Independent Thinking®

Steady Investing in Changeable Markets

January 28, 2016

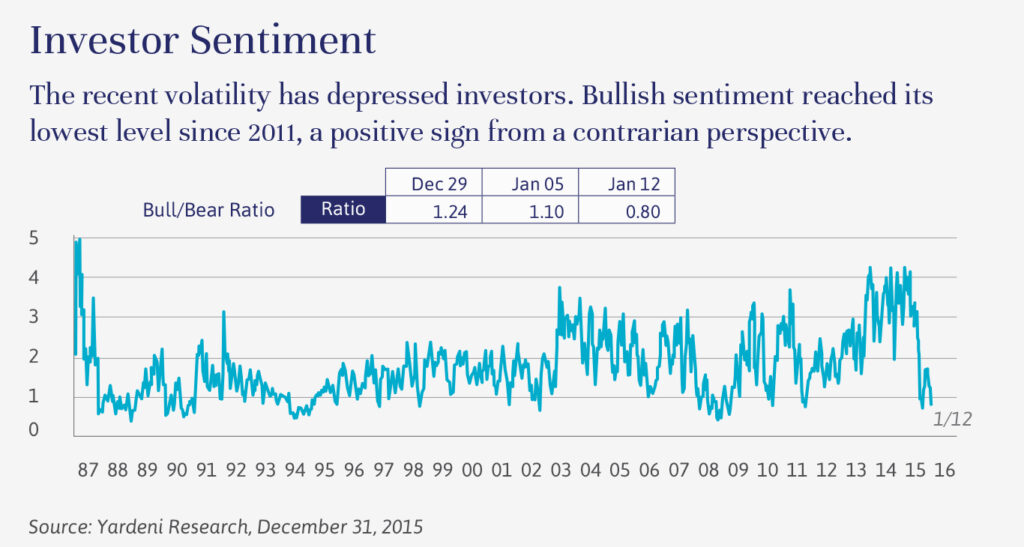

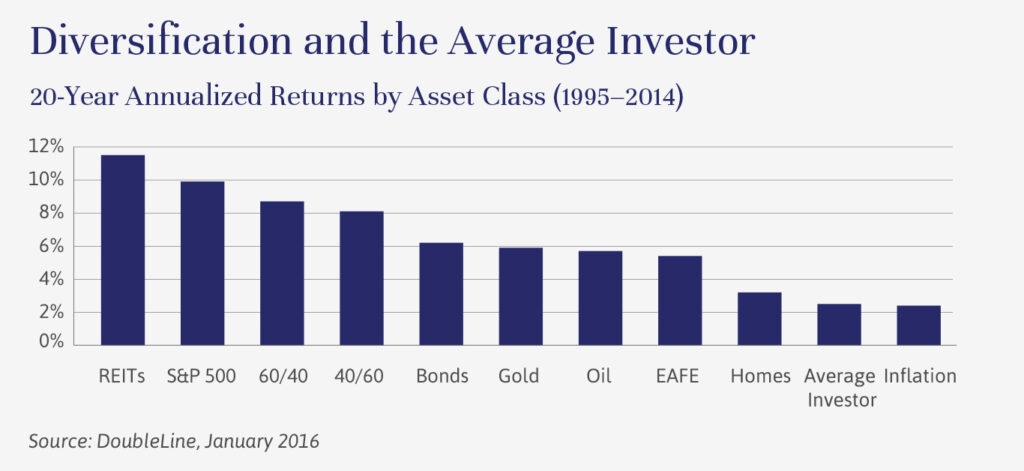

Behind all the market headlines is one incontrovertible fact: It is impossible to consistently time the markets. Just about everyone gets it wrong, so much so that over the past 20 years, when the S&P 500 compounded at a 9.9% annual return, the actual return on a dollar-weighted basis experienced by the average investor in U.S. equity mutual funds was just 2.5%1. Swept up in market sentiment, they bought high during periods of optimism and sold low during market downturns.

Sticking to an appropriate asset allocation strategy and rebalancing the portfolio – which far more effectively allows investors to buy low and sell high over the long term – is the way to go. It takes discipline, especially in volatile markets like the one we are currently experiencing. However, the probability of achieving sustainable performance and meeting long-term financial goals is far greater.

Now that the U.S. market has corrected back to more typical valuations, it’s important to identify the developments that will continue to have a significant impact on U.S. domiciled investors. We reduced our capital assumptions early last year, in anticipation of slowing global growth, and are confident in our current asset allocation. We do see some increased risks, however, as well as some discrete investment opportunities afforded by excessive selling in the marketplace.

