Independent Thinking®

Prospering in a Low-Growth World

May 3, 2019

A growing labor force is one of only two drivers of real economic growth (the other is productivity) and it can be forecast into the future with a much higher degree of certainty than most economic variables.

After fairly consistent growth since the beginning of the Industrial Age, the labor force is now shrinking in most developed countries. While the United States is in relatively good demographic shape, we should expect slowing global growth and continued low inflation.

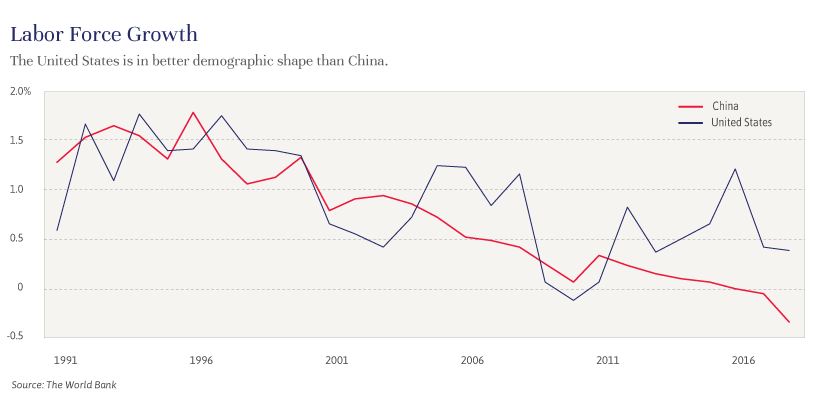

China has been the engine of global economic growth for over 30 years – but its growth rate is slowing and looks likely to continue doing so. This is partially due to the country’s official one-child policy, which was abandoned in 2016 after 35 years and the prevention of 400 million births, by the government’s reckoning. China’s labor force peaked in 2015 and is now declining (as illustrated by the chart below), while its population continues to age, in what economist Ed Yardeni describes as the “world’s largest nursing home.” Its gender gap of approximately 118 boys for every 100 girls, another consequence of that policy, does not bode well for future growth.

Declining labor force growth drives down consumer demand. Flat to declining labor force growth is now happening in the European Union, as well as in China and Japan, which has for years been the major economy with the oldest population. Slowing consumer demand is a powerful deflationary force, and it goes a long way in explaining why inflation around the world has stayed stubbornly low in the face of extraordinarily expansive monetary policy across all the major central banks in response to the financial crisis of 2008-2009.

In the United States, the growth of the labor force is also slowing due to declining fertility rates, although the pace is more moderate. As Ashley Ferriello discusses here, the average lifespan in the United States is currently 79. This has increased over the prior 80 years from a life expectancy of just 60. Additionally, the fertility rate is 1.9 per woman, or slightly below replacement level. As in other industrialized countries, more people are continuing to work past the conventional labor force range of ages 15 to 65, and more women are entering the workforce. However, an increase in women of childbearing age entering the workforce can cause the fertility rate to drop further, compounding the problem down the road.

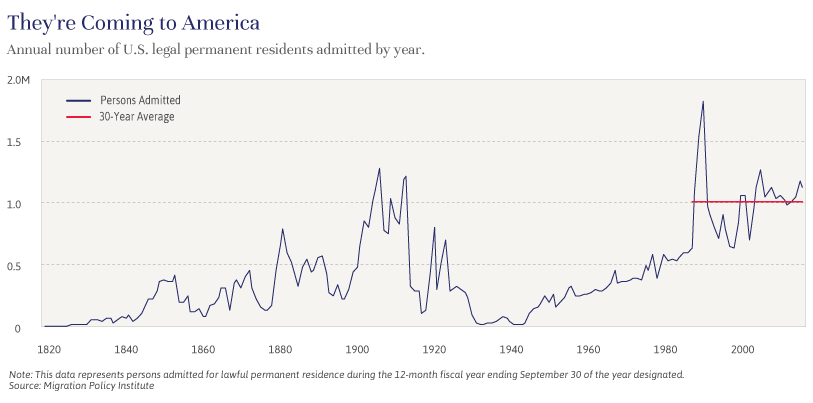

The real demographic differentiator and an enormous boon to the U.S. economy is a net annual legal immigration rate of about one million people, as shown below. Immigration mitigates the economic impact of aging populations and lower birthrates, maintaining the labor force and supporting consumer demand. Of the nine countries that the United Nations predicts will account for half the world’s population growth to 2050, only one – the United States – is a fully developed economy. If this continues, our labor force growth should remain positive, albeit slow, for the foreseeable future.

The solution to the problem of a shrinking labor force generally is productivity growth. Unfortunately, measured productivity growth in the United States and elsewhere is also slowing, as the latest cycle of technology invention, adoption and saturation wraps up. But the imminent rollout of 5G technology, with its ultra-fast transmission rates, coupled with advances in robotics and artificial intelligence, may herald the next turn in the technology growth cycle and, perhaps, an even greater surge in productivity.

The United States has a considerable advantage in being the only major economy that will not experience negative population growth for the foreseeable future. Indeed, if we are really fortunate, the much-discussed risks of machine learning may actually be just what an economy that lacks labor force growth needs.

In the interim, and against this backdrop of continued low inflation and relative demographic strength, U.S. assets appear to us reasonably valued and we remain overweight the United States. We recommend exposure to diversified risks, including uncorrelated return streams to make portfolios more robust. We continue to believe that illiquid investments will earn a premium over liquid public markets in a low-growth environment.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].