Independent Thinking®

Still Betting on America

January 20, 2015

About this time last year, we observed in our annual investment outlook that many private investors were anxious about the markets following a 32% gain in the S&P 500 index in 2013. The index has since gained another 14%, to rise 50% in just two years. That can make now seem, as it always does, the hardest time to invest.

We are as confident in the U.S. economy as we were a year ago, however. Recent gains in the jobs data suggest that growth rates, already bolstered by low energy costs and continued low interest rates, may soon accelerate. The strong dollar is a plus, as consumption accounts for 72% of the economy and exports only 14%. And, as our Evercore colleague Stuart Francis discusses on page 10, the United States continues to lead the world in technological innovation.

The prospects for the investment markets are more opaque, in part because U.S. investors are very focused on the future path of monetary policy. Stocks are likely to become more volatile when the Federal Reserve signals a willingness to begin hiking interest rates. It must be recognized that in all developed markets there is, and will continue to be, considerable uncertainty around long-term monetary policy following the unprecedented massive expansion of the major central bank balance sheets since 2008. There is no established playbook for how we return to normal interest rate levels.

More worrying, other major economies are faltering. At least 40% of the S&P 500 revenues come from outside the United States and the strong dollar impacts their earnings. Continued low interest rates and energy prices will allow the U.S. economy to go it alone for a while, even as Europe falls back into recession and China slows, but that will not necessarily translate into higher stock prices.

Longer term, the black clouds now over these regions and Japan may cast more than a shadow on our investment landscape. The recent plunge in energy prices and the related volatility in the U.S. markets reflect the faltering global economy and, specifically, the slowdown in China.

China’s economy is completely out of balance. Since the start of the decade, investment has grown to account for 48% of the economy, up from 36%. That compares with an average of 28% across the emerging markets as a whole. No country that has relied heavily on investment has ever made the transition to a consumer economy without a financial crisis – and no country has ever relied as heavily on investment as China does now.

Most observers give China the benefit of the doubt, as the country’s managers have successfully overseen 30 years of almost uninterrupted economic growth. But it is difficult to see how the Chinese will spend their way out of this problem; the government has already invested in the equivalent of the entire U.S. interstate highway system in just ten years. How much more can they really do?

Japan has an astonishing debt load that exceeds 240% of its GDP, compared with about 100% for the United States and 110% for developed economies on average. To date, the government has staved off a full-blown crisis with very low interest rates and its willingness and ability to finance its debt internally. But its aging – and shrinking – population can’t continue to afford this burden much longer. If outside creditors demanded, say, 3% interest rates on Japanese government bonds, the interest expense would soon exceed total government revenues. The yen would collapse and the resulting tailspin could make the Lehman Brothers collapse look like a picnic.

