Independent Thinking®

Keeping Interest Rate Rises in Perspective

November 28, 2022

Higher interest rates – up fourfold in a year, albeit still low – can complicate wealth planning decisions. But families who keep rates in perspective, stick with established wealth plans, and make tactical moves now should stay on track to help meet long-term goals.

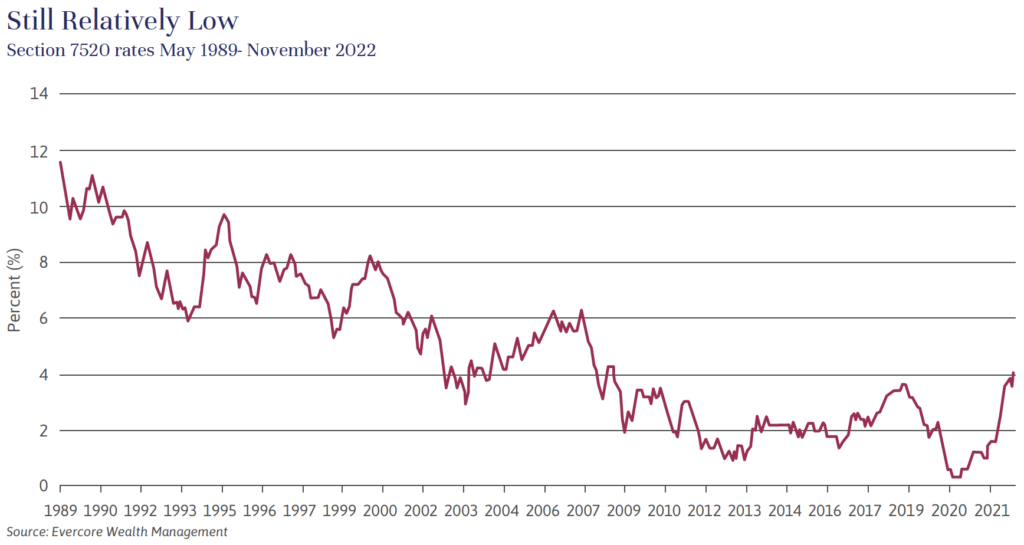

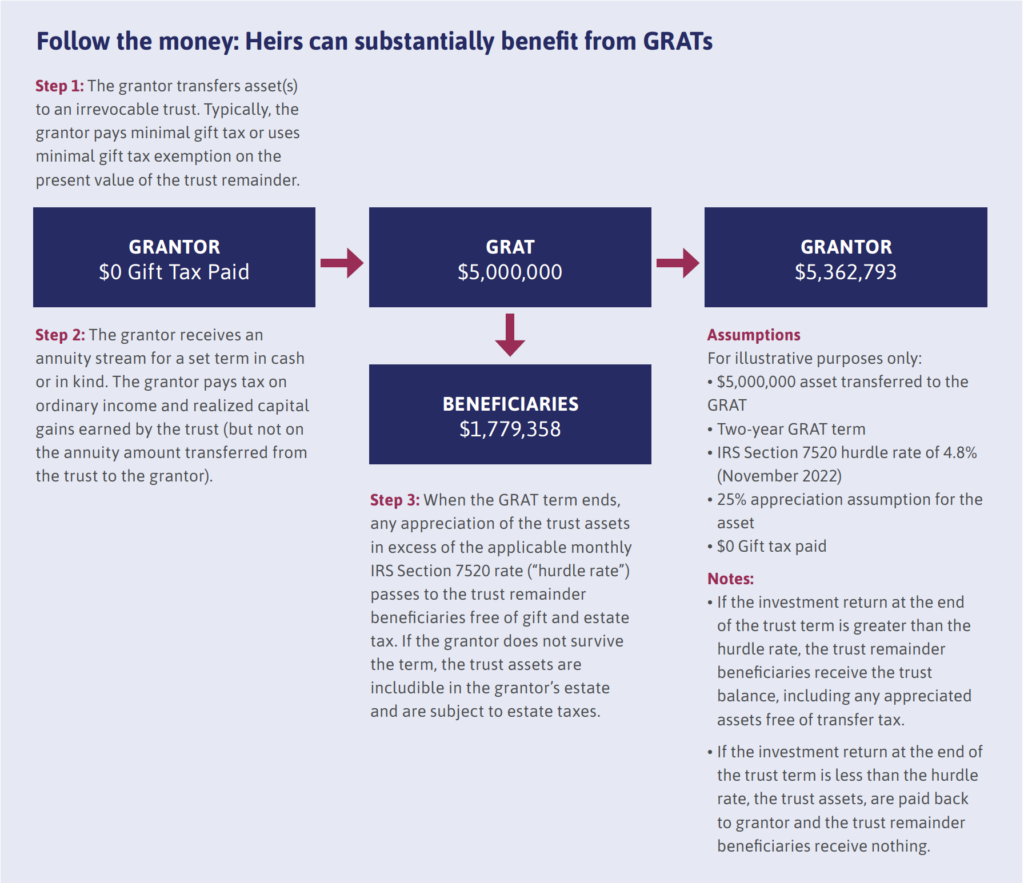

Grantor Retained Annuity Trusts, or GRATs, have been popular with high-net-worth families for years. Historically low interest rates have enabled grantors to fund trusts at the Section 7520 rate, or the hurdle rate, published monthly by the IRS, in the expectation that the funds would in fact outperform that rate and the excess appreciation be transferred to the beneficiaries free of gift and estate tax. That worked brilliantly when rates were low and markets were rising. Now families have a higher hurdle to surmount; as of November, the 7520 rate is 4.8%, up from 1% just a year ago. And the markets haven’t been helping the existing GRATs.

This is where perspective matters. Sure, rates aren’t as favorable as they were a year ago, but as illustrated by the chart below, they are still low from a longer-term perspective. As for the markets, a bear market can be a boon when funding a brand new GRAT. Once the account performance clears the hurdle rate, the GRAT beneficiaries could benefit from a subsequent market recovery. (See the diagram below for an example of a GRAT.)

A Charitable Lead Annuity Trust, or CLAT, may still be an attractive transfer strategy for families who are charitably inclined. CLATS are split-interest trusts that benefit a charity during their terms and, at the termination of the trust, allow remaining assets to pass to the remainder beneficiary, typically the heirs. As with a GRAT, the amount of the remainder will depend on whether the trust’s investments outperform the Section 7520 rate.

In a still relatively low interest rate environment and after a market dislocation, CLATs can be an effective means of wealth transfer to the next generation. The interim beneficiary of the charitable lead interest can be a donor-advised fund, a private foundation, or a public charity. If structured as a grantor trust, the grantor may have an immediate tax deduction as well. Decisions between grantor and non-grantor CLATs are based on personal circumstances and should be made with professional consultation.

