Independent Thinking®

Overload at the California Ballot Box

October 14, 2016

In another bumper season for statewide ballot initiatives, including some that seem too complicated for a general electorate, investors in California have to be wondering how much of a good thing is too much for the state’s fiscal health.

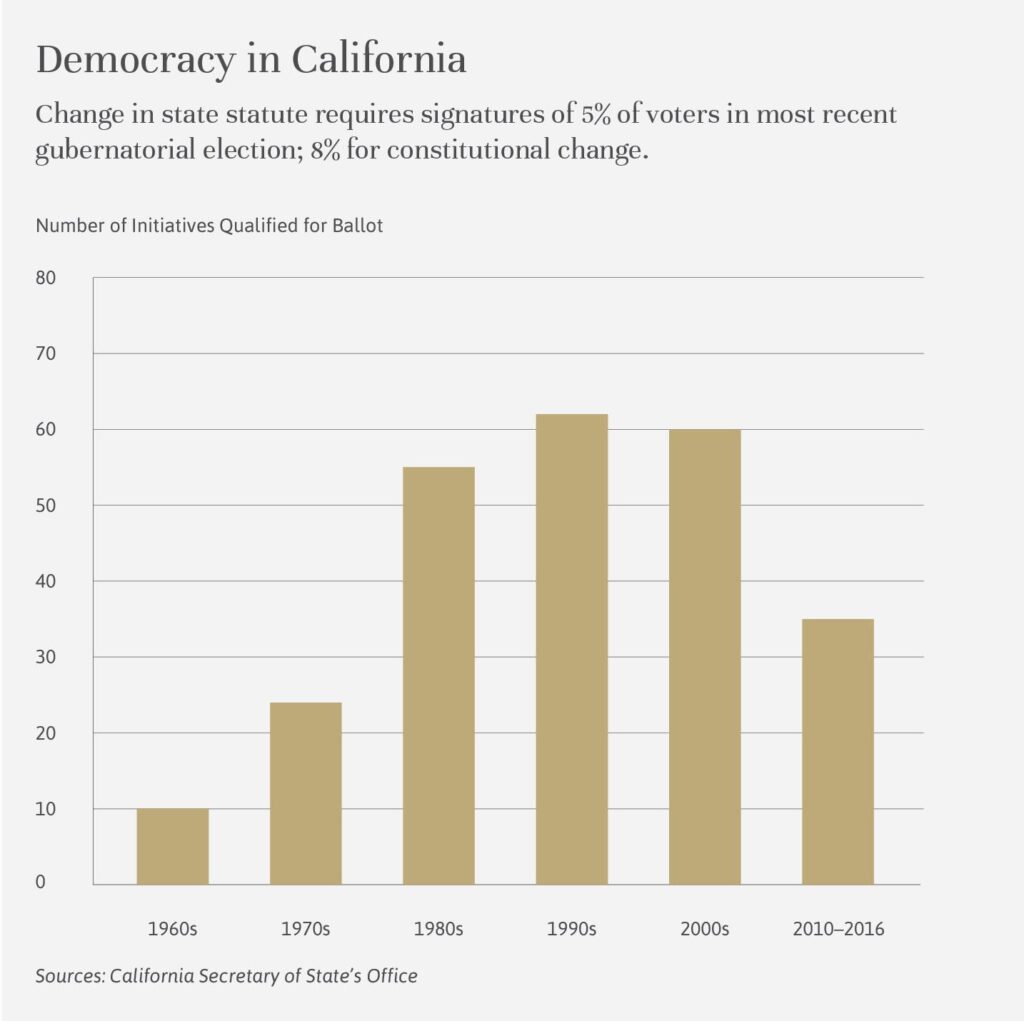

The number of signatures required to get a measure on the California ballot is reset every four years, based on the votes cast for governor in the previous general election. Since only 42% of the state’s registered voters – a record low – turned out in November 2014, it’s even easier now to put a proposed law before the voters. At the same time, state law now requires all citizen initiatives go before voters in November during a general election.

Important decisions are therefore left to a relatively small – and quite possibly overwhelmed – electorate. Of the 17 statewide ballot initiatives confronting voters this season, the product of record campaign spending, a number could have an outsized impact on the state’s operating and capital budgets. The estimates from the California Legislative Analyst’s Office on the total operating budget impact is between $6 billion and $11.4 billion, or 5% to 9.5% percent of California’s entire general fund revenue budget for fiscal 2017.

For investors in California bonds, the outcome of these initiatives and their relationship to the state’s budget is critical for California’s future. On the operating side of the budget, the importance is based on the state’s volatile revenues, which are linked to difficult-to-forecast financial market performance caused by a highly progressive income tax structure. On the capital side of the budget, there is a huge backlog of deferred maintenance and infrastructure needs across the state. Forcing people to vote on these complicated policies during a tumultuous election cycle makes the outcome difficult to predict.

This unwieldy ballot forces both proponents and opponents of each measure to rethink their strategies to compete in an unusually crowded field. Unlike voting for candidates, in which there are signals around partisanship or ideology based on political party affiliations, individuals voting in a referendum who don’t know the specifics around a measure, or are confused about the wording, may be likely to skip it or just vote no out of frustration.

The many recent propositions involving the tobacco, oil, plastics, and pharmaceutical industries also drive up the costs, as deep-pocketed interest groups are willing to spend considerable amounts of money to protect their interests. It also encourages a dual-track system for managing state finances, with some decisions made at the Capitol and others at the ballot box, as politicians lack the political will to make unpopular decisions. Conspicuously absent from the 17 statewide ballot proposals this November, for example, is any explicit mention of funding transportation programs after the governor’s failed attempt during a special session calling for a transportation package of $3.6 billion a year.

The state’s revenues, which have a propensity for wide swings in performance, mean that the forecasted tax collections aren’t reliably sustainable, and investors will have to weigh the potential impacts in the context of future recessions along with today’s relatively robust environment. Capital needs may also need to be realigned during an era of significant underfunding for infrastructure. The hard-fought fiscal alignment achievements of the past five years could be eroded, exposing Californians to more political and financial uncertainty.

While we remain reasonably confident that California will retain its recent fiscal discipline and that the state and most local entities will manage their long-term liabilities while identifying new revenue sources to address capital needs, the sheer volume of initiatives add a level of uncertainty. At present, we favor purchasing California bonds secured by essential purpose enterprise systems in affluent regions. We continue to research and purchase a diversified variety of state and local credits that help provide appropriate risk/return rewards for our clients.

Howard Cure is the Director of Municipal Bond Research at Evercore Wealth Management. He can be contacted at [email protected].