Independent Thinking®

Powerful Protection in a Low Interest Rate Climate

December 11, 2019

Is there still a case for owning bonds? Some investors don’t think so, asserting that low interest rates mean that the traditional 60% stock/40% bond portfolio is dead in this low interest rate environment – stocks and alternative investments, such as hedge funds and private equity, are the only asset classes worth owning. But like reports of Mark Twain’s demise, these accounts are greatly exaggerated.

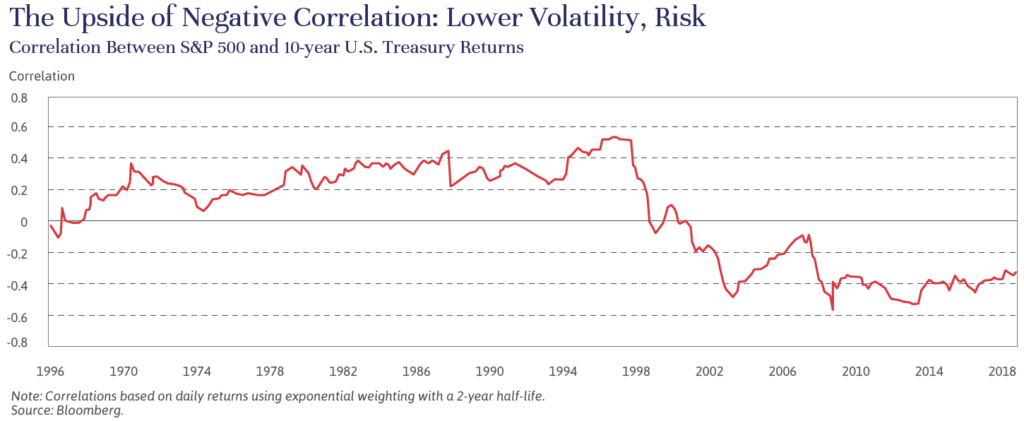

At 25 years and counting, the current low and reasonably stable inflation environment is not only very helpful to equity valuations, as we have previously discussed,1 it is also helpful to the relationship between stocks and bonds. Low inflation in the United States and the rest of the developed world is generating a strong negative correlation between stocks and long-term bonds. The rise in the price of one asset class corresponds with the fall of the other, effectively making each – and the portfolio as a whole – more valuable.

When inflation is low and stable, economic growth rather than inflation is the dominant variable for both the bond and the stock market. If economic growth surprises to the upside, the stock market will react positively. At the same time, both markets will anticipate a tightening of monetary policy to avoid the market overheating. Interest rates, especially to real (or post inflation) interest rates, will rise in response, causing bond prices to fall while stock prices climb. A downside surprise in growth results in the opposite; stocks fall and bonds rise, in anticipation of looser monetary policy. This negative correlation between stocks and bonds reduces the overall volatility and significantly improves the risk/return characteristics of the 60/40 portfolio.

A return to sustained inflation above 3% would reverse this equation. When inflation is high and variable, the correlation between prices and stocks flips. That’s because inflation news tends to dominate Fed actions and market reactions. Inflation surprises on the high side tend to move bond yields up and bond prices down, while expectations of tighter monetary policy and resulting economic slowdown cause stock prices to fall. Higher discount rates applied to future cash flows also suppress equity values. A positive correlation undermines the diversification of a traditional 60/40 portfolio. If both asset classes are moving in the same direction at the same time, the exposure of investors to a market downturn is effectively compounded.

However, we retain a fairly high level of confidence that inflation will remain low, thanks to three and possibly four long-term secular trends, which we’ve discussed before in this publication but bear repeating.

Demographics are the most powerful and easiest to predict. The dramatic slowdown in population growth throughout the world, save Africa, is deflationary.2 Slower population growth, coupled with an aging population, exerts significant downward pressure on inflation due to a slowdown in demand.

