Our portfolio managers include some of the most experienced professionals in wealth management, with world-class capabilities across a range of investment strategies.

We accommodate existing holdings – including concentrated stock positions – and factor in related considerations, including tax, securities laws, and legacy concerns, in the context of each client’s liquidity needs, risk tolerance, tax position and objectives.

We design and manage customized portfolios, adjusting for changes in family and business circumstances, the economic and regulatory environment, and the evolving aspirations and constraints of our clients. Through a process we call Efficient Architecture®, we combine our proprietary expertise and carefully selected external investments across a range of asset classes defined by their risk, return and liquidity characteristics.

Evercore Wealth Management designs custom portfolios that strive to generate the highest after-fee, after-tax, risk-adjusted returns across a range of asset classes to meet specific client goals. We seek to represent our fees, as well as the impact of inflation and taxes, in an entirely transparent manner.

Our asset classes include:

| ASSET CLASS | ALLOCATION INTENT | SAMPLE ASSETS |

|---|---|---|

| CASH | Anticipate spending needs and future investments |

|

| DEFENSIVE ASSETS | Preserve capital and provide current income |

|

| CREDIT STRATEGIES | Enhance total returns through credit risk exposure while minimizing interest rate risk |

|

| DIVERSIFIED MARKET STRATEGIES | Offset risks to which traditional allocations of bonds and diversified stock portfolios are vulnerable |

|

| GROWTH ASSETS | Incorporate all growth-oriented assets |

|

| ILLIQUID ASSETS | Allocate to investments with potential for high-growth returns |

|

We are always striving to generate the highest after-fee, after-tax, risk-adjusted return and we are proud of our investment performance. Please contact us to learn more.

LEARN MORE

Globalization: Reshaped but Not Reversed

Gold and Bitcoin: The Rising Value of Nonproductive Assets

The Case for Private Equity: The Evercore Wealth Management Private Equity Access Fund

Editor’s note: Neo Wang is the lead China economist/strategist at Evercore ISI, the leading U.S. research firm according to Institutional Investor’s annual survey. Evercore Wealth Management has limited investments in China, all of which are made through broader emerging market…

Editor’s note: Neo Wang is the lead China economist/strategist at Evercore ISI, the leading U.S. research firm according to Institutional Investor’s annual survey. Evercore Wealth Management has limited investments in China, all of which are made through broader emerging market mutual funds.

If Beijing has its way, the “Made in China” label will soon come to be associated with high quality and advanced goods. Massive investment in education and production is being made to innovate and move the country’s manufacturing sector up the global value chain. For investors, the potential impact is twofold.

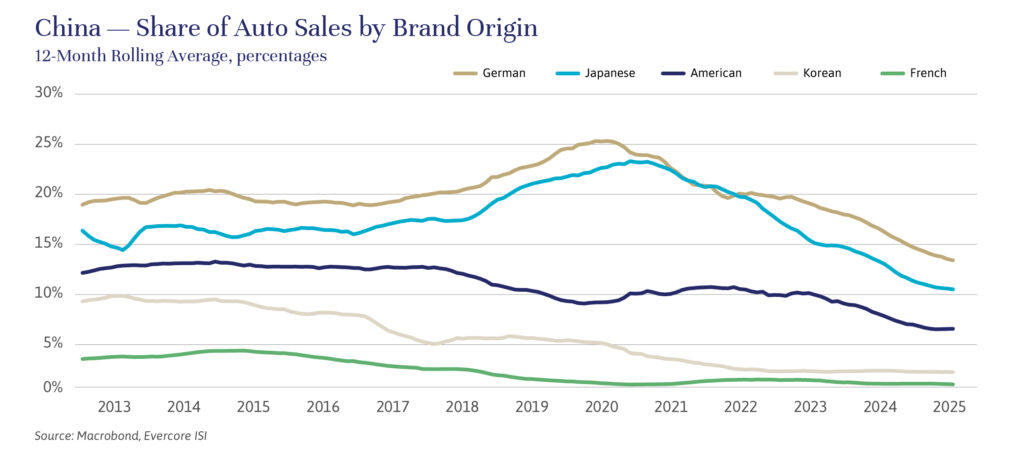

First, it will become harder for foreign companies doing business in China to make money. Rising local product quality, brand awareness, and perceived value-for-money will steadily erode their advantages. At present, many foreign companies are blaming China’s still lackluster economy and/or its politics for their own poor performance in the country — and there’s some truth in that. But as the economy improves, it should become apparent that many foreign companies are losing market share.

Second, companies in global markets will find Chinese companies more competitive at the higher-value end. Foreign demand is an indispensable force in Beijing’s plan to sustain or manage the slowdown of economic growth in the long run. Exports will remain a defining feature of China’s economy, regardless of what happens to domestic consumption, real estate, or infrastructure construction.

New-energy vehicles, or NEVs, are the most obvious case in point, as cars are the biggest ticket and most technologically intensive expenditure for many consumers. If China can get cars right, the thinking goes, then consumers will be more likely to embrace other Chinese products. This worked for the United States, Germany, and Japan, and now it seems to be working for China, as illustrated in the chart “China — Share of Auto Sales by Brand Origin”.

The emerging market is the focus, in line with China’s Belt and Road global infrastructure Initiative (more in the sidebar “A New Take on an Ancient Trading Route”). Developed markets are incentivized to put up barriers to reduce exposure to imports from China, to protect domestic industries and jobs. In contrast, countries that rely on imports for most higher value-added products don’t have many manufacturing jobs to protect; these consumers base their purchase decisions largely on perceived value for money. As these countries develop, Chinese manufacturing must move up the value chain to avoid local pushback.

Will it work? For China, growth has been a bumpy road since the three years of pandemic restrictions overlapped with the housing downturn. And the country faces challenging demographics, with an aging and declining population. But this time, it is not focusing on stimulus, but on a more fundamental shift, at home and abroad — one that has only gathered steam since July 2024, when Beijing described “high-quality development” as the primary task of “advancing Chinese modernization,” the core mission of the party. China has a significant advantage in its long-term planning and its large, relatively young, and rapidly expanding pool of engineers, a sustainable and suitable talent pipeline for its ambition. Combined with national efforts to tackle key techno-industrial bottlenecks, the size of China’s market for commercialization, and still relatively low labor cost, we believe it is inevitable that China will become an ever-increasing competitor — and less of a collaborator — to the established powers of advanced manufacturing.

A New Take on an Ancient Trading Route

China’s Belt and Road Initiative, the global infrastructure development strategy adopted by China in 2013, is not a charity project. It was the first step in Beijing’s long game to develop global growth in its favor to profit from that growth, mostly in emerging markets, via higher-end exports. The project continues but is now featuring more “small and beautiful” projects in response to concerns about the debt sustainability of receiving governments.