machine.” Many young people are interested in helping their families and making meaningful contributions to charities, as well as spending on themselves. However, it’s important to first establish a clear understanding of assets, objectives, financial needs and goals, and cash flows. It can be difficult to select a financial advisor (see Jeff Maurer’s article, Navigating Wealth Management), but there are resources available. It’s up to the individual, as well as his or her business manager, to ask the tough questions and demand clear answers.

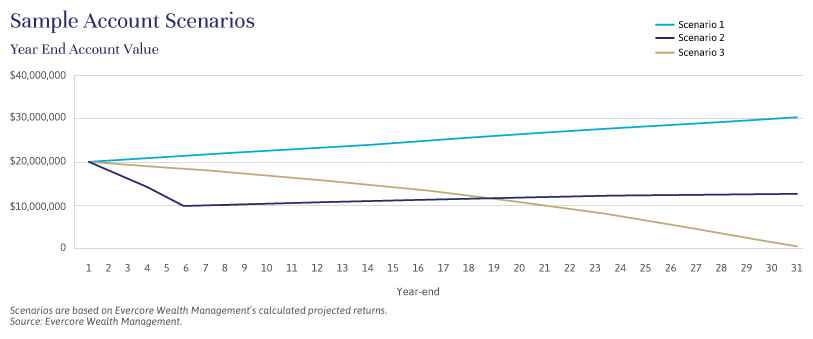

The long-term growth and preservation of wealth is a function of the combination of spending choices and investment choices. To establish a reasonable rate of spending, it’s important to first understand the expected annualized return for the assets on an after-tax and net-of-fee basis, adjusting for risk tolerance, time horizon and liquidity needs, and allocating assets appropriately. The right plan serves as a spending guide. For instance, if a diversified portfolio might reasonably expect to deliver long-term annualized net returns of 5%, then a reasonable spending rate might be 3% of the annual value of the portfolio.

Let’s look at the implications of the choices for a young person with, say, $20 million before age 30, as illustrated in the chart below. Establishing a diversified portfolio can help the asset base grow over time, when coupled with a reasonable level of spending (Scenario 1). If spending is significant at the beginning, even if that spending moderates in the later years, the longer-term effects on a diversified portfolio can be negative (Scenario 2). Even if spending is set at a reasonable level at the outset, without the benefit of growth from a diversified portfolio, there is a risk of asset depletion over time (Scenario 3).

Again, any investment strategy should consider the time horizon, liquidity needs, tax treatment, and suitability of each investment. Developing a sensible asset allocation for each grouping of assets, taking into account these considerations and building out a diversified portfolio of imperfectly correlated assets, will help to smooth returns and avoid financial calamities. All investors need to understand what they are investing in, what incentive the advisor has to make the investment, and if there are any restrictions or fees related to liquidating the investment. Fees can have an impact on the long-term success of a financial plan, and it is important to understand all fees associated with all providers and products.

Once individuals have educated themselves to the greatest extent possible and selected a trusted qualified advisor, they can begin to establish a financial plan. One of the most critical decisions will be how much to invest and how. A variety of IRA vehicles, including traditional IRAs, ROTH IRAs and SEP IRAs (among others), depending on individual circumstances, can be effective ways to compound growth in an income tax-efficient manner. If there are children involved, there are many ways to set funds aside in a tax (income and/or gift and estate) advantaged way, including 529 plans and other trust structures. Time is on the side of young investors, and leveraging that horizon to save and invest for the future can have a significant impact on financial security decades later.

Further asset protection takes on many forms. A comprehensive understanding of the location, custody, and titling of all assets is essential to assess risk and build in protection. A careful review of insurance, both property and casualty and life, should be undertaken along with a review of the proper structuring of any business or investment relationships (utilizing partnership structures to limit the exposure to liability, for example). If and when appropriate, specialty insurance policies available through customized underwriting can be created to address very specific risks, such as an injury. If marriage is a consideration, a prenuptial agreement may be appropriate. If there are particular people who should benefit from the assets (children from a previous marriage, for example), a trust structure could be a solution.

It is never too soon to start thinking about the future. From basic defensive planning, including health care proxies and durable powers of attorney, to living trusts and tax-efficient wealth transfer strategies for the benefit of others, taking responsibility for young wealth is at least as satisfying as spending. And it’s far, far more rewarding in the long term.

Tom Olchon is a Managing Director and a Wealth & Fiduciary Advisor at Evercore Wealth Management and Evercore Trust Company, N.A. He can be contacted at [email protected].

* Sports Illustrated 2009