Independent Thinking®

Opportunity Knocks: Qualified Opportunity Funds

November 7, 2018

The nearly decade-long bull market has fueled about $2.3 trillion in unrealized capital gains. New legislation means that investors can qualify for a tax deferral and even tax-free appreciation by reinvesting these gains. The question is, will the investments be worth the long-term commitment?

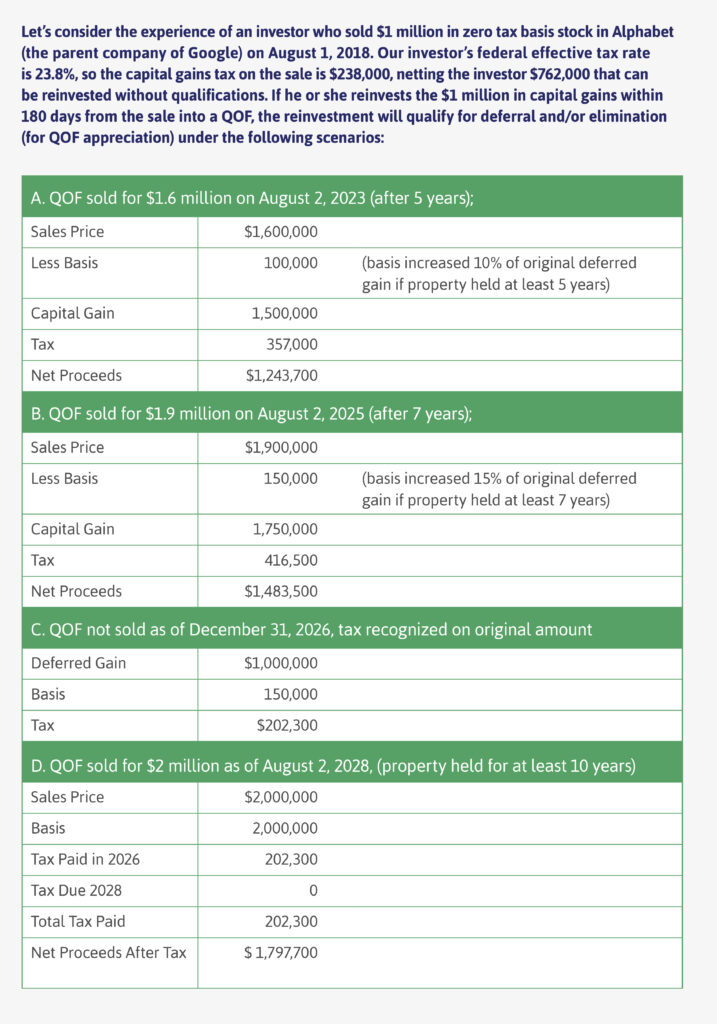

First, some background. Congress passed legislation in the 2017 Tax Cut and Jobs Act, or TCJA; one provision is designed to spur economic development by providing favorable tax treatment on the sale of appreciated assets reinvested in designated economically distressed communities. The TCJA allows unlimited realized short- or long-term capital gains, including gains from sales of 1256 contracts and art, to qualify for a tax deferral. If the reinvestment is held for at least 10 years, the appreciation earned during the reinvestment period in the Qualified Opportunity Fund, or QOF, will be excluded from tax.

Reinvestment must be made within 180 days of the original investment sale date, and in a properly structured QOF, many of which are in development now. The QOF holding period determines the amount and timing of the federal income tax benefit:

- A temporary deferral for reinvested gains occurs at the date the investor sells the investment in the QOF or December 31, 2026, whichever comes first;

- A partial forgiveness of the deferred gain results if the investor holds the property for at least five or seven years. The investor receives a permanent step-up in basis of either 10% or 15% of the original gain and, for investments held at least 10 years, the investor receives a permanent exclusion of capital gain from appreciation realized in the QOF. As noted above, the investor will recognize gain on the original deferral on December 31, 2026. Any further investment appreciation from the QOF will be excluded from tax if held for the 10-year period.

So, does the tax deferral and subsequent exclusion of gains within the QOF provide a sufficient incentive to justify reinvestment? It appears so, if the qualified investment vehicle makes sense in its own right and the investor has a sufficiently long-term horizon.

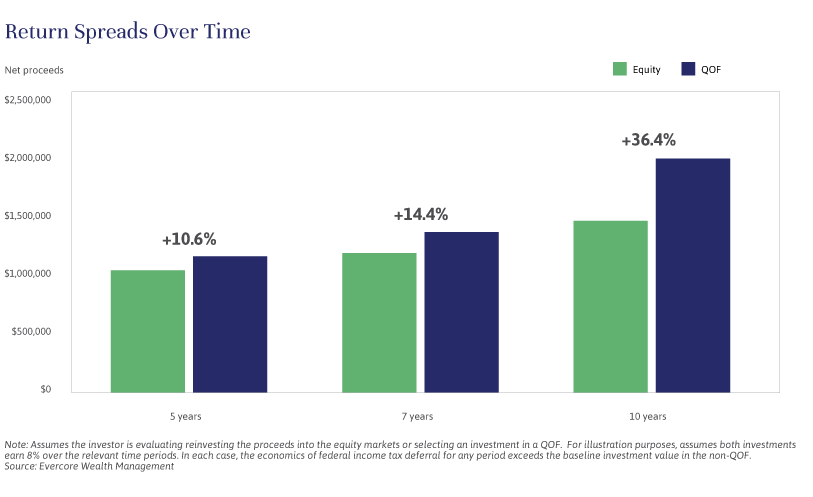

We have analyzed the opportunity of reinvesting in a QOF compared with paying the tax on the original amount on day one. Assuming a growth rate of 8% for all investments, the spread of returns varies from 10.6% for a five-year holding period to 36.4% for a 10-year holding period. These returns can be even more robust after considering the impact of state and local taxes. Although we have used the same rate of return in this analysis, the risk and return profile of investing in a QOF is significantly different from equities listed on the exchange and, at this point, hard to quantify.

At Evercore Wealth Management, we are evaluating managers who are creating QOFs that may offer investors attractive risk adjusted returns. For clients with long-term investment horizons, as well as for Dynasty Trusts and certain other trusts in which Evercore serves as trustee or investment advisor, we believe that QOFs may provide diversification and long-term return opportunities.

Julio Castro is a Partner at Evercore Wealth Management and a Wealth & Fiduciary Advisor at Evercore Wealth Management and Evercore Trust Company, N.A. He can be contacted at [email protected].

1. 1256 Contract is a term used by the Internal Revenue Service to denote any regulated futures contracts, foreign currency contracts, and a range of options.

2. Investment must be made before December 31, 2019 to take advantage of 5% basis increase in year seven.