Independent Thinking®

Inflation Hedges: What’s in Your Portfolio?

October 19, 2021

Properly diversified investment portfolios are naturally hedged against inflation. Short-term bonds, equities and real estate can be surprisingly strong defenses against rising inflation; assets commonly perceived as targeted inflation hedges, not so much. It’s a distinction worth thinking about in asset allocation, even in periods of transitory inflation.

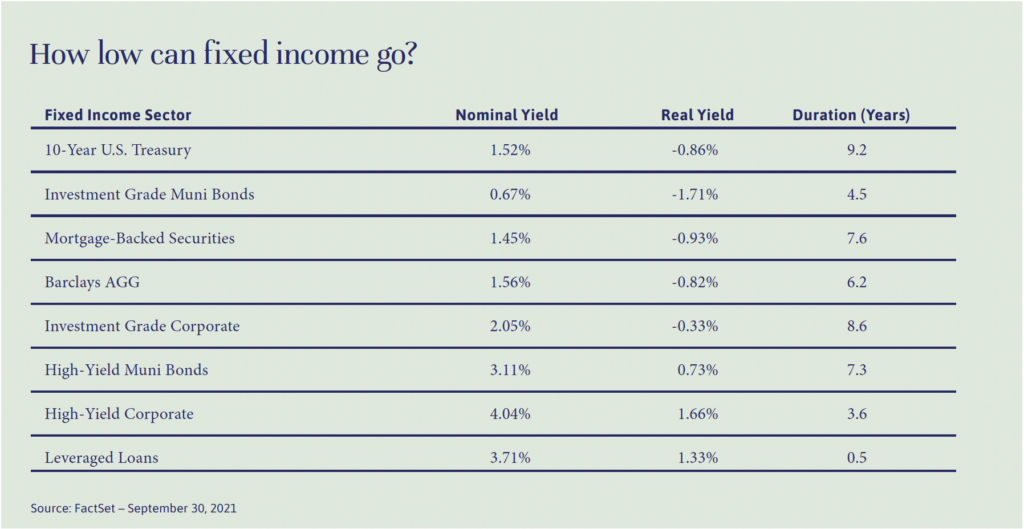

Let’s start with fixed income. Bonds with long-term fixed interest rates, especially those with 10 years or more to final maturity, are no one’s idea of strong performers when inflation is relatively high, as it is now at 5.3%, after averaging just 1.9% over the previous decade. While inflation doesn’t present a risk to the principal value of bonds (assuming the issuers don’t default on their obligations), it can certainly erode the purchasing power of their proceeds. At present, the 10-year Treasury note has a nominal yield of just 1.52%, well under the 2.38% inflation rate widely anticipated in the market over the same period.

In contrast, high-quality municipal and corporate fixed rate bonds with shorter-term maturities are relatively stable in periods of high inflation, at least relative to longer-term maturity bonds. Additionally, investors are able to reinvest proceeds more quickly, to take advantage of higher yields.

Floating rate securities, which carry variable coupons that change based on a benchmark rate, usually tied to short-term interest rates, are also relatively appealing when inflation and interest rates are rising. Many higher-yielding corporate securities, such as bank loans and middle market loans, are offered at floating rates, and provide attractive current cash flows that could rise if inflation persists. (See the chart below for current fixed income returns.)

Treasury Inflation Protected Securities, or TIPS, are commonly misunderstood as effective inflation hedges. TIPS were created by the U.S. Treasury Department in the 1990s in an effort to provide investors with a way to protect their Treasury investments from inflation. Principal and interest payments are indexed to the Consumer Price Index, or CPI, providing investors with some protection from a decline in the purchasing power of their money. But the prices of TIPS are also dependent on the prevailing market real interest rate (the yield less expected inflation over the life of the security).

Currently, the real interest rate for a 10-year TIPS is -0.89%, meaning that a TIPS investor effectively pays a premium to invest in a bond with no coupon. In an inflationary environment, investing in TIPS will provide a rate of return less than that of expected future inflation. If the real yield increases, the price of the TIPS declines, as bond yields move inversely to price, further diminishing the TIPS’ total return. Indeed, TIPS can generate negative returns even if inflation is rising.

What about commodities? Investors may still associate precious metals generally, and gold in particular, as beneficiaries of inflation. But gold now appears to be most correlated to changes in real interest rates, rising as real interest rates – and the returns of conventional investments such as cash equivalents and bonds – fall. Gold prices are therefore unlikely to perform well in an environment where the Federal Reserve starts to aggressively increase interest rates to fight accelerating inflation. There may be other reasons to own gold within an investment portfolio, but it’s likely not an effective inflation hedge.

