Independent Thinking®

Protecting Market Gains

April 17, 2015

Highly appreciated stocks and higher tax rates are presenting many investors with a high-class problem: what to do with substantially appreciated stock positions. A number of wealth planning strategies can help ease diversification and protect gains, even in these conditions.

The first step is to understand the risks associated with single concentrated holdings (about 10% or more of a portfolio). While there can be reasons to preserve the position (and tax-efficient ways in which to do so), the temptation is all too often to hang on, especially for those with an emotional stake in the company or a fear of paying tax. Indeed, it can take a drop in the share price and corresponding drop in account value, pending retirement or a stock-for-stock takeover to shift an investor’s perspective.

Once that Rubicon is crossed, the diversification needs to be achieved in the most tax-efficient manner possible, in the context of the investor’s lifestyle, family, philanthropic and legacy goals. There is rarely one single strategy that will work on every count, however, and it’s important to consider the full range of options, including potential combinations structured to meet those diverse goals.

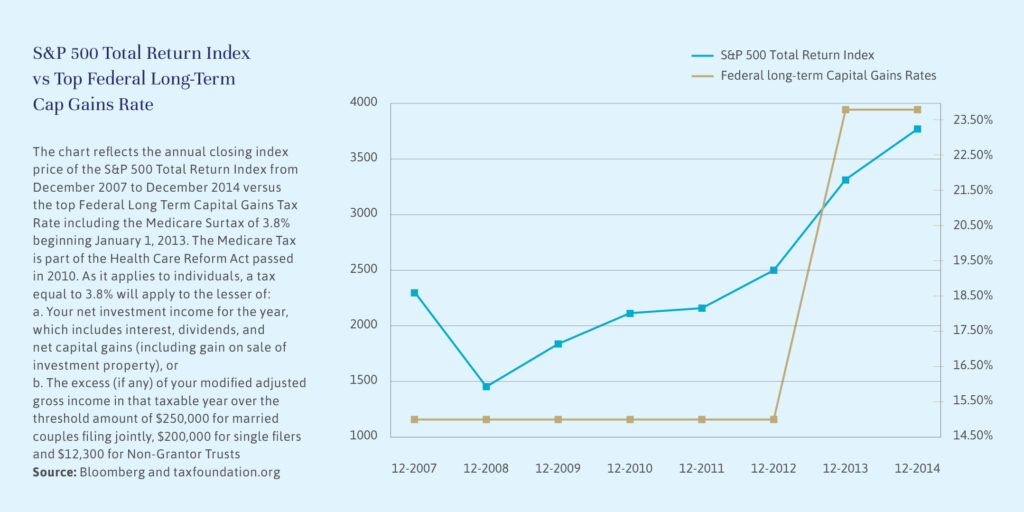

Selling the stock outright is the most obvious choice and, prior to 2013, it was often the best, providing a level of certainty. The subsequent rise in federal long-term capital gains tax to 20% from 15% and the introduction of a 3.8% Medicare surtax on high earners resulted in an almost 60% tax increase on the sale of concentrated low-cost stock positions, making this once-simple approach to diversification harder to swallow.

Investors can enhance the value of outright sales and by selling so-called out-of-the-money covered call options, or selling the right to someone else to buy the stock at a specified price from the investor. For stock worth $30 a share, for example, the call option at $33 might be worth $1. By selling another investor the call option at $33, the investor can receive the $1 premium today and, at the time of sale, the $33, assuming the stock reaches that price (and the counterparty exercises the call). If it doesn’t, the investor keeps the $1 premium, which is taxed as a short-term capital gain. The investor continues to have full downside exposure on the stock beyond the $1 premium protection, so it is important to note that this strategy is more of an income enhancement than a hedge.

There are also a number of hedging strategies that can help investors who have short- to medium-term concerns about a stock’s prospects and would like to protect the position while deferring the realization of capital gains taxes.

For pure downside protection, investors can purchase a put option for the right to sell the stock at a particular price. An $85 put option on a $100 stock would protect the holding dollar for dollar should it fall below $85. Put options can be prohibitively expensive, however, depending on the volatility of the stock. To offset that cost, an investor could sell at the same premium (subject to market conditions) a corresponding call option at a price higher than the current stock price. This so-called “zero premium equity collar” requires no upfront cash outlay and provides the investor exposure to the stock between the put and the call price, say $125 in this same case, without incurring a full taxable event.

Zero premium equity collars can be attractive hedges. But there are restrictions on the borrowing amounts, and liquidity features have limitations. It’s also important to note that the position itself remains undiversified and any dividends on the stock are taxed at ordinary income rates (and not the lower rates afforded qualified dividends), which adds to the cost of the transaction.

