Independent Thinking®

Staying Focused When the Going Gets Tough

March 28, 2020

This pandemic is testing the resilience of our society, our organizations, and our portfolios. There’s a long road ahead, but it seems to me that we are coping and will prevail. I see great resilience all around me, from our first responders, to our scientists, to the people who are stocking – and restocking – supermarket shelves. As for the rest of us, we are doing our part in doing what we are told, carrying on while remaining socially isolated, to help flatten the curve and to allow economic activity to restart.

Our firm is certainly resilient, up and running remotely at full steam as soon as we vacated our office buildings across the country. I could not be more proud of our teams and the ways in which we are staying close to each other and to our clients.

Of course, it’s easier to be resilient if you are prepared. Our partners and I, all of whom have experienced past significant market upheavals, built this firm to meet clients’ long-term goals. That means constructing and managing portfolios to anticipate and limit the impact of big drawdowns and to produce reasonable, risk-adjusted returns through all market conditions.

Our drawdown analysis is based on 50 years of data and has, in my opinion, always been one of our most important tools and a focus of discussions with potential and existing clients. Not many firms show the potential impact on portfolios of a big drawdown. We always have, which has helped our clients prepare for the real thing.

When we entered 2020, we projected that our model balanced portfolio had a drawdown potential of 24% – meaning that it could fall 24% from its peak value to its trough value and remain positioned to participate in the subsequent economic recovery.

Our balanced portfolios include growth investments and defensive investments. In times of market disruption, we generally anticipate that growth securities can lose as much as half their value (to date, the S&P 500 has been down 34% and is now down 18.5%) while defensive securities, mainly investment grade bonds, as the name of the asset class suggests, will generally hold their value. Our clients who felt they could not tolerate a drawdown of 24% have more defensive assets in their portfolio, and those who felt they could tolerate more risk have more growth assets in their portfolios.

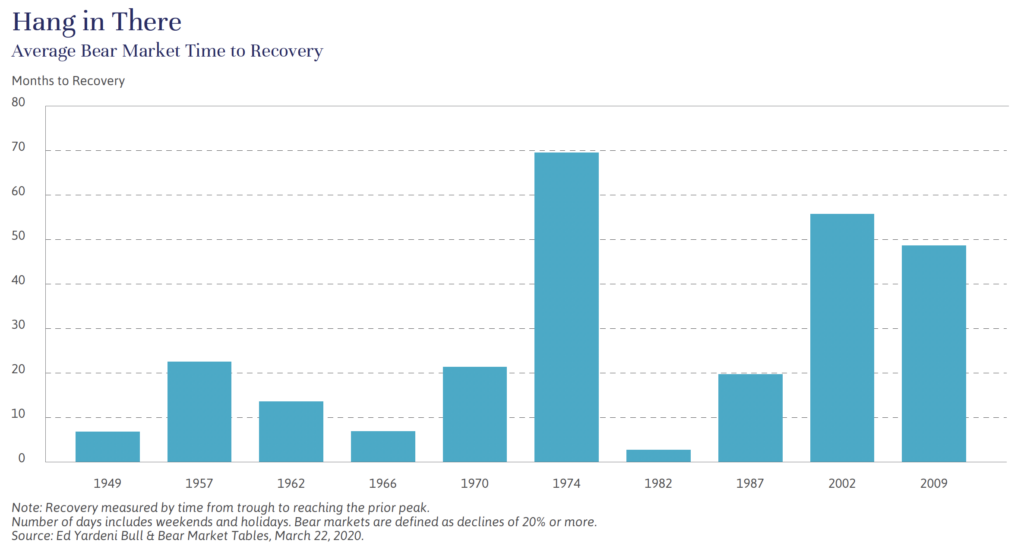

We were surprised by the recent lack of liquidity in high-grade bonds, but take comfort that liquidity is returning to those high-grade markets in anticipation of fiscal and monetary stimulus. In past market drawdowns, the time for the growth assets to return to previous peak values has varied from three months to 70 months with an average of 27 months, as illustrated below.

This has certainly been no ordinary market drawdown, as John Apruzzese and others discuss in these pages. Nevertheless, we believe our balanced portfolios will continue to prove resilient and that our clients, with the help of our advisors, will maintain sufficient liquidity and be in a position to benefit from the recovery.

One of the paradoxes of this period of social isolation is the renewed appreciation of the people in our lives. As I write this, my wife and I remain holed up at home in Florida, missing family, friends and colleagues but grateful to be in constant touch. I enjoyed seeing so many familiar names engaging in our recent investment outlook webinar; seeing the questions scroll through made me feel as close to our clients as if I were in the same room.

I know I speak for all my colleagues when I say that I am very grateful for our wonderful clients.

Jeff Maurer is the Chairman of Evercore Wealth Management and Evercore Trust Company. He can be contacted at [email protected].