Independent Thinking®

Municipal Bond Market Update: What’s Changed, What Hasn’t

December 7, 2016

For all the changes in bond market yields since the surprise election of Donald Trump, some important economic drivers haven’t changed.

As the managers of customized portfolios with strong allocations to defensive assets, we know that it’s important to distinguish between long-term secular trends and short- to medium-term market reaction.

Yields on U.S. Treasuries – already on the rise from the historic lows post Brexit – have jumped since the U.S. election by close to 60 basis points, on investor expectations that inflationary and pro-growth Trump policies and improving economic news will spur higher interest rates. Indeed, the market has already priced in a December increase in the Fed Funds rate and the likelihood of additional rate hikes in 2017.

However, the longer-term disinflationary and even deflationary forces of subpar global growth, continued technological advances, aging demographics, and a historically high national debt load could very well restrain interest rates and inflation. We will discuss these issues and our portfolio strategy in depth in the next edition of Independent Thinking.

In the interim, it’s important to note we continue to manage our portfolios conservatively, with respect to both duration and credit. As appropriate for individual clients, we are making opportunistic purchases with longer maturities. And we are actively pursuing tax swaps that are advantageous to our clients, by realizing bond losses to offset capital gains in the rest of their portfolio, and replacing those bonds with issues with a similar yield and maturity. The majority of municipal bonds issued in 2016 are selling at higher yields and lower prices.

Demand for municipal bonds has also changed dramatically since the election, from 52 straight weeks of fund inflows to outflows as investors perceived a threat to the market from a higher rate of growth and inflation and lower income tax rates. (See the box below on Mr. Trump’s proposed tax changes and a comparison with the Reagan years.) This, in turn, has led to an arguably excessive loss of liquidity and wider yield spreads between higher and lower quality bonds.

This market reaction may be exaggerated. New issue supply is uncertain, as the pace of refundings will likely decline due to the recent increase in rates (although some issuers may rush to market to avoid the anticipated higher rates).

The proposed changes to the tax benefits of municipal bonds receive the greatest attention by investors, but the structure of the market may also change. Mr. Trump has advocated $1 trillion for infrastructure spending to improve the country’s aging airports, roads, and bridges. Spending for these types of projects has historically fallen primarily to the states and cities. Mr. Trump has also proposed tax credits for corporations that repatriate money to the United States and then invest in infrastructure projects. His proposal for a tax credit for companies that contribute equity for specific infrastructure projects could also impact the structure of the municipal bond market and curtail the issuance of new tax-exempt municipals.

However, if Congress elects to subject all municipal interest to federal taxes, it is highly improbable that existing municipal bonds would lose their tax exemption, which would lead to a scarcity and increase in the demand for older outstanding issues.

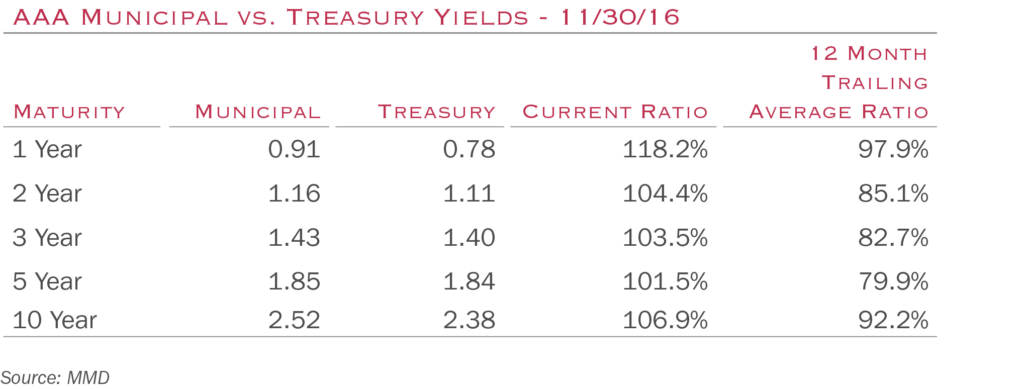

Details regarding tax reform and changes in income tax rates, the timing of their implementation, and possible changes to the structure of the municipal market will remain unanswered for some time. In the interim, as evidenced in the chart below, yields for AAA-rated municipals now equal or exceed those provided by their taxable U.S. Treasury counterparts with similar maturities, which has begun to attract crossover buying by corporations and tax-exempt entities. Indeed, that already seems to be happening. In just the past couple of days, buyers started moving to municipal bonds in recognition of the relatively higher yields, a trend that may continue in the coming weeks.

This is going to be a challenging period in the bond markets, and we will remain vigilant in managing risk on behalf of our clients, always mindful of their long-term goals and individual tax considerations.

Please contact your portfolio manager at Evercore Wealth Management with any questions.

Gary Gildersleeve is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].

