Independent Thinking®

Risk and Asset Allocation

July 21, 2016

Risk matters. A portfolio that holds risky assets has a greater likelihood of more extreme movements. If these movements are outside an investor’s comfort range, there’s another risk at play: that he or she will abandon an investment plan, with potentially unfortunate consequences.

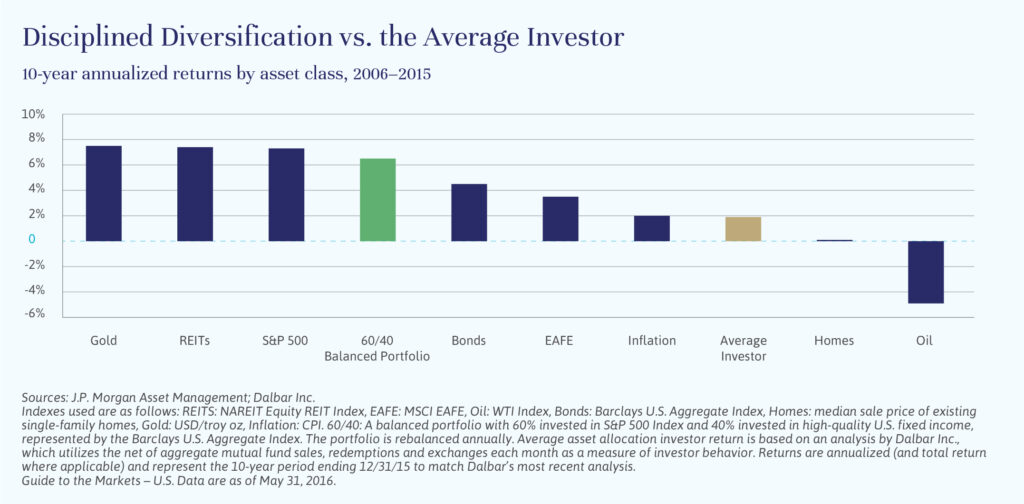

Look at what happens when investors try to time the markets. As the chart below shows, the average mutual fund investor underperforms most major asset classes. That’s because they are more likely to sell after bad news is already priced into the market or buy after the market has rebounded. It’s far better to stay invested through the full market cycle, usually five to 10 years from economic boom to recession and back to boom again, than to dip in and out. A truly goals-based approach to investing first tries to limit the level of portfolio risk within a comfortable range and then focuses on maximizing risk-adjusted returns.

Risk Assessments

Portfolio risk should be evaluated against prospective benefits. Growth assets, such as stocks, have greater potential for higher returns, but also have more risk, or volatility. Bonds should be considered defensive assets, as they lower a portfolio’s overall risk and provide a more stable return stream.

Finance professionals often describe risk in terms of volatility, which is a measure of the dispersion (or range) of returns for an asset. Higher volatility means higher risk, because there is more uncertainty around where the price will be at any particular point in time. However, volatility is not the best measure of an investor’s comfort level. Volatility focuses investors on how much a stock price can lose in a day or a month, but it’s the total cumulative loss in a down market over a prolonged period of time – the maximum potential drawdown – that truly impacts an individual investor’s risk tolerance.

In a severe market downturn, the drawdowns can be painful; in the global financial crisis of 2008-2009, the total drawdown in equities was 55%. Investors who couldn’t stomach the pain of these sustained losses sold out of their stocks near the low point and missed much of the rebound. In contrast, a balanced portfolio invested in 60% equities and 40% fixed income had a maximum drawdown of 30% over that same period. Not only do bonds have lower volatility than stocks, but the two generally have a low correlation to each other, meaning that they usually do not move in the same direction or at the same time. During most periods that stocks are down, bonds will be flat or slightly positive, thereby reducing the maximum potential drawdown in a balanced portfolio.

