Independent Thinking®

The Alpha and Beta of Alternatives

April 24, 2016

As returns in traditional stock and bond markets struggle to live up to past experience, adding different return streams to portfolios makes sense. In addition, assets that zig when other markets zag, as uncorrelated assets are meant to, assets provide the added benefit of reducing the volatility in the overall portfolio and smoothing out the return streams.

Academically, these concepts are very powerful. In theory, a portfolio of assets with low correlation to each other and with an attractive long-term return expectation will improve the overall risk-adjusted return of the portfolio by lowering the portfolio level volatility. In practice, however, many managers in both the hedge fund and liquid alternative space have struggled mightily since the financial crisis, while assets have flooded these relatively untested strategies and markets. As alternative investments have gained in popularity, it has become increasingly challenging to identify managers who can consistently provide additive returns.

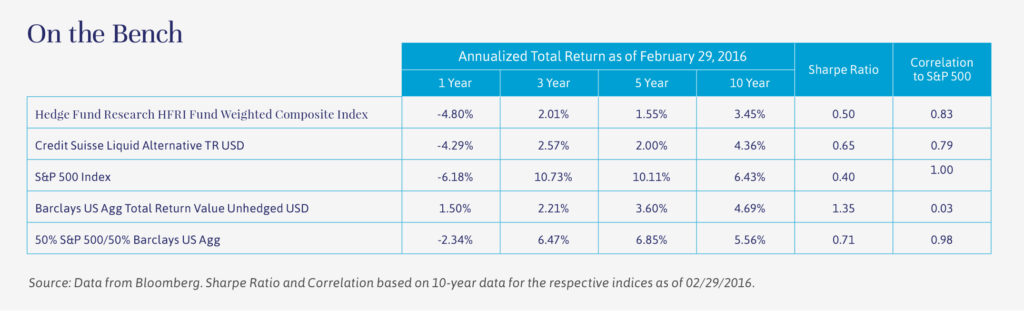

The hedge fund industry generally has not been able to produce any alpha over the past one-, three-, five- and 10-year periods. (See the chart below.) Even more disturbing, many strategies can’t even boast of low correlation, giving investors weak returns that are actually correlated to the rest of their portfolio. Although fees are a bit lower, liquid alternative managers have also failed as a group to deliver alpha on a persistent basis.

Good performance does exist, both in hedge fund and mutual fund form, but these are few and far between and often have either volatile return streams, high fees or are closed to new investors. As demonstrated in the chart below, in recent years, hedge fund and liquid alternative benchmarks aren’t beating a combination of the S&P 500 and Barclays U.S. Aggregate, even on a risk-adjusted basis.

The answer is not to stay away completely, in our view, but to identify investment strategies that achieve our portfolio goals and are appropriate for our clients. Our asset allocation attempts to group investments based on their risk profile and the way in which they will correlate to each other, allowing us to better understand and manage the risks inherent in our clients’ portfolios.

Our Diversified Market Strategies asset class is designed with two purposes in mind: to provide a negative correlation with equities and bonds; and an expectation to generate a positive return through a full market cycle, typically defined as five to seven years. Ideally, the individual strategies within this asset class should also be uncorrelated to each other. We prefer simplicity, lower fees, and better liquidity.

So how do we set about finding the right strategy to fit our needs in a sea of underperforming strategies? Instead of chasing the white whale – the alpha-producing hedge fund or liquid alterative – we look for alternative betas. Alternative betas are common risk factors shared by a group of investment strategies, outside of both equities and bonds.

Think of a portfolio of reinsurance risk, exposed to catastrophes. This portfolio may have a risk and return profile that looks similar to an equity portfolio, but a downturn in this strategy is unlikely to coincide with a downturn in equities, as the coming of a hurricane has nothing to do with a bear market in stocks. While we don’t currently invest in reinsurance, primarily due to pricing and valuation levels in the insurance space today, we are trying to achieve use of this same principle in capturing alternative beta. These strategies have associated risks, but they are unlikely to rear up at the same times that equities are struggling. (See the interview with AQR on page 12 for an overview of one of our current investments.)

We also aim for a significant diversification of securities. Often, alpha is driven by a concentrated portfolio in which the managers make large bets on their best ideas. We prefer highly diversified portfolios that bet on a pervasive, repeatable investment process.

If these alternative betas generate positive returns, and truly are uncorrelated with equity returns, bond returns, and to each other, then we can expect relatively smooth returns that provide a ballast to the portfolio, dampening the volatility and increasing the portfolio’s risk-adjusted return.

It’s Not All Greek

Alpha can be defined as the excess return of a fund or strategy relative to the return of the strategy’s benchmark or index. In other words, it’s the portion of return that cannot be explained by common risk factors in the market, such as equity risk manager or interest rate risk. Those common risks factors are known as beta.

Risk-adjusted returns measure the return of a portfolio against the amount of risk taken to attain those returns. The most common measurement of risk-adjusted return is the Sharpe Ratio, a measurement that subtracts the risk-free rate from the return of an asset, and then divides the difference by the standard deviation of that asset.

A hedge fund is a pooled investment vehicle, typically within a limited partnership structure. It has a wide investment latitude, both in terms of types of assets and investment strategies, and is able to invest in both long and short assets, often using leverage. Hedge funds generally charge high fees, often including a carried interest, or a percentage of the profits delivered to the end investor. Hedge funds gained popularity after an impressive run of good returns in the 1990s and early 2000s, and had low correlation to the equity and bond markets. They have struggled over the past 10 years as new capital and new managers flooded the space, and high fees ate away at returns.

Liquid alternatives are relatively new. They can encompass everything from long-only mutual funds that own equities of Master Limited Partnerships (MLPs) or Real Estate Investment Trusts (REITs), to funds using strategies historically only available in hedge fund form, like long/short equity, merger arbitrage, and macro funds. Many liquid alternatives also have a stated goal of having a low correlation to equity and bond markets.

Brian Pollak is a Partner and Portfolio Manager at Evercore Wealth Management. He can be contacted at [email protected].