Independent Thinking®

Moving On: Preparing to Exit Your Business

November 1, 2018

About two-thirds of the six million small businesses with employees in the United States are owned by Baby Boomers, according to U.S. Census data.

However, if history serves as any guide, no more than 30% of these businesses will be successfully transferred. All owners will exit their business at some point. So why do so few plan for it? In Minneapolis, a study of local business owners found that 90% agreed or strongly agreed that having a transition strategy in place is important, but 79% said that they have no written business transition plan, 48% confessed that they have done no planning at all, and an overwhelming 94% said that they have no written personal plan.1 Far too often, transfer planning is left until one (or more) common triggers occur: death, divorce, disability, disaster, and disagreement. At that point, owners find themselves scrambling and are often forced to sell or liquidate their business at unfavorable terms.

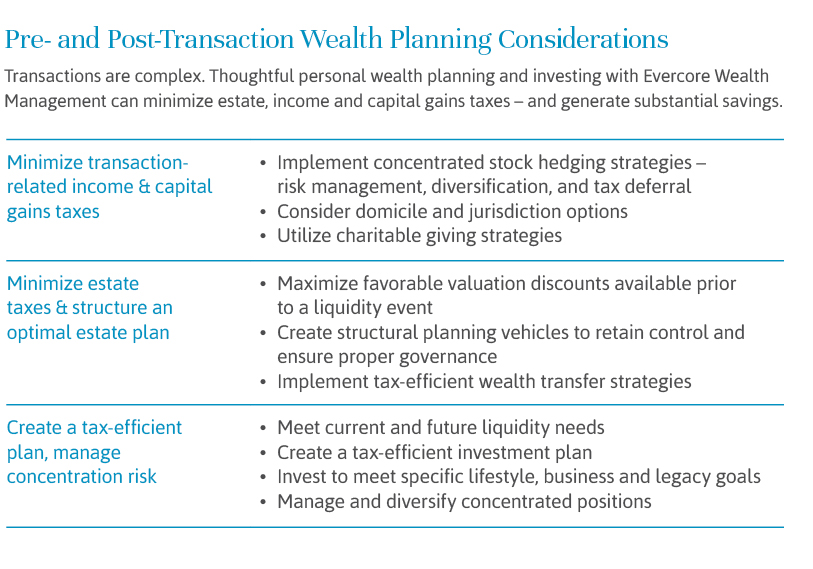

Preparing for a successful business transition at any age means addressing some tough questions. The answers to these should shape both pre- and post-transaction wealth planning, as illustrated below.

First, what is the actual value of the business? Is the business positioned to maximize transferable value? If a business does not have a strong management team and cannot operate without the participation of the owner, it does not have much transferable value beyond its hard assets. Owners may wish to consider hiring a strong organizational consultant and building a management team and business processes well ahead of a transfer.

Second, can the owner afford to sell the business? The answer can be complex. Business owners need to consider the full implications on their family finances and plan and invest accordingly. (See Jeff Maurer’s article here on spending in retirement and adjusting for market downturns.) Consider too that a business may have been covering significant expenses, as well as generating income from salary and distributions. If these expenses continue, they will have to be paid for.

Third, what comes next? This is quite possibly the most difficult and important challenge to tackle, especially for people who have shaped much of their lives – and their identity – around building their business. “What will I do when I’m not running my company?” “Where will I go when I don’t have my office to go to anymore?” “Who am I when I’m not the CEO anymore?” These are just some of the questions that can prevent owners from tackling their eventual exit.

The good news is that all of those questions can be resolved, given enough lead time and the right advisors. Many business owners procrastinate because they think their choices are confined to an outright sale to a competitor or a transition to a family member or key employee. As described below, partial sales, employee stock ownership plans, dividend recapitalizations, mergers and acquisitions, venture capital, or private equity are also ways to transition ownership. A good exit plan need not utilize only one strategy.

Business owners are often surprised to discover the wide range of options available to keep them engaged in the business for the rest of their lives, if they wish, or to structure a smooth departure. After all, as the playwright Tom Stoppard put it, every exit is an entry somewhere else.

Exit ramps

- Acquisition – Acquiring a business to build on the strengths, fill in the weaknesses, or add additional capabilities to better position the company for succession or sale

- Employee stock ownership plan – Using a qualified retirement plan to transfer company stock to the ownership of the employees

- Leveraged dividend recapitalization – Incurring debt to pay stockholders a special dividend as a partial exit strategy

- Merger – Similar to an acquisition, a merger can add to the position of the company as well as add new potential leadership

- Private equity/venture capital – Adding private equity investors to liquidate existing ownership

- Sale – Disposing of all or part of the company assets and stock

- Transfer to family – Transferring to a family successor through gifting or installment sale

- Transfer to key employee – Transferring ownership to one or more identified key employees through stock ownership plans, long-term installment sales, leveraged management buyout and modified buyouts through phases

Daniel Stolfa is a Managing Director and Wealth & Fiduciary Advisor at the Minneapolis office of Evercore Wealth Management. He can be contacted at [email protected].

1 Exit Planning Institute: The State of Owner Readiness 2017.