Independent Thinking®

Illiquid Assets: Worth the Trouble?

July 20, 2017

Many investors are familiar with – and comfortable investing in – traditional asset classes. Stocks and bonds, along with the associated risks, are generally well understood, and their returns are widely reported. Alternative assets are less understood, and the associated complexity can seem daunting. There are often high minimum investment requirements, long capital lock-up periods, and erratic capital calls and distributions. And there’s a lot of paperwork involved, including filing Schedule K-1 tax returns, sometimes in multiple states.

Alternatives can be worth the trouble, however. Illiquid assets, in particular, have the potential to add attractive and uncorrelated return streams to a portfolio, improving the portfolio’s overall return and reducing risk.

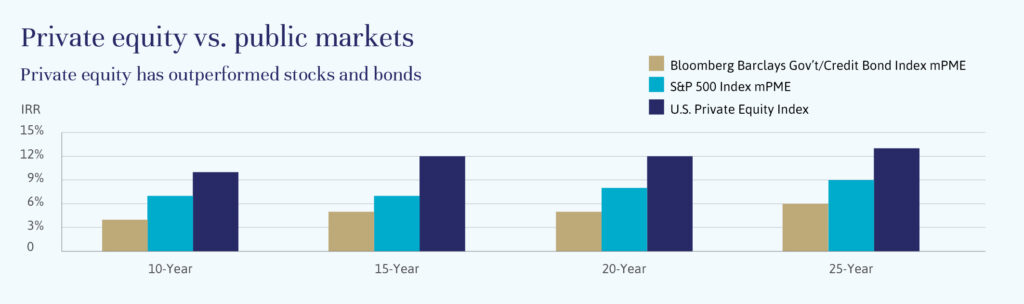

Over long periods of time, illiquid assets have historically outperformed public market stocks and bonds, net of fees. This illiquidity premium, or the additional return that investors expect to receive in exchange for locking up their money for a period of time, has generated returns 3%-5% higher than those of public equities over 10-, 15-, 20- and 25-year time periods.1

The illiquidity premium is increased further when investing in top-quartile funds, due primarily to the differences in skill levels, or value-add, among managers. Although there is no guarantee of future results, studies have shown that manager performance in illiquid investments tends to be highly persistent,2 meaning that those skilled managers who have outperformed their peers and the market in the past have a higher likelihood of outperforming again in the future. To this end, identification of, and access to, top-quartile performers is key.

Expanded Opportunity Set and Portfolio Diversification Benefits

Investing in illiquid assets allows investors to participate in opportunities that are not accessible in the public markets. Private equity managers can invest in a broader universe of companies, often with high-growth potential. For example, venture capital and early-stage growth equity funds provide capital to companies developing new technologies and disruptive business models. Although many of these companies go public later in their business cycle, typically a substantial portion of their growth occurs while they are privately held. A significant amount of real estate properties are also privately held, including office, retail, multi-family, and industrial properties.

Illiquid asset managers also focus on privately held middle market companies: those with revenues between $10 million and $1 billion. This is a robust market across many sectors, and one that has outpaced the revenue growth of S&P 500 companies in the past three years.3 There are nearly 200,000 businesses in the United States in this range, or four times the number of publicly traded companies. Middle market companies make up nearly 33% of the country’s private sector GDP and provide nearly one-third of all U.S. jobs.4

Investors in illiquid assets can participate in the growth of the middle market by investing in private equity funds, which own middle market companies, or by investing in private credit strategies, which lend to middle market companies. It’s also worth noting that many private equity firms bring not only patient capital to the companies that they invest in, but also considerable operational and industry expertise. Firms with specialized industry knowledge are able to create value throughout economic cycles, beyond using financial leverage. Selecting the right manager with the right skills is critical.

Private equity has generated outperformance over public markets generally, and particularly in the years following weak equity markets and weak economic growth periods. Analysis of private equity performance has shown that funds that deployed capital during the years that the U.S. had tepid economic growth and weak S&P 500 performance had the strongest value-add.5 This is because private equity funds investing capital in declining or volatile periods have the opportunity to invest at favorable prices.

Economic Alignment

Managers of illiquid assets generally have their interests closely aligned with their investors in several ways. First, they often commit their own capital alongside investors in their fund. In addition, they typically cannot take a profit until specific predetermined performance hurdles have been met. The better a fund’s performance, the greater the return will be to both the investors and the fund managers.

Tax Efficiency

Investments made by private equity or other illiquid asset strategies are generally held for longer than 12 months; therefore, a significant portion of the returns can be realized as long-term gains.

No one likes filling out forms, but our Wealth Advisors and Portfolio Managers can help investors manage the complexities associated with illiquid alternative investments. It has been our experience that, for most of our clients, the illiquidity premium is well worth the trouble.

Stephanie Hackett is a Managing Director and Portfolio Manager at Evercore Wealth Management. She can be contacted at [email protected].

1 Source: Cambridge Associates LLC, Bloomberg Barclays, Standard & Poor’s. Data as of December 31, 2016. The Cambridge Associates LLC U.S. Private Equity Fund Index is a horizon calculation based on data compiled from 1,370 U.S. private equity funds (buyout, growth equity, private equity energy and mezzanine funds), including fully liquidated partnership, formed between 1986 and 2016. Private indexes are pooled horizon internal rate of return (IRR) calculations, net of fees, expenses and carried interest. Cambridge Associates Modified Public Market Equivalent (mPME) seeks to replicate private investment performance under public market conditions. The public index’s shares are purchased and sold according to the private cash flow schedule, with distributions calculated in the same proportion as the private fund.

2 Source: Steven N. Kaplan, Robert S. Harris, Tim Jenkinson, Rudiger Stucke, “Has Performance Persisted in Private Equity? Evidence from Buyout and Venture Capital Funds (February 2014)”. Darden Business School Paper: 2304808.

3 Source: Golub Capital Middle Market Report 1Q 2017.

4 Source: National Center for the Middle Market, Q1 2017 Middle Market Indicator.

5 Source: Artivest, Cambridge Associates.