Tax Reform and Municipals: Back to the Future?

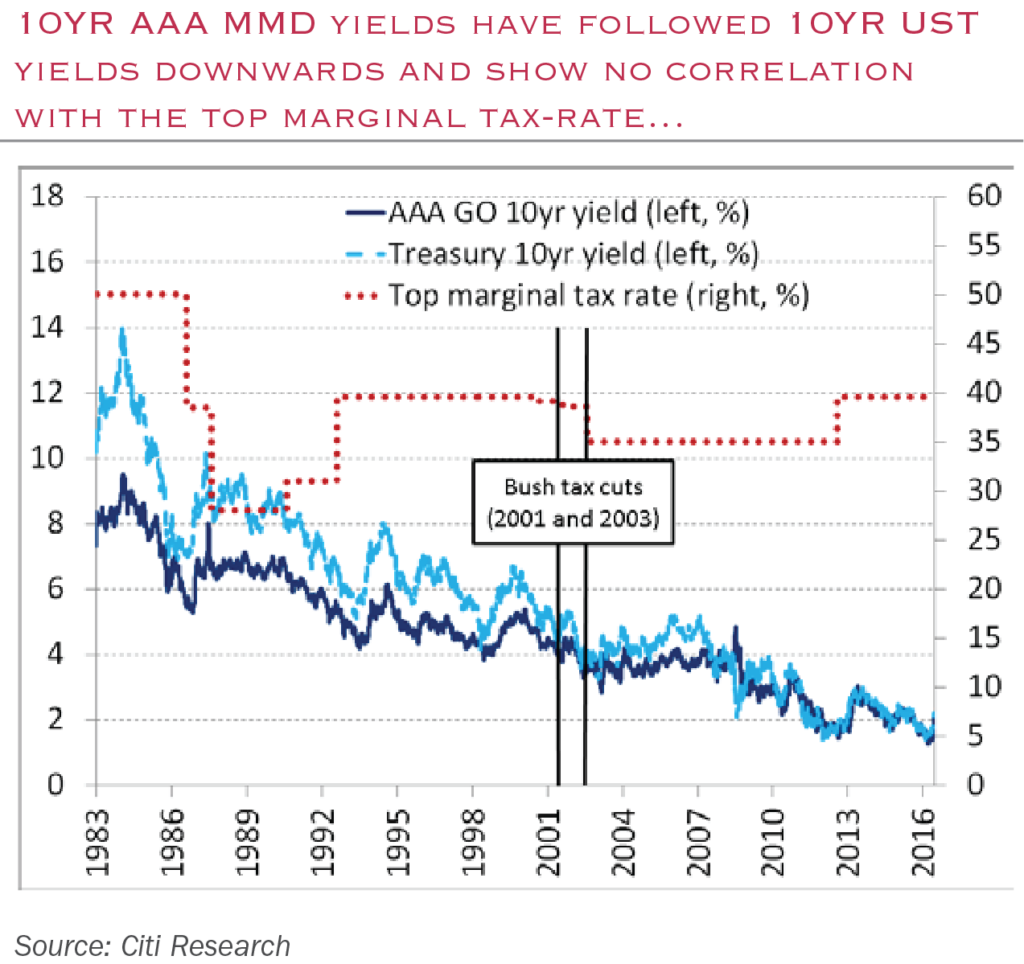

When Ronald Reagan won office in 1980, the maximum income tax bracket was 70%. It was reduced to 50% in 1981 and then, under the Tax Reform Act of 1986, to 28%. The maximum tax bracket has since fluctuated, with the maximum as low as 28% (1988-1990) to today’s nominal high of 39.6% (which can be as high as 44.6% in real terms, after the Medicare surcharge and Pease Limitation). As the attached chart depicts, it is, in general, the level of absolute rates and not the maximum tax bracket that has the greatest impact on municipal bond yields relative to the yields of U.S Treasuries.

The details and timing of any reform or changes to the personal income tax code will also have a major impact on the future pricing of municipal bonds. There is a nearly universal desire by Republicans and Democrats alike to reduce the Federal corporate income tax rate. It should be noted that a reduction in the personal income tax rate would likely be accompanied by a removal, reduction or cap of current deductions. State and local income taxes constitute a key deduction that will be considered for elimination in exchange for lower tax brackets. If eliminated, this would have the greatest impact on those states with the highest income tax rates, including California, New York, New Jersey, and Minnesota – all Democratic Party dominated states. While retaining the Federal tax exemption for interest from state and local issuers will be discussed, it seems highly unlikely that existing bonds would lose their tax preference.

We should also note that revising the personal tax code was a topic of discussion in the 1984 presidential election, was discussed throughout 1985, finally agreed upon and passed in 1986, and did not go into full effect until 1988. It seems that immediate implementation of Mr. Trump’s tax proposals will be challenging.