High debt levels discourage additional credit creation, which reduces the ability for demand to grow faster than income growth. Since 2008, the fiscal debt has expanded to 76% of gross domestic product from 36%.3

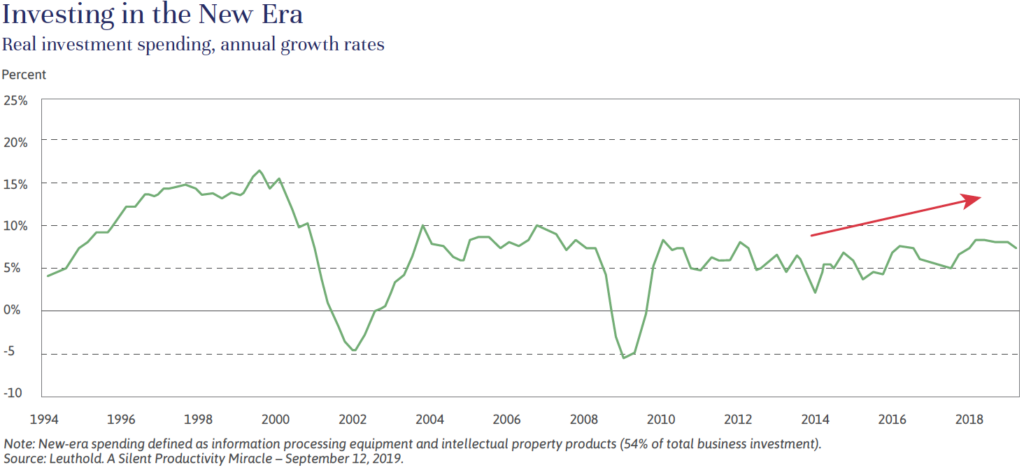

Technological innovation is driving productivity, which in turn drives down production costs across most businesses, from oil drilling to financial services. As illustrated below, investment spending on information processing equipment and intellectual property products, which now accounts for 54% of total business investment, has been growing at an annual rate above 5% since the financial crisis.

Globalization has been an influential deflationary force for the past 25 years. However, its impact has diminished recently due to trade tensions, notably between the United States and China. It could revive as a deflationary force if those trade tensions are resolved, but we are not holding our breath.

These secular deflationary trends should, we believe, keep inflation low for the foreseeable future. The negative correlation between stocks and long-term bonds should therefore continue as well. Yes, the yields of high-quality bonds are low, with the 10-year U.S. Treasury close to 2%. But all other developed countries have significantly lower or negative rates on their sovereign debt, leaving plenty of room for yields on long-term Treasuries to fall ahead of the next recession. Bonds would then rise, even as stock and other assets decline, curtailing the total drawdown in a balanced portfolio.

While it might be tempting to trade back and forth between two negatively correlated asset classes, it is important to stress that price moves in both the stock and bond markets are in response to unforeseen events and not consistently predictable. A consistently balanced portfolio with a negative correlation between the two major asset classes provides the highest possible risk/return ratio.

Mark Twain lived another 13 years after the rumors about his death circulated. The 60/40 portfolio remains a robust starting framework for diversified portfolios. Of course, we adjust the ratio to each individual client’s investment objectives and risk tolerance. At Evercore Wealth Management, we also modify the traditional 60/40 portfolio to include additional asset classes to help further diversify the portfolio.

Many of our clients are comfortably able to allocate 10%-15% of their portfolios to illiquid assets including private equity, venture capital and real estate; and another 10%-15% to credit and uncorrelated strategies. This still leaves 70%-80% of the portfolio in a combination of stocks and high-quality bonds, which benefits from their negative correlation.

We own bonds in balanced accounts because they reduce volatility, provide liquidity and produce current income. In growth accounts, we do not own bonds because our clients want greater returns and are willing to accept greater volatility.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].

1 John Apruzzese, A Reality Check for Stock Valuations. New York, November 2017.

2 Brian Pollak, Demographics and Development (Independent Thinking Spring 2019).

3 Federal Reserve Bank of St. Louis.