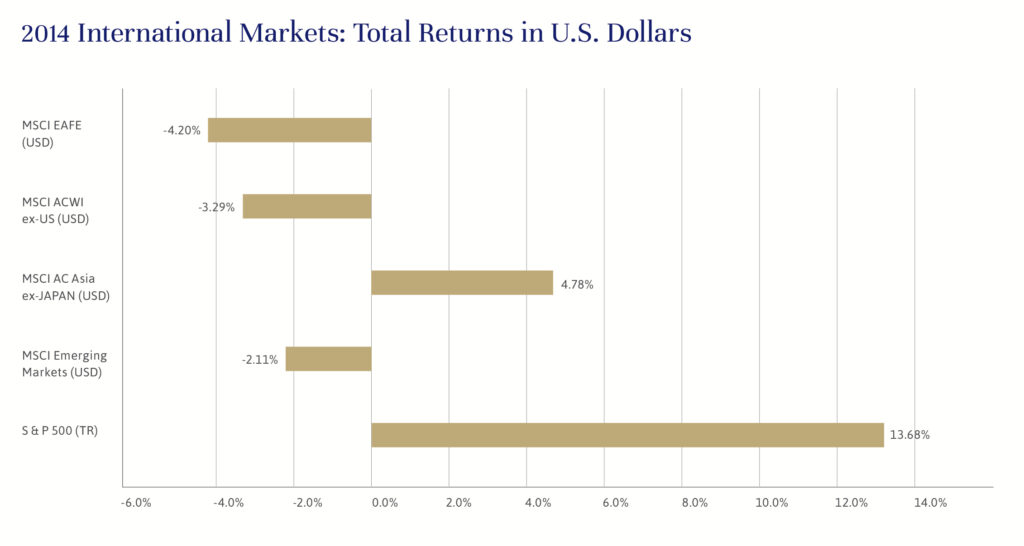

For these reasons, and because our investors are generally dollar-denominated – earning and spending their money in dollars – we remain overweight on the U.S. markets relative to our industry. This approach, as well as the continued strong performance by our core equity team, has served our clients well to date and we remain confident that the U.S. economy and, to a lesser degree, its markets will continue to outperform this year.

The firm’s core equity strategy returned 16.55% net of fees last year, compared with 13.69% for the S&P 500 index. Since inception (2/3/2009) the strategy returned 19.88% net of fees on an annualized basis compared with 18.93% for the S&P 500. As Portfolio Managers Tim Evnin and Charlie Ryan describe in a video seen here, the concentrated portfolio of 40 or so carefully chosen stocks provides both diversification and exposure to growth opportunities.

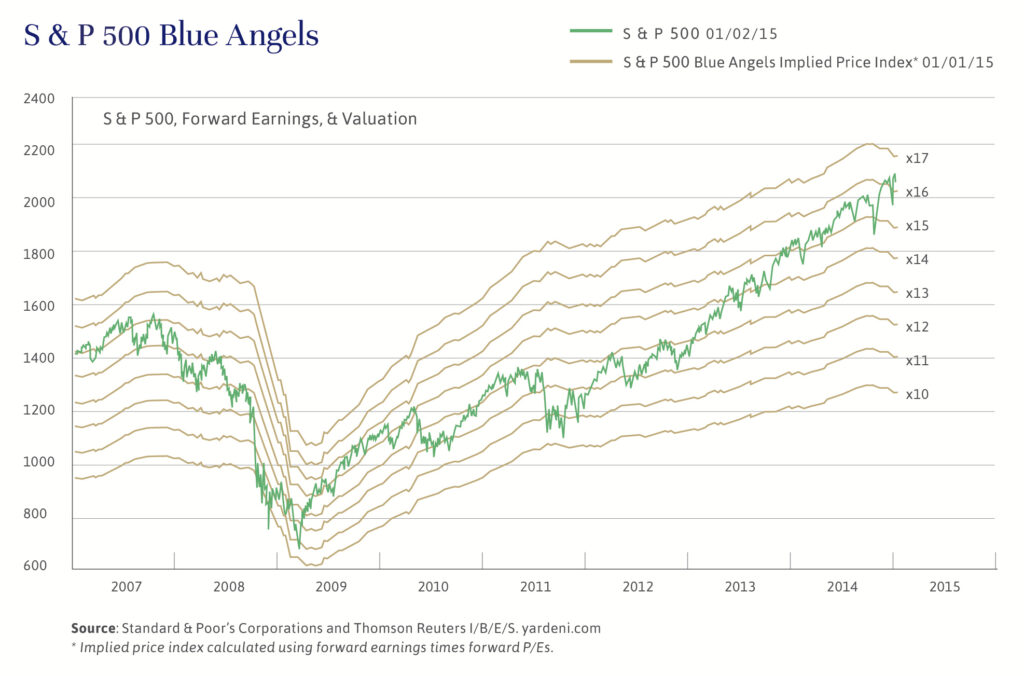

There is no doubt that stocks have been trading at relatively high multiples recently, reflecting investor optimism. Just how high is demonstrated by the chart below. We continue to find opportunities in this market, however, driven by corporate earnings growth, and we expect the U.S. economy to continue its upward trajectory in 2015.

Now is always the hardest time to invest. We will maintain well-balanced portfolios on behalf of our clients, mindful of these risks at home and abroad, but also ready to benefit from expected further gains.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].