A prepaid variable forward, or PPVF, is similar in structure to an equity collar, in that it has a floor and a cap. In this case, however, the investor agrees to deliver some or all of the underlying shares at a future date in exchange for an upfront cash advance, which does not have to be repaid but is adjusted for the carrying cost. As margin rules do not apply here, the investor may allocate 100% of the cash advance to a portfolio of securities (or other investments). If the stock drops below the floor at maturity, the investor will be required to deliver 100% of the underlying shares (if settled in stock) and the taxable event will occur at that time. While the PPVF offers investors the upside in the stock to the cap and defers the realization of capital gains tax to a later date, the opportunity to invest the entire cash advance in securities during the term of the contract is an added benefit over the equity collar.

There are drawbacks, however. The discount in the advance rate is not currently deductible as investment interest expense, and the dividends on the underlying stock are treated as nonqualified, similar to the equity collar. Also, the uncertainty around this transaction if the counterparty uses borrowed shares makes it extremely important to structure this deal carefully, mindful of the often considerable inherent financial, legal and tax complexity involved.

It is important to note that executives deemed to be insiders for SEC reporting purposes must report these hedging transactions, although they are filed differently than an outright sale. Also, many public companies restrict their senior executives from engaging in these transactions under corporate policy. Investors who received shares in conjunction with a public transaction should secure a careful analysis of the regulatory and securities law factors impacting the stock.

As we have discussed in earlier editions of Independent Thinking, philanthropically-minded investors can give long-term appreciated securities to a public charity, donor advised fund or private foundation, achieving immediate diversification and a charitable income tax deduction (subject to limitations), but at the expense of both the principal and income of the assets as well as the flexibility of retaining those assets outright.

A charitable remainder unitrust may be a viable alternative to efficiently diversify a concentrated stock position while continuing to fund personal cash flow and provide a future bequest to charity. This vehicle, which can be established for a term of years or for the donor’s lifetime, allows the donor to contribute long-term appreciated stock, and diversify and reinvest the proceeds immediately without incurring current income tax consequences. The donor receives an upfront charitable income tax deduction, but only on the present value (determined by IRS factors) of the amount that is projected to pass to charity at the end of the term of the trust. During the term of the trust, the donor receives an annual payout based on a fixed percentage, set at the trust’s inception, of the annual fair market value of the trust. The donor is taxed on the annual payout, but the growth of the assets remaining in the trust is tax-deferred.

Interest in exchange funds rises along with taxes and asset valuations – and for good reason. Exchange funds, typically registered as limited liability companies, enable investors to contribute low-cost stocks without incurring immediate tax and while remaining fully invested in a diversified portfolio of holdings (constructed from various contributions) for the duration of the fund. It’s important to note that these funds must invest 20% of their holdings in nonpublicly traded securities or real estate units, and typically use leverage to accomplish that objective.

The investor must remain in the fund for at least seven years to realize the full income tax benefits of the fund and avoid any exit or redemption fees. There is typically a low level of income during that time, as the fees and expenses within the fund may offset any dividend income. At the end of the term, the investor can elect to receive a distribution of securities from the fund, which will retain a carryover cost basis from the fund (which may be close to the original basis of the security contributed). The fund’s management typically maintains the right to select the securities distributed back to the investor. This can generate a great deal of uncertainty.

While investors may benefit from staying fully invested and achieving tax deferral and timely diversification, the exact terms of the exchange fund, including fees, redemption terms, past performance and distribution policy of the management team, should be carefully considered before entering into this type of transaction.

There are myriad ways to manage the diversification of a concentrated, low-cost stock position – and success is most often achieved when both the advisor and the client are clear in the specific goals that the client would like to achieve. Investors who are presented with anything resembling a “one-size-fits-all” strategy should get a second opinion.

Qualified Small Business Stock

Entrepreneurs and partners in venture capital funds may be able to reduce or eliminate tax on gains of up to $10 million, if their holding qualifies as a small business stock, or a QSBS under IRC. Sec. 1202.

They must own eligible stock in a qualified corporation for more than five years and meet a series of IRS requirements at the time of issue, including a maximum gross assets test. Additional requirements apply to the general partners of venture capital partnerships, to keep the QSBS status intact.

The capital gains exclusion, which has been modified several times over the past five years, ranges from 50% to 100% of the gain, depending on the date the stock was acquired. State income tax implications must be considered, especially in California where there are additional requirements for QSBS status, as well as a less favorable c apital gains exclusion (capped at 50%), and a different alternative minimum tax treatment.

Also worth considering is the option, under IRC. Sec. 1045, to roll over capital gains from the sale of a QSBS held for more than six months, if the individual investor purchases other small business stock during the 60-day period beginning on the date of sale.

These strategies can drive significant savings but require a very careful determination of QSBS status and its impact on other tax planning strategies.

Chris Zander is a Partner at Evercore Wealth Management and the Chief Wealth Advisory Officer. He can be contacted at [email protected].