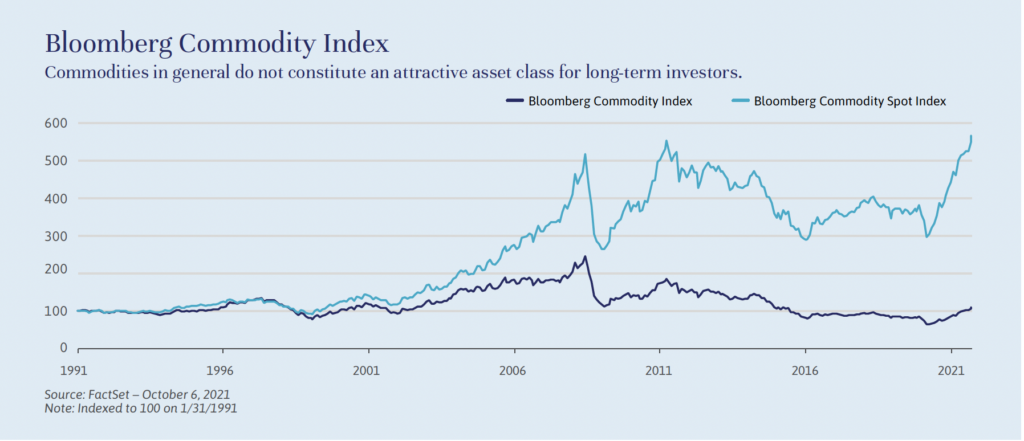

Commodities overall often perform well as an asset class during inflationary periods, as prices generally rise rapidly with demand. But they can fall just as fast when supply catches up and/or other inputs become a factor, such as rising costs, regulation and technologically driven productivity gains. There are interesting developments in some areas of the market (see the article by Michael Kirkbride on page 6 on the impact of ESG investing on the energy sector), but we believe that commodities in general do not constitute an attractive asset class for long-term investors.

While spot commodity prices typically do well during periods of inflation, they generally do poorly in other environments, such as in low or stable inflation or deflation. In addition, the spot prices are not investible, forcing commodity investors into vehicles that purchase futures. The Commodity Futures Index has had a 0% cumulative return over the past 30 years (as illustrated by the dark blue line in the commodity chart below).

Equities, in contrast, have a good chance of performing well through periods of high inflation, although investors may need to be patient for a couple of reasons. The first reason is that companies may initially struggle to increase revenues at a rate high enough to offset input cost inflation while maintaining profit margins, creating temporary equity market volatility. We’ve seen this in the utility sector, for example, where regulatory constraints make quick repricing difficult. The second reason is that long-term investors tend to discount the value of future cash flows more steeply during periods of high inflation, forcing the multiple on future earnings down overall, and a shift to companies with relatively certain near-term cash flow and earnings power, and away from growth companies. But again, this move in the market is likely to prove temporary. Eventually, we expect companies with persistently high earnings growth to outgrow the rate of inflation.

It’s important to note that price dispersion among companies during inflationary periods may increase, as those better or more quickly able to pass through costs to end consumers will be at an advantage, and shares in some could even be considered inflation hedges. Commodity producers, consumer staples companies and financial services companies should be able to raise prices quickly as inflation rises, offering inflation protection. Conversely, companies with fixed prices that are difficult to change or tied to inputs other than inflation will likely underperform. Companies with high dividend yields, but limited revenue growth, may also be susceptible to rising inflation, as the value of the dividend cash flow to investors diminishes.

Private equity and venture capital investments have similar characteristics to their public counterparts in an inflationary period. The underlying economics are the same, in that private companies with pricing power will be able to manage increasing input costs. However, private companies are not marked to market as quickly as public companies, so the initial drops in value due to reduced valuation metrics are not as obvious and may be overcome for private companies that are able to quickly adjust to the inflation of their input costs. Over the long term, we continue to expect private investment returns to outstrip their public counterparts, due to the illiquidity premium, which is driven by managements’ longer-term outlook and higher levels of low-cost leverage.

Investors able and willing to accept illiquidity may find that prudently leveraged private real estate, with its solid current cash flows and the potential to grow cash flow through increasing net operating income, is one of the best hedges against inflation. In general, private real estate generates cash flows at a rate higher than traditional fixed income, and those cash flows can grow over time, in some cases at a rate tied to the Consumer Price Index. Real estate is a hard asset with intrinsic value that can also appreciate in value, protecting the purchasing power of the investment.

Yes, many real estate submarkets look expensive at present. But there is some natural land scarcity in many regions, and the value of any existing real estate in those locations will be tied to the cost to replace a similar structure, which should also be rising during periods of inflation. Private real estate is often purchased using leverage – and leverage, especially the fixed rate variety, can significantly enhance the investment performance of an asset during inflationary periods, as the value of the principal and fixed interest costs are diminished by broadly rising prices. Unlike commodities, real estate has the potential added benefit of having a positive expected return in a low inflation environment, if the cash flows provide a floor to expected returns.

Bitcoin and digital assets are uncorrelated to inflation, although they may provide an inflation hedge to the extent that they provide diversification from assets that could be impacted by inflation. Our approach in this area is through venture capital investments focused on digital assets and related businesses, as appropriate for individual clients.

It may take time, but the market and the Federal Reserve appear to believe that inflation will moderate from its current high level, as supply chain issues ease and volatility in commodity prices abates. Jay Powell, the Fed Chair, had this to say during a recent speech at the annual Jackson Hole conference: “While the underlying global disinflationary factors are likely to evolve over time, there is little reason to think that they have suddenly reversed or abated. It seems more likely that they will continue to weigh on inflation as the pandemic passes into history.”

We agree. But as stewards of family and institutional capital, we remain alert. We believe broad diversification can help protect portfolios from all manner of long-term risks, including the potential for sustained high inflation, if and when it comes.

John Apruzzese is the Chief Investment Officer at Evecore Wealth Management. He can be contacted at [email protected].

Brian Pollak is a Partner and Portfolio Manager. He can be contacted at [email protected].