Independent Thinking®

Sticking with the Plan: Wealth Strategies Ahead of Tax Increases

October 29, 2020

Trying to time tax policy changes can be as risky as trying to time the market. While taxes may soon rise, proposals are nothing more than proposals and no one knows what form they will eventually take. In the interim, there are opportunities – tax and interest rates are low and gift and estate and generational-skipping tax exemptions are at all-time highs – but they only make sense in the context of thoughtful long-term planning.

With that in mind, let’s consider some potentially attractive strategies in this environment, including some that can mitigate the risks of rushing in.

Estate, Gift and Wealth Transfer

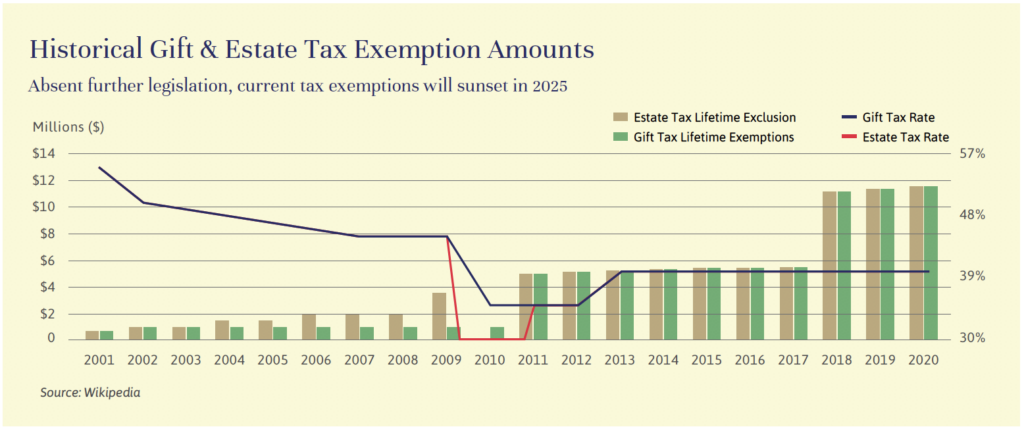

At present, the federal gift tax, estate tax and generation-skipping tax exemptions are the largest on record, as illustrated by the chart below, at $11.58 million per person or $23.16 million for a married couple. In the absence of further tax legislation, this window to shift significant assets out of an estate will sunset on December 31, 2025 and revert to $5 million per person, adjusted for inflation. As dramatic as that is, other factors should be evaluated to avoid donor’s remorse. Does the gift truly advance the family’s long-term wealth transfer objectives? Are the assets no longer required by the donor to meet lifestyle goals? These and other considerations should come first.

If the answer to either question is a resounding yes, it may be worth considering a spousal lifetime access trust, or SLAT. A SLAT allows one spouse to irrevocably transfer assets to a trust for the benefit of the other, for his or her lifetime, as well as to heirs. The obvious benefit is the availability of assets during the donee spouse’s lifetime if needed; otherwise the assets are growing for the next generations. If set up properly, a SLAT is an effective tool for utilizing the exemption while minimizing the risks of giving away assets. It is important to remember that these assets are held in an irrevocable trust and not held outright. Divorce, death and, who knows, possible future legislation may limit or terminate access for the spouse. Depending on the circumstances, the SLAT can be funded utilizing just one spouse’s exemption.

Prospective donors without a spouse can consider a self-settled trust, often referred to as a domestic asset protection trust, or DAPT. Many states including Delaware allow self-settled trusts whereby a donor can irrevocably transfer assets to a trust and fully utilize their exemption. Again, if structured correctly, the donor can have assets available to meet unexpected needs during their lifetime. There are limitations and risks to DAPTs that should be reviewed with counsel to determine their appropriateness.

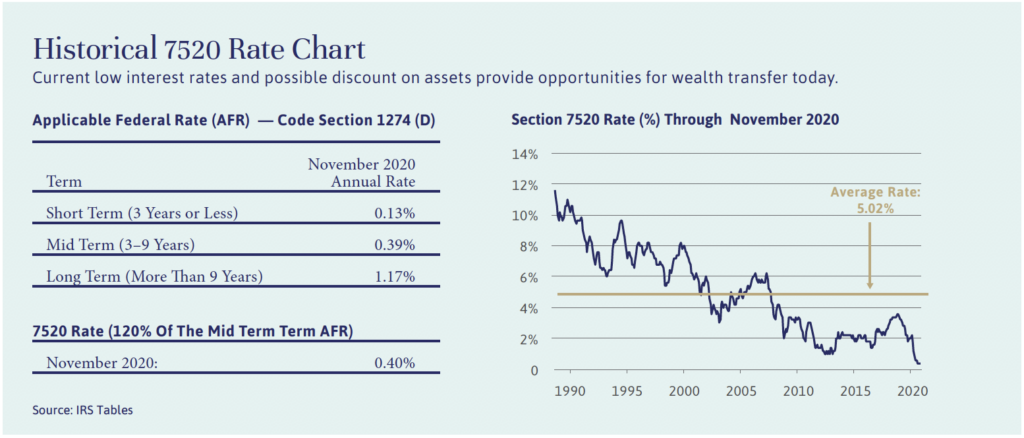

Other wealth transfer strategies worth considering now benefit from current low interest rates. One strategy is to make or refinance intrafamily loans, at below-market rates published monthly by the IRS, also illustrated below. Assets can be reinvested and appreciate in excess of the loan rate, free of gift tax. Another use of the loan may be to assist a family member who was in the process of purchasing a home and requires additional funds for a down payment. This may also be an opportune time to consider refinancing existing loans to family members or to lend monies to existing trusts and family partnerships at a low fixed rate to make high-potential investments on behalf of the next or future generations.