For an investor to remain engaged through a full market cycle, the maximum potential drawdown based on worst-case expected market assumptions needs to be within a range that’s perceived as acceptable. If it’s not, that’s a signal to limit risk by increasing the amount of defensive assets, such as bonds, in the portfolio mix. For those with a longer time horizon and higher tolerance for potential drawdowns, a higher exposure to growth assets may be appropriate. Either way, it can be helpful to set aside a separate fund with the equivalent of several years’ worth of spending. The investor is able to fund his or her lifestyle through the worst of the market cycle and remain invested in the markets.

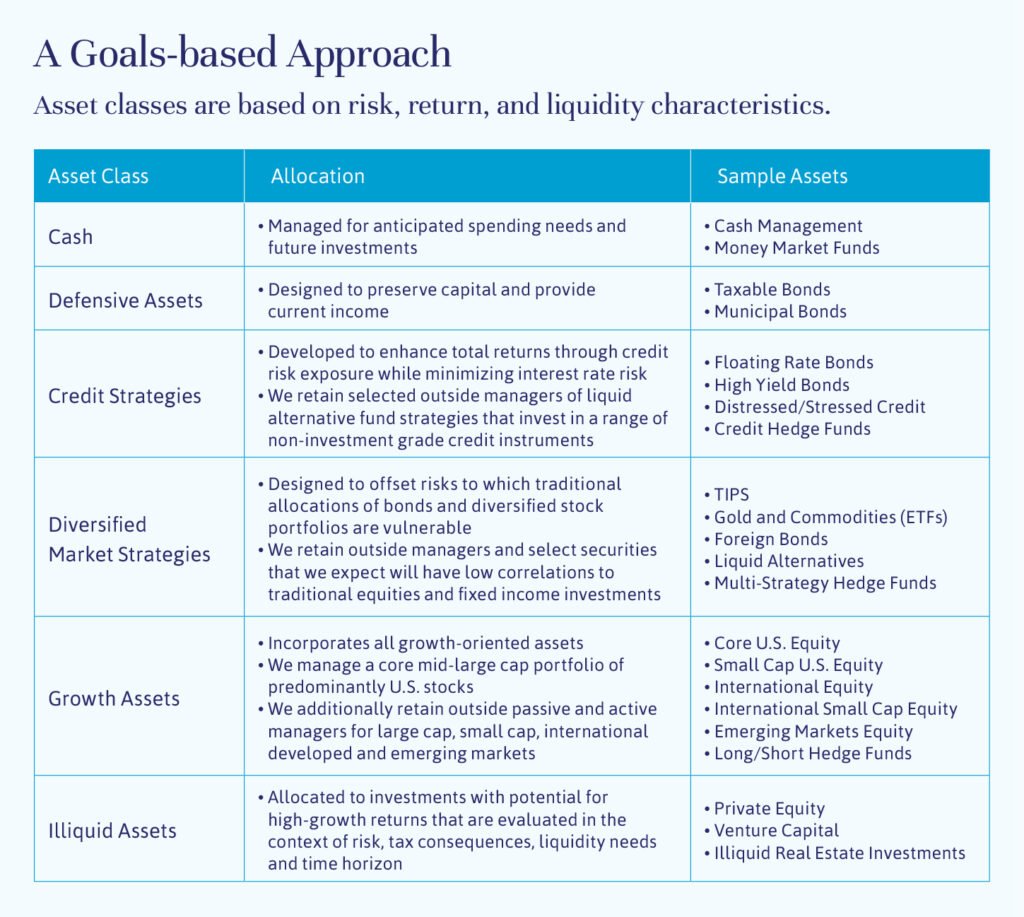

As appropriate to each client, we incorporate other asset classes into the portfolio mix, based on their potential to maximize returns for each unit of risk. Additions to our asset allocation framework must either reduce the overall risk in the portfolio without lowering expected return, or have the potential to increase overall return without increasing risk. Our asset categories are based on their risk, return, and liquidity characteristics.

It’s important to strike the right note for each portfolio, preserving and growing assets in the context of current market conditions. That’s the best way we can help our clients invest with confidence and stay on track to meet their long-term goals.

Stephanie Hackett is a Managing Director and Portfolio Manager at Evercore Wealth Management. She can be contacted at [email protected].