Independent Thinking®

Impact Investing

July 21, 2016

Among the many misperceptions around socially responsible investing, arguably the biggest is that investors in this sphere are any less focused on returns than their more traditional counterparts. This $21.4 trillion global discipline is increasingly effective, transparent, and measurable.

As socially responsible investing, or SRI, and its more proactive twin, environmental, social and governance, or ESG investing, mature, it is becoming evident to even the most skeptical investors that focusing on companies with these factors in their mandates can have a positive impact on performance. As we discussed in the last issue of Independent Thinking, increasing interest in socially responsible companies and improving returns in the SRI/ESG sector have together created something of a virtuous circle. Good sustainability practices positively impact a company’s stock price.1

Today, returns from almost two-thirds of the investment managers focused on SRI/ESG strategies meet or exceed the median returns of the managers of traditional funds.2 The MSCI KLD 400 index of socially responsible companies continues to outperform the more traditional MSCI USA Investable Market Index, averaging a 9.53% annualized return over the past five years against the 9.37% return of its benchmark.3

At the same time, SRI/ESG is becoming easier to understand. Access to public information related to companies’ best practices, especially for domestic and international developed markets, has increased dramatically. Some company disclosures, including compensation practices, board structure and diversity, are now mandatory in most developed markets. Financial metrics, such as how much revenue is derived from a business line that produces a lot of CO2, are also increasingly easy to access.

Additional information related to companies’ SRI/ESG practices are now voluntarily disclosed, although many companies remain selective in publishing their metrics. An expanding range of third-party information sources, such as Bloomberg, MSCI and EIRIS, a leading global provider of ESG research, are making this data more transparent, which helps investors craft a thoughtful approach to impact investing.

Improved transparency enables better measurement, a key component of effective SRI/ESG investing, especially as many investors see themselves as voting with their wallet. Careful analysis of all underlying holdings and voting, either directly or by proxy through an investment adviser, in shareholder resolutions is a powerful way to drive market change and encourage government intervention.

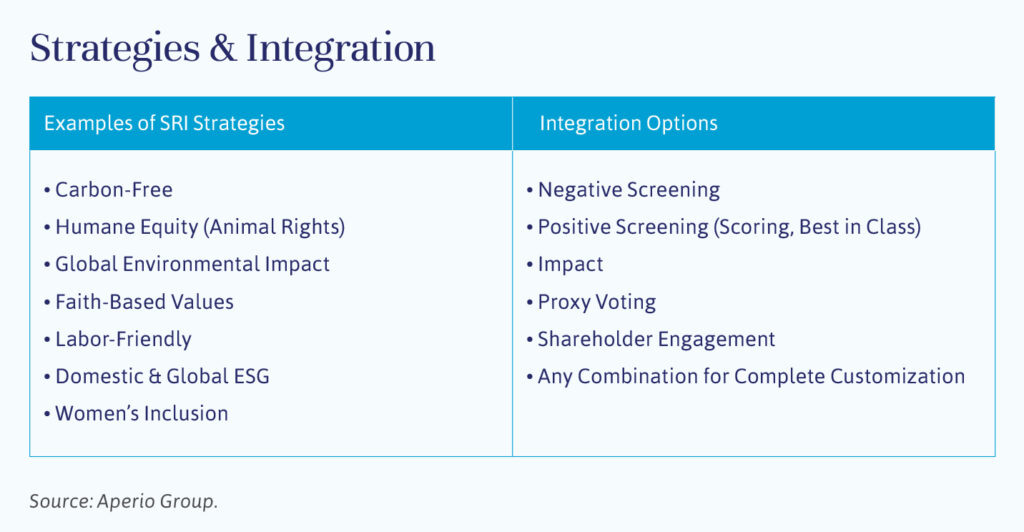

Despite – or perhaps because of – all these recent advances, investors still aren’t sure how to actually describe impact investing. Since its origins in the abolitionist movement, SRI/ESG investing has come to mean very different things to different people. Not long ago, most strategies avoided the so-called sin stocks such as tobacco, alcohol, and gambling. These days, SRI/ESG strategies often include a focus on investing in companies that are good stewards of the environment, with relatively low carbon footprints, while avoiding certain sectors entirely, such as coal. Others focus on encouraging board diversity, Catholic values, and/or steering clear of animal testing, factory farming, child labor, and arms manufacturing. The universe of SRI/ESG factors, both negative and positive, is large and still expanding.

Global Impact Investing Network, or GIIN, a New York City-based trade group, recently tackled this nomenclature challenge, proposing that impact investments be defined as “investments made into companies, organizations, and funds with the intention to generate social and environmental impact alongside a financial return.” The group notes that impact investments can be made in both emerging and developed markets, and can target a range of returns from below market to market rate, depending upon the circumstances.

This seems reasonable. However, what is meaningful to one investor in terms of social or environmental goals may not be for another. Solutions must be customized to specific individual and family goals. It’s important to assess an SRI/ESG mandate in the same way as other, more traditional opportunities are evaluated, by measuring returns against industry benchmarks, and determining fee-effective, risk-adjusted, tax-efficient and, preferably, liquid investments in a particular asset class.

At Evercore Wealth Management, we work with Aperio to provide detailed customization for clients willing and able to invest $1 million or more in an SRI/ESG strategy. And we follow up, to access and score investment data that can continually inform and support each investor’s goals. We also allocate funds to external managers for clients interested in making smaller commitments. (See the interview with Dimensional Fund Advisors’ Joseph Chi on page 14.)

For an increasing number of investors, SRI/ESG strategies are an increasingly effective, transparent and impactful solution.

Iain Silverthorne is a Partner and Wealth & Fiduciary Advisor at Evercore Wealth Management. He can be contacted at [email protected].

1 Smith School of Enterprise and the Environment at the University of Oxford.

2 As of June 30, 2016.

3 As of June 30, 2016.