Please note that both GRATs and CLATS should only be used for the transfers to the immediate next generation, not to grandchildren.

Families looking for more immediate wealth transfer solutions, say to help buy a home or start a business, may want to consider intra-family loans, especially now that mortgage and bank personal loan rates have spiked. Intra-family loans can be made using the Applicable Federal Rates (AFRs) published monthly by the IRS. At present, that could mean as much as a three-percentage point difference on a 30-year mortgage. It is important to note that the loan documents should be properly drafted, as they may otherwise be viewed by the IRS as a gift. The interest on the loan will be taxable to the lender as ordinary income.

Other estate-planning vehicles, such as Qualified Personal Residence Trusts (QPRTs) and Charitable Remainder Trusts (CRTs), will become more attractive if interest rates continue to rise. We will review these in future editions of Independent Thinking as circumstances warrant. At present, rates are still relatively low, and we continue to think that it is more likely than not that they will stay that way. (See John Apruzzese’s article titled, Orienting in a Changing Investment Landscape.)

Either way, it’s important to keep in mind that interest rates should never be the only driver in wealth transfer decisions. While giving sooner rather than later could provide significant tax benefits, as a married couple can transfer up to $24.12 million in 2022 and $25.84 million in 2023 completely free of taxes over their lifetimes until 2025, after which time the exemption amounts are roughly halved, transfer strategies should also be executed in the context of long-term plans. Families considering substantial transfers should consult their Evercore Wealth & Fiduciary Advisors to review the most appropriate planning vehicles in the context of long-term wealth plans, as well as prevailing economic and market conditions.