Independent Thinking®

Seeing the Forest – and the Trees

April 24, 2016

Recognizing change is difficult. It is far more comfortable to extrapolate into the future familiar assumptions about a conventional U.S. president-elect, a growing Chinese economy, controlled oil prices, union in Europe, and positive interest rates, even as evidence mounts to the contrary. But long-term investors need to concentrate now on managing risk.

A striking feature of these risks is how intertwined many of them are. The impact of the U.S. elections, addressed by Evercore ISI Senior Political Strategist Terry Haines on page 8, will be felt around the globe, even as the slowdown in China continues to influence everything from Japanese interest rates to Saudi oil policy to valuations in S&P 500 index companies. These aren’t the only drivers of market change, of course. Diversification, along with a focus on value and on maintaining a margin of safety, should be the mainstay of investment portfolios.

Diversification has to be managed carefully. Risks that are unrelated but purely speculative are not useful, and overdiversification, along with the associated fees, can water down returns to very mediocre levels. We see some unconventional opportunities that are uncorrelated to the stock and bond markets and have sound expected returns. As we discuss on page 6, we have made several investments in our diversified market strategies and illiquid alternatives asset classes that we anticipate will stabilize portfolios and generate alpha, even as the stock and bond markets struggle.

In these, as in any investment, value – or the price of an asset relative to its expected future cash flows – is the single most critical element. Overpaying for anything, no matter how attractive, will result in disappointing returns. We take a fundamental approach to determining value, reviewed on page 5, and have a slightly contrarian bias. Avoiding overpriced assets and identifying undiscovered opportunities requires critical thinking.

Proper valuation must include a margin of safety, which incorporates an assessment of the level of confidence around the future projections. This is also not an easy exercise, as it requires self-awareness so that common behavioral mistakes are minimized.

It also requires patience, in investors and clients alike. Communications technology and the investment media are encouraging investors to focus on increasingly short time frames, at the expense of a more thoughtful approach. We remain focused on three-to-five-year-plus time horizons and sound economic rationale when considering an investment, an approach that has historically served our clients well.

All successful investment strategies go through periods of short-term underperformance, however, and our own core equity strategy is no exception. The past few months have been trying, as the market became increasingly narrow, with index returns skewed by the performance of a few large speculative stocks. But cooler heads will eventually prevail. Our belief is that the best time to invest or add to a strategy that has a sound investment approach and good long-term performance is after a period of short-term underperformance. We think our core equity strategy fits the bill.

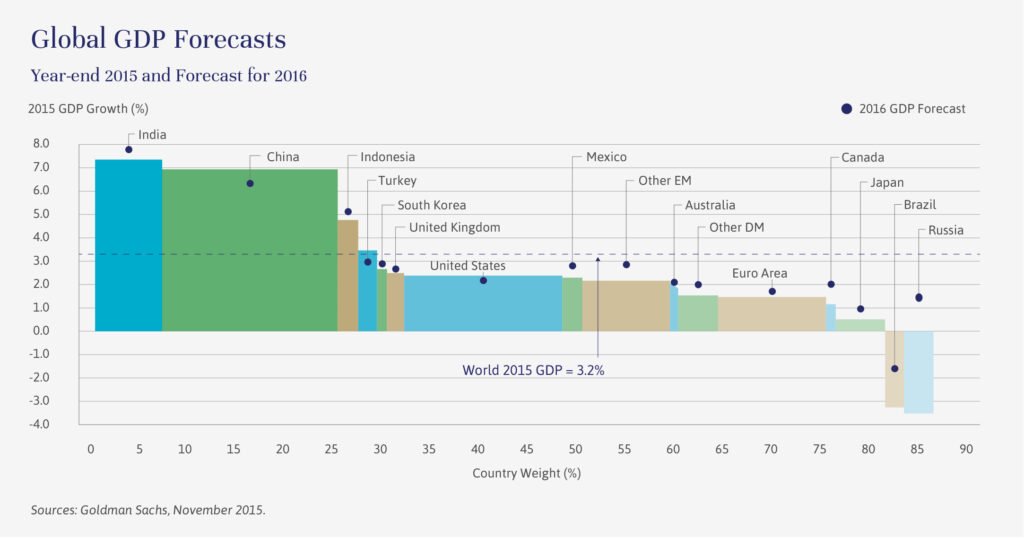

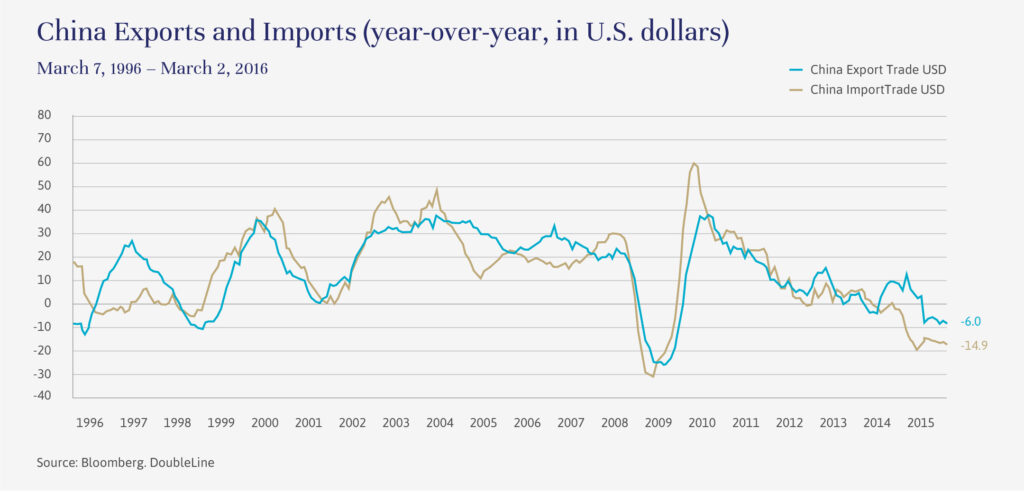

Looking further ahead, change seems inevitable after seven years of a bull market without a 20% drawdown. To date, the market has taken the increasingly astonishing headlines about the U.S. election in stride, still betting on a more predictable outcome. In the interim, the focus remains more on China’s growth rate, an issue that affects us all. World economic growth is projected by Goldman Sachs and others to rise 3.2% in 2016. But, as the chart on page 3 shows, that assumes that China grows at the government’s public target of 6.5%. Hard numbers that cannot be manipulated by the Chinese government – such as China’s imports and exports, which are down considerably as shown in the chart below – imply that China is actually growing somewhere between 0% and 3%. The resulting slowdown will be a real drag on revenues for companies worldwide, including the components of the S&P 500 index and on oil prices, which we do not expect to trade much above $40 for the rest of the year.

Falling global growth should cause the Fed to slow down the pace of rate increases, while monetary easing in Europe and Japan should support the markets in the near term. It’s worth noting that low oil prices are an important long-term positive for the United States, as well as for Europe, Japan, and China. Indeed, the vast majority of companies around the world are beneficiaries of low energy prices. In the interim, the United States economy remains resilient, with pockets of real opportunity, as well as considerable risk.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].