Independent Thinking®

Successful Families: Transferring Assets and Values

August 1, 2023

You may have heard the proverb “shirtsleeves to shirtsleeves in three generations,” but did you know that Italians say that families go “from stalls to stars to stalls”; Chinese caution that “wealth never survives three generations”; Mexicans warn of “first-generation traders, second-generation gentlemen and third-generation beggars”; and Swedes sum it up with the stark “acquire, inherit, ruin?”

Regardless of the country, culture or even tax laws, there appears to be a sense that when families attempt to transfer wealth to future generations, something vital is often lost.

It doesn’t have to be this way, of course. Families that successfully transfer wealth think long and hard about what they are trying to preserve – and why they are trying to preserve it. They focus on preserving nonfinancial capital in addition to financial capital. This can include individual capital, or each family member’s personal strengths and talents; collective capital, such as family members supporting each other; community capital, which includes the family’s contributions to the local community; and spiritual capital, which can take many forms but drives the family’s ethos. In short, they transfer values along with money.

Communication is a crucial element in maintaining success. Much has been written about the significant differences among generations – from Baby Boomers and Generation X, on to Generation Y (the Millennials), Generation Z, and the most recent Generation Alpha. Successful families acknowledge that the life experiences of grandchildren and future generations are going to be very different from those of their grandparents. As an example, according to a 2021 Pew Research Center survey, more than two-thirds (68%) of U.S. respondents said they think today’s children will be financially worse off as adults than their parents.1 For wealthy families, this is an even bigger challenge, given the relatively higher starting point. A recent Stanford study found that approximately 90% of those born in the 1940s earned more than their parents as adults, compared to only about half of those born in the 1980s.2

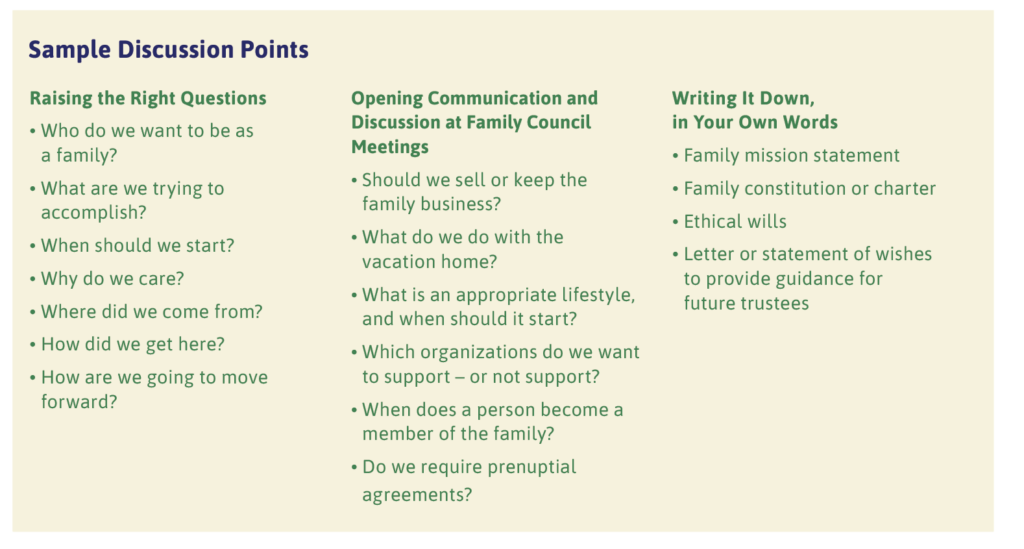

Demographics, addressed from an investment point of view in this issue of Independent Thinking, shouldn’t need to shape a family’s destiny – not if differing perspectives are raised and addressed. To encourage healthy communication, regular family council meetings can be surprisingly effective. Family council meetings can provide every member of the family an opportunity to proactively contribute to the family’s long-term success while preserving the role of the matriarch and/or patriarch. Please take a look at the chart below for some sample discussion points.

Another key factor for successful families is that that they tend to be philanthropic. Indeed, studies have shown that philanthropy actively fosters happiness – as well as the potential for significant tax savings.3 In preparing the next generation to be happy and productive members of society, family philanthropy – or giving to charity collaboratively as a family – could be one of the most impactful activities to consider.4 James E. Hughes, Jr., the author of Family Wealth, put it best when he observed that: “Paradoxically, families often learn more about long-term wealth preservation through the process of learning to give away than by the process of learning to accumulate and spend.”

While healthy family governance is a vital part of multigenerational success, families can’t ignore the importance of comprehensive tax and investment planning. Since no one advisor can or should do it all, successful families rely on a collaborative team of advisors to provide a cohesive strategy for growing and preserving wealth across multiple generations. That should also include all the left-brain wealth management responsibilities, such as legal documents, asset protection, privacy, confidentiality, taxes, investments, and so on. And it should also include all the right-brain family-oriented issues: an understanding of the family’s mission, vision, and values; educating family members; and supporting future family leadership. After all, successful families don’t just care about transferring the maximum amount of assets in the most tax-efficient manner to future generations, they also focus on preserving family harmony so that their family legacy will continue for future generations.

It’s worth recalling Warren Buffett’s well-known line on giving his children “enough money so that they could feel they could do anything, but not so much that they could do nothing.”5 The challenge for families is that there is no magic dollar figure when it comes to transferring wealth to future generations in a manner that helps – rather than hinders – their future happiness and success. Anyone struggling to identify how much money that might be should instead follow the secrets of successful families and consider the more important question: “What have you prepared them for?”

Justin Miller is the National Director of Wealth Planning at Evercore Wealth Management and Evercore Trust Company, N.A. He can be contacted at [email protected].

1 Pew Research Center, “Economic Attitudes Improve in Many Nations Even as Pandemic Endures,” Global Attitudes Survey (2021).

2 Chetty R, et al., “The fading American dream: Trends in absolute income mobility since 1940,” Science, Vol. 356, Issue 6336, pp. 398-406 (2017).

3 Dunn EW, Aknin LB, Norton MI, “Spending money on others promotes happiness,” Science, Vol. 319, Issue 5870, pp. 1687- 1688 (2008); Harbaugh W, Mayr U, Burghart D, “Neural Responses to Taxation and Voluntary Giving Reveal Motives for Charitable Donations,” Science, Vol. 316, Issue 5831, pp. 1622-1625 (2007).

4 For more information on family philanthropy, see Miller, J, “Preparing the Next Generation for Success,” Independent Thinking, Vol. 44 (2022).

5 Kirkland R, “Should You Leave It All to the Children?” Fortune (Sep. 29, 1986).