Another attractive wealth transfer mechanism in this environment is to transfer assets to one or multiple grantor retained annuity trusts, or GRATs. Funding, for example, a two-year GRAT with assets highly likely to appreciate in that period should generate an annuity over that period equal to the entire value of the funding amount plus the IRC Section 7520 rate, which is 0.4% as of November 2020. Assuming the grantor survives the term of the trust, any appreciation beyond the annuity amount passes to heirs with no gift tax or reduction in the lifetime exemption. This strategy is particularly attractive now, given the market volatility experienced this year; if the asset rebounds strongly from here, it will easily exceed the 0.4% hurdle rate. GRATs typically offer the donor the power to substitute assets, such as appreciated stock holdings, which can be an effective planning tool to lock in the appreciation as market conditions evolve and increase the tax basis for future heirs.

To benefit a charity, as well as family, a third option to consider is to create a charitable lead annuity trust, or CLAT. This is a split-interest trust that benefit a charity during their term, and at the termination of the trust, any remaining assets pass to the remainder beneficiary, the family or other designated heirs. As with a GRAT, the amount of the remainder will depend on whether or not the trust’s investments outperformed the IRC Section 7520 rate.

In this historically low interest rate environment, as with after a market dislocation, CLATs can be an effective means of wealth transfer to the immediate next generation. The interim beneficiary of the charitable lead interest can be a donor-advised fund, a private foundation or a public charity. If structured as a grantor trust, the grantor may have an immediate tax deduction as well. Decisions between grantor and non-grantor CLATs are based on personal circumstances and should be made with professional consultation.

There are other strategies to consider that can be used in combination with the strategies mentioned here. If you have not already done so, discussions with your wealth advisor and other professional advisors should take place now to determine the appropriateness of these strategies.

Income & Capital Gain/Loss Tax Planning

In 2020, the top income tax rate of 37% applies for those with taxable income over $518,400 for single taxpayers and $622,050 for married couples filing jointly. Capital gains and losses realized during the tax year should be netted against one another to minimize capital gains taxes. Net capital loss amounts in excess of $3,000 may be carried forward indefinitely but do expire at death. It’s important to review capital gains and losses across all investment portfolios, including business assets and LLC or partnership interests, as well as gains on the sale of any real estate. Those with sizable realized short- or long-term capital gains may consider investing in a Qualified Opportunity Zone, or QOZ, which pairs a very valuable tax-deferral strategy (even with the specter of higher future tax rates) along with the selection of high-quality real estate investments. Please note that the evaluation of both the tax plan and the investment selection is critical to achieving future success.

Alternatively, those who do not want to defer the capital gains in a QOZ investment and believe capital gains rates will increase in 2021 may want to consider selling a portion of the highly appreciated securities in 2020 if they intend to sell in the near term. For expected longer-term holdings, it may well be worth holding the security and deferring any tax on its appreciation while retaining the ability to offset against future losses or give the securities to charity, and then avoiding incurring those gains altogether (while potentially achieving a more valuable income tax deduction when tax rates are higher).

Generally, accelerating other forms of income into 2020 (from 2021) makes sense for those who believe income tax rates will rise. On that basis, deferring charitable contributions to 2021 to achieve a higher income tax deduction benefit should also be considered unless new tax legislation includes more limitations on deductibility. When given to a donor-advised fund or family foundation, the income tax deduction can be taken upfront (and over five additional years for those in excess of the annual adjusted gross income [AGI] limitations), but the charities themselves can be selected later. The right approach will consider the impact of gains and deductions.

If the decision is to move forward with the charitable gift, low basis stock (held for greater than one year) should be used to make charitable gifts, as the current fair market value of the securities contributed (subject to AGI limitations) can be deducted while avoiding the capital gains tax due on the appreciation if the asset had been sold. If the goal is to diversify the stock position immediately, create a tax-efficient income stream for lifestyle purposes, receive a partial upfront tax deduction and ultimately benefit a charity in the future, consider establishing a charitable remainder trust (CRT) as part of your wealth plan.

These are just a few of the planning considerations ahead of potential tax policy changes. But it’s important to stress that every family situation is unique, and these decisions should only be made in close consultation with wealth advisors, accountants and attorneys. The evaluation process needs to be holistic and completed well in advance of execution.

Julio Castro is a Partner at Evercore Wealth Management and a Wealth & Fiduciary Advisor at Evercore Wealth Management and Evercore Trust Company, N.A. He can be contacted at [email protected].