Independent Thinking®

Near & Far: Investing Internationally

July 20, 2017

The S&P 500 index of leading U.S. shares has risen over 50% faster than the rate of international markets in the eight years since the financial crisis – and for good reason. Early and aggressive monetary policies helped stimulate the U.S. economy and, most important, corporate earnings. In addition, the extraordinary confluence of innovation and capital in one corner of California continues to drive the global technology sector. Eight of the world’s top 10 tech companies are based in the United States.

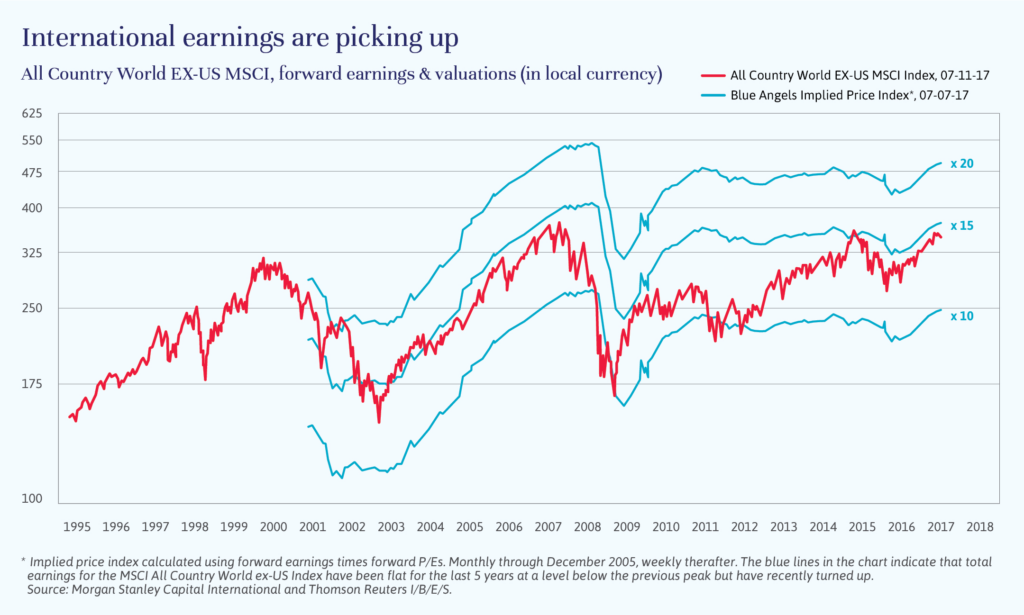

Betting on America should continue to pay, but at current price levels, it’s difficult to see how it will pay quite as much, relative to either recent years or to other developed markets. U.S. equities are trading at 18 times their forward estimated earnings, compared with a 50-year average multiple of 15 times forward earnings (see chart below). At the same time, international markets have begun to outperform the S&P 500, as international foreign corporate earnings grow after many years of stagnation. Stock markets around the globe, including France, China, and India, have recorded bigger gains so far this year – and may continue to do so – but remain relatively cheap.