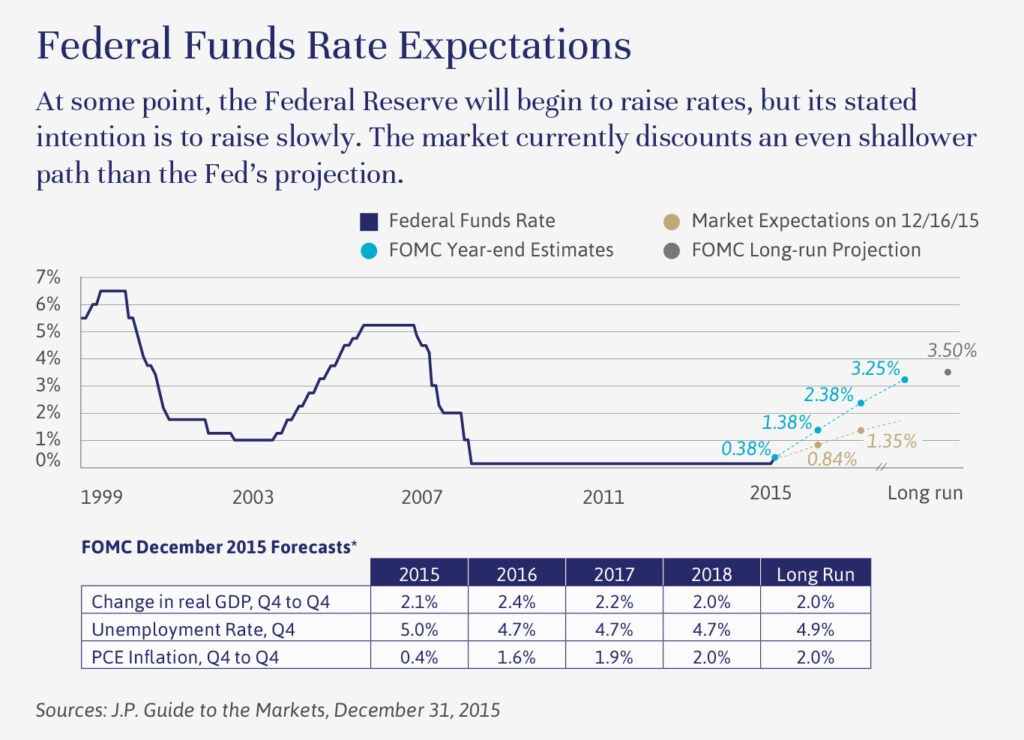

Top of mind is the Federal Reserve, now back in the hot seat after finally pulling the trigger in late 2015 on the first rise in the Federal Funds rate in nine years. At the time, many investors argued that the move was long overdue – that the markets had become addicted to artificially low interest rates. The initial market reaction was muted, but the market has corrected once again as the prospects of further rate increases feed into weak foreign currencies and falling commodity prices. If these trends continue, it seems that the Fed will have to hold off on additional rate increases.

We agree that the dollar will continue to strengthen – but not by as much as many investors expect, as most of the potential gains are already priced into the currency. We are not at all convinced that long-term interest rates will increase substantially, as inflation remains stubbornly low. Continuing deflationary forces mean that high-quality fixed income should continue to have a significant role to play in well-diversified portfolios.

Plunging commodity prices have also captured their share of headlines, but it seems likely that prices should bottom out in 2016 as supply and demand functions react to the lower prices, albeit with a lag. Patient investors may find opportunity in high-quality energy companies and, significantly, in distressed situations through well-positioned illiquid funds that specialize in distress investing. Continued oversupply will prevent a dramatic recovery, but there should be real opportunity in this sector.

In the interim, however, it is important to note that there is a related and very real possibility of a global manufacturing recession in 2016. Much will hinge on China’s ability to pivot its economy toward consumption and away from investment. The era of double-digit GDP growth for China is over. China is going to have to dramatically reduce overcapacity in the construction-related heavy industries such as steel, and address the pollution being generated by their cheap coal-fired generation plants, among other reforms. The market will continue to be whipsawed by changing perceptions of how successfully China will get through this major transition.

Here in the United States, consumers are benefiting from an improved job market and low commodity prices, albeit somewhat offset by higher healthcare costs. Wage growth, which has been increasing at a disappointing rate of 2% a year, should start to accelerate as the jobs market continues to tighten. While the jobs market has had an unbalanced recovery, with the emphasis on high skilled jobs, we are starting to see labor shortages in areas such as long-haul trucking.

This brings us to continued innovation in artificial intelligence and robotics, the potential game-changer in our time. Advances in artificial intelligence and robotics will create both winners and losers, to the benefit of astute investors, even while questions around the net effect on jobs remain unanswered. Those new trucking jobs, for example, might be lost to driverless trucks in the not-too-distant future, a boon for the companies involved and a boost to productivity.

It’s worth sounding two notes of caution about two other headline subjects: M&A activity and share buybacks, both of which have reached dizzying heights.

Merger and acquisition activity reached record levels last year, with transactions totaling more than $4.5 trillion. This trend will continue into 2016 as activist shareholders become more brazen and CEOs struggle to generate growth in a slow economy. It’s important to stay on the right side of these equations, investing in the companies poised for growth and avoiding companies that are merely deploying financial engineering for short-term results but actually destroying long-term economic value and taking on risky levels of debt.

Meanwhile, we estimate that the S&P 500 will pay out over $1 trillion in 2016 to shareholders, from a combination of dividends and share buybacks. This represents a 5% yield and is an important pillar for market valuations. While dividends are straightforward, share buybacks are more controversial because they create value when stock prices are low and destroy value if stock prices are too high.

It is our job to try to find undervalued companies that are returning capital to shareholders at an attractive rate while continuing to invest in the business for future growth. While the cash payout to shareholders is close to 100% of operating earnings for the S&P 500 index, the companies in our portfolio are paying out on average a much more reasonable 50% of operating earnings. The balance of the earnings are retained and reinvested for future growth.

2016 is shaping up as another volatile year in the markets, with no shortage of headline financial and, in this election year, political news against the less vivid but more significant backdrop of continued slow economic growth. Volatility can be uncomfortable – but it creates opportunities for disciplined investors focused on the bigger picture.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].

11994-2014. Dalbar Inc.