Independent Thinking®

The State of the States: The Municipal Bond Outlook

October 29, 2020

Editor’s note: The following is extracted from an Evercore Wealth Management paper, Got Munis? The Case for Bonds as States Adjust Budgets and a recent client webinar, Rumors vs Realities in the Municipal Debt Market: How Bad is It?

All states have been affected by the shutdown of the U.S. economy in the spring and the subsequent slow – and erratic – reopening. And all rely on Washington, D.C. for adequate financial support, as they, not the federal government, are on the front lines in managing the pandemic. But the differences in fiscal health at the state level are extreme now, even more so than during the 2008-2009 fiscal crisis.

The ultimate effects on states of COVID-19 will vary based on their economic and revenue structures and poverty rates. States with low economic volatility and those willing and able to adjust tax rates are likely to suffer less severe impacts than those with less diversified economies or a high dependence on the most volatile taxes, such as very progressive personal income and capital gains taxes.

Other hurdles to recovery include the growing wealth gap, which places more pressure on states with large underserved populations, the long-term impact of remote working on municipal tax bases, the decline in oil prices on energy-dependent state economies, market volatility that will have an impact on instead of upon pension fund investments, and overall uncertainty about the duration of the economic crisis.

As a result, state and local governments are likely to operate with structural imbalances. For some, it could take years to recover and return to the revenue baseline. However, municipalities are resilient, meaning that they have many more levers to pull to ride out the rough patches than similarly rated corporations do. And with a historical default rate of just .008% of all investment grade municipalities, they have historically been considerably safer as well.

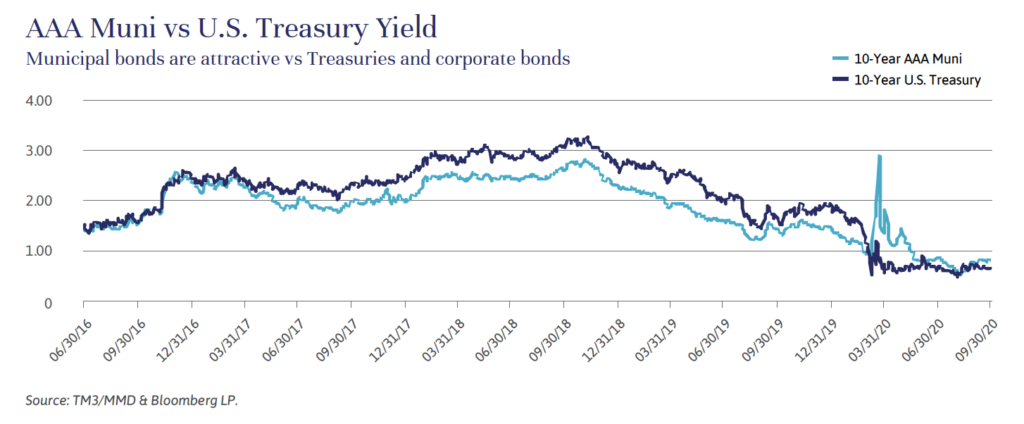

For these and other reasons, municipal bonds remain an integral part of many private investors’ diversified portfolios. They serve as a ballast to equity market volatility, as high-quality bonds most often move inversely to stocks. Most important, they can also provide a consistent and dependable tax-free income stream. While it’s hard to argue that yields are attractive from a historical perspective, municipal bonds are attractive when compared to Treasuries and corporate bonds on an after-tax basis, as illustrated in the chart below, and they remain the best risk-adjusted, fixed income vehicle for clients in the highest tax brackets.

It is important to consider the defensive asset nature of municipal bonds, even during the pandemic and the related – and unusual – stress felt by individual states. Even at these low rates, municipal bonds also offer total return potential beyond the current yield to maturity in the event that Federal Reserve policy moves interest rates negative on the short end or market expectations of longer-term deflation push market rates into negative territory. These are possibilities, albeit unlikely ones, and they would probably coincide with equity price volatility, furthering the case for bonds as a hedge for equities.

We are confident that we have the experience to navigate our clients through this challenging credit environment, and we expect all of our client holdings to pay timely interest and principal.

Jim Holihan is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].

Howard Cure is the firm’s Director of Municipal Bond Research. He can be contacted at [email protected].