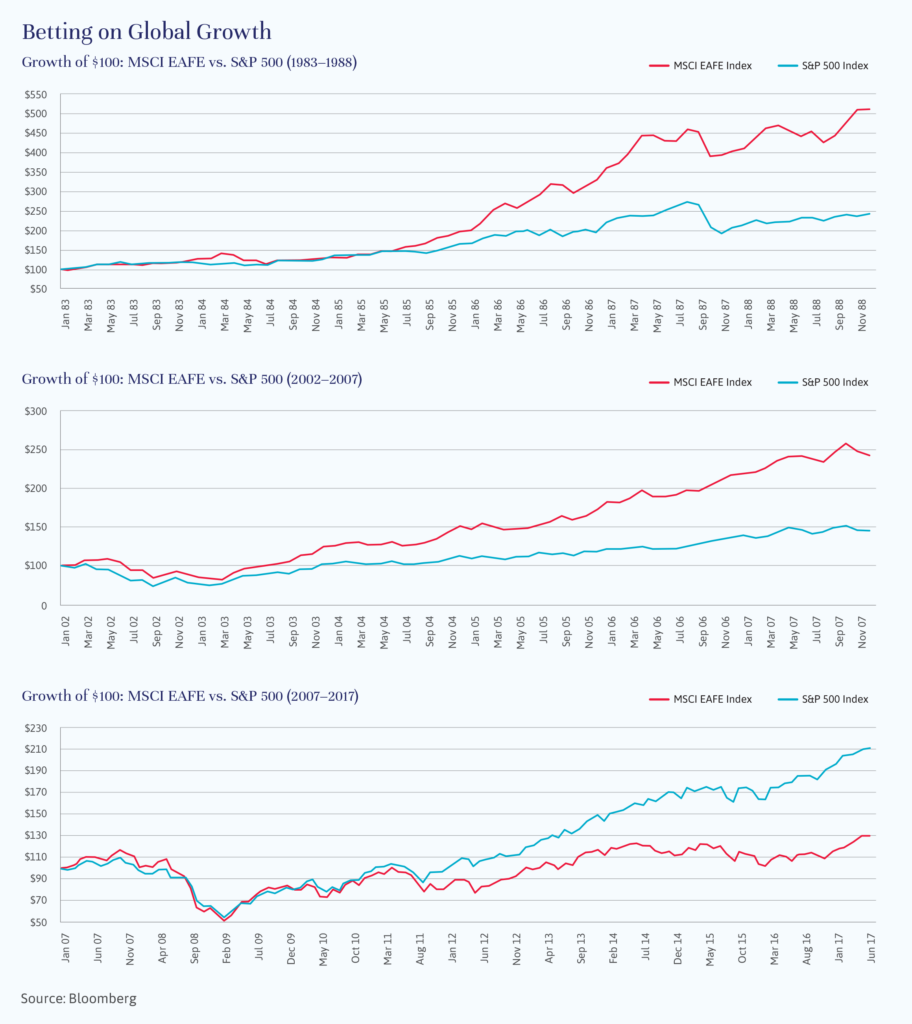

For U.S. domiciled investors, determining an international allocation is not obvious. Passively following the global benchmark would call for allocating about 50% of an equity portfolio in U.S. stocks. This strikes us as too low. The S&P 500 companies derive about 40% of their collective revenue abroad, providing U.S. investors with significant international exposure and minimal currency and political risk. In other words, betting on large U.S. corporations has been tantamount to betting on global growth, for U.S. dollar-based investors. As the third chart below shows, this approach has clearly paid off in the past 10 years.

However, it’s important to challenge complacency and rebalance portfolios that skewed too far in favor of the United States. International stock markets as a whole have outperformed the S&P 500 when the U.S. dollar is relatively cheap, which seems to us a distinct possibility over the next few years. (Indeed, as the charts below illustrate, returns on international stocks beat the U.S. market between January 1983 and December 1988 and again between January 2002 and December 2007.) We recently increased our allocation to international stocks to 30% from 25%, which seems to us about right at present.

In Europe, fears that Brexit will cause the European Union to unravel have greatly diminished after very different electoral results in the Netherlands and France. It may be that the isolationist policies in Britain – and in the United States, with the election of President Trump – have brought continental Europeans together, as they reaffirm shared values and strive to present a unified front in what can seem like a more fractured, dangerous world. At the same time, the economy’s growth rate is accelerating, unemployment is falling, corporate profits are on the rise, and the Euro has firmed against the U.S. dollar, while remaining at a rate helpful to European exporters. Europe as a whole is also a major beneficiary of low oil prices.

The picture is not quite as bright in Japan, where economic growth is constricted by severe demographic challenges. But there does appear to be a significant change in corporate culture and government regulation that is causing Japan’s major corporations to pay more attention to shareholder returns. Rising profit margins from persistently low levels is evidence of fundamental change.

The emerging markets are, as always, more of a wild card. In China, the driver of most of the emerging economies, growth is clearly slowing and total debt levels are a concern, but the economy is still growing faster than most, and the authorities have proven adept at keeping the game going. (Click here for an interview with Matthews Asia.) India is another bright spot in Asia, with the potential to take the growth baton from China.

While actively managing a core U.S. equity portfolio is a core competence of ours, selecting stocks within the very diverse international markets is not. We gain exposure to the international markets by investing in both the enhanced passive and active strategies of firms that have demonstrated an ability to generate positive returns from international equity investments.

At present, we are adding the Artisan International Value Fund to our current holdings in the DFA International Core Equity Portfolio and the Matthews Pacific Tiger Fund. Artisan is an actively managed international fund with a strong, fundamental, value-oriented investment process that will complement the DFA fund, which is more closely tied to the benchmark.

The U.S. economy has performed relatively well during this slow-growth recovery and expansion, and we remain positive on U.S. equities in general. However, we are not complacent. A robust exposure to international stocks seems to us appropriate at this juncture.

John Apruzzese is the Chief investment Officer at Evercore Wealth Management. He can be contacted at [email protected].