Independent Thinking®

Prepared for Anything with Good Technology and Good Advice

July 6, 2020

Fifty years ago, I was attending business school and marching up and down Wall Street – but not the way you might think, at least not at first. Back then, I was marching as an organizer of a group called Business Students for Peace. It was just a few weeks after the Ohio National Guard fired on protesters at Kent State University, a time that felt much like this. A few weeks later I was marching the street again, seeking employment. I stumbled into a position at U.S. Trust, then located at 45 Wall Street, and entered the wealth management business.

I’ve learned at least two things since. The first is to hold on to our ideals, as they will be repeatedly tested in our personal and business lives. I like to think I’ve done my best, but I know that there is much more that I (and all of us, as a society) can do, a subject I hope to revisit in subsequent editions of Independent Thinking. The second is to be prepared for change, because none of us know what’s coming next.

Enter COVID-19. I haven’t been to a restaurant, bumped into a friend or colleague or, worse still, hugged a grandchild without a mask since mid-March. And like many among my generational cohort, I’m sad to say that I have no plans to rush back to the old normal. But if I didn’t expect a pandemic, I was at least prepared, thanks to good technology and good advice.

I love technology. I find it incredibly interesting, and it informs my work and other passions. So when I realized my home offices in Florida and New York would in fact be my only offices – and video my only way of catching up with those grandchildren – I was already set up with the appropriate equipment (as were my colleagues, thanks to years of robust business continuity planning). And I was equipped to play, as well as to work. My spouse of 47 years and I had subscriptions to multiple entertainment sources – daily online newspapers, magazines, music and films, as well as video technologies that enabled us to socialize, order online, and settle $5 wagers on golf games through Zelle.

On a related note, our financial accounts were online, our documents stored on the cloud (as are our photographs), and we were enrolled in contactless payment systems.

It is my hope that all Evercore Wealth Management clients, irrespective of age or technological sophistication, will similarly benefit from technology. Please see Ashley Ferriello’s article on virtual wealth planning here and, if you were unable to join our recent webinar Thriving in a Digital Age: A Primer (and More), you can access the replay on our client site or here.

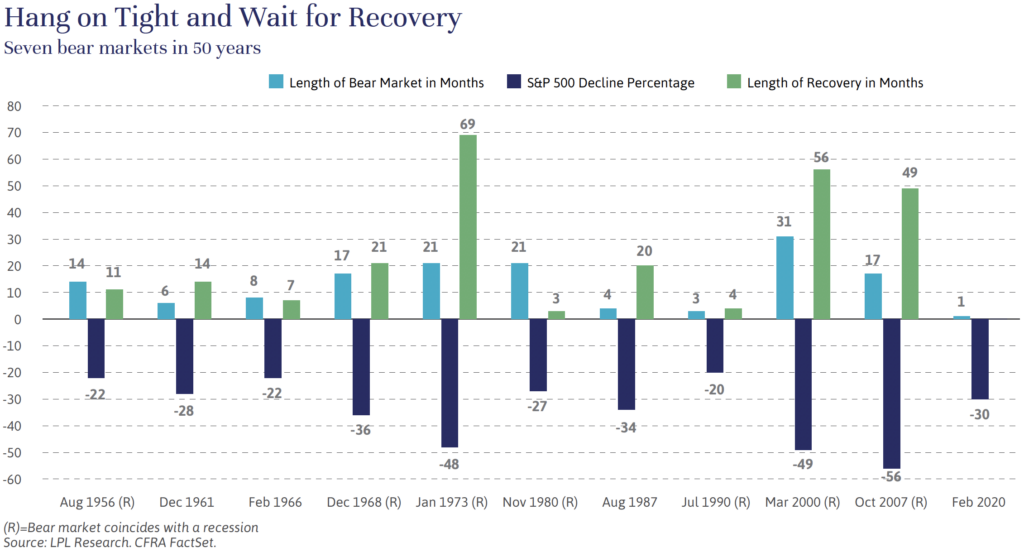

Additionally, I (along with other Evercore Wealth Management clients) was ready on the financial front. In the 50 years since those marches on Wall Street, I’ve experienced seven bear markets, all very different but none pleasant. The important thing is to ride them out, which means staying close to trusted advisors who have their clients’ best interest at heart and are objectively focused on those clients’ long-term goals.

As illustrated below, each of those bear markets had a maximum drawdown of between 20% and 56%, and lasted between three and 31 months, with recovery times longer still. The COVID-19 bear market, which started in February and resulted in a 30% drawdown, appears to have lasted less than one month, although we won’t be sure of that for some time. But we’ll be prepared, in any case.

None of us know what’s coming next. I’m sure that all of us hope for an increasingly equitable society, an effective COVID-19 vaccine, and to gather in peace in a new and better normal.

Jeff Maurer is the Chairman of Evercore Wealth Management and Evercore Trust Company. He an be contacted at [email protected].