Independent Thinking®

The Race To Zero

April 17, 2015

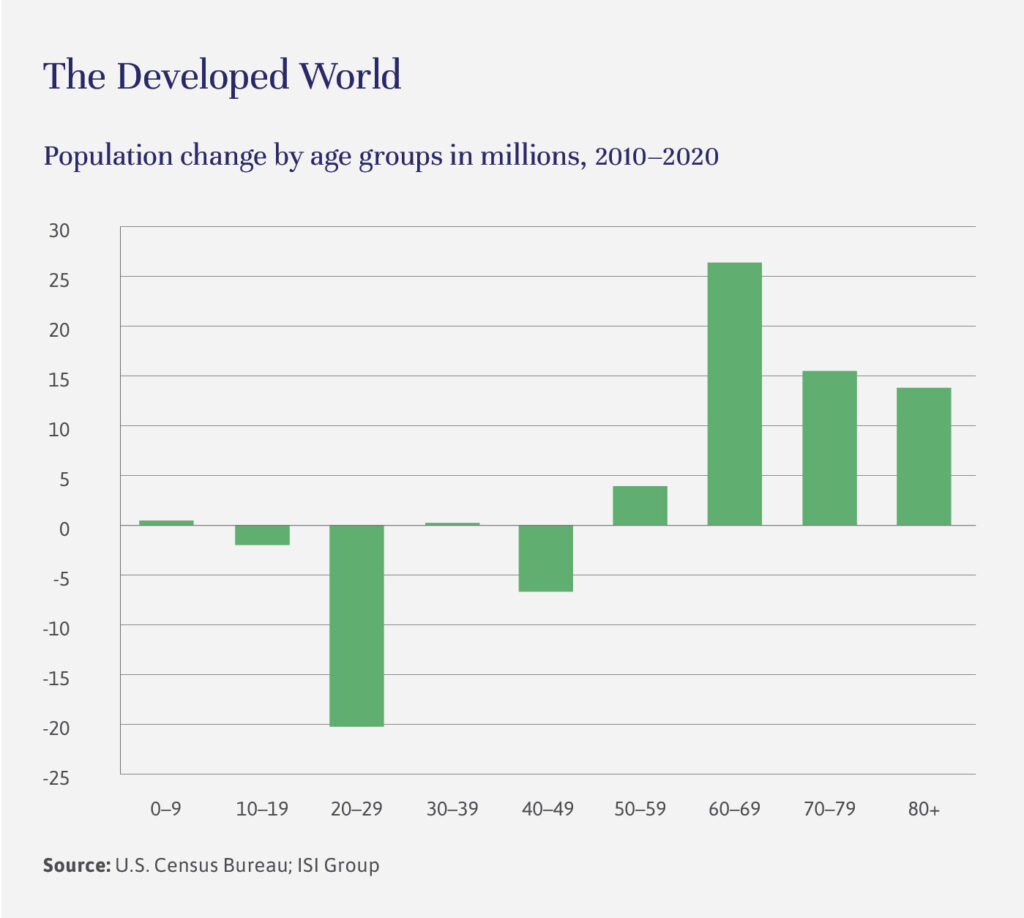

The world is engaged in the race to zero nominal interest rates, thanks to a more slowly growing and aging global population that crushes inflation, exerting continued downward pressure on inflation and nominal interest rates. The probability of a strong, synchronized world business cycle occurring any time soon is low.

China’s economic growth rate is slowing, reflecting the decline in its population of working age. Although much of continental Europe faces a similar demographic headwind, there is the possibility of a stronger cyclical recovery, reflecting still high rates of unemployment in many European countries. Thus far, however, there has been essentially no growth in bank loans. Since bank financing accounts for 80% of total financing for European companies, it is difficult for us to imagine that current signs of more robust economic activity can be sustained. While the United States addressed its banking problem before it began the fiscal stimulus, Europe has yet to do so.

Africa is a wild card in terms of global economic growth. While we are optimistic regarding the prospects for some but not all African countries, it is more realistic to conjecture that their ability to make a significant contribution is not imminent.

The asset class that we are most positive about is U.S. equities: We expect further expansion in the price-to-earnings multiple for the stock market, reflecting “lowflation,” or very low rates of price inflation, low interest rates, and positive demographics.

The usual counterargument to our lowflation forecast is that all of the money printing by central banks in the United States, Europe and Asia will create a global inflation problem. Inflation is a monetary phenomenon – however, our focus is on money demand, as opposed to money supply. In other words, central banks can print money, but they can’t make us spend it. Central banks are increasingly pushing on a string, as evidenced in the continued decline in the velocity of money.

The reality of continued low interest rates poses a significant change in asset choices for investors. When investors are young and working, the focus is on capital growth, which means owning risky assets. As one ages, the focus shifts toward capital preservation and the desire for an income stream. Historically, this meant a shift from equities to fixed income.

While we are not bearish on fixed income, the period of high total returns on fixed income is behind us, and the total returns from fixed income are too low to allow for this major asset shift. This will mean having to own riskier assets longer. The desire for an income stream also means an increasing appeal of stocks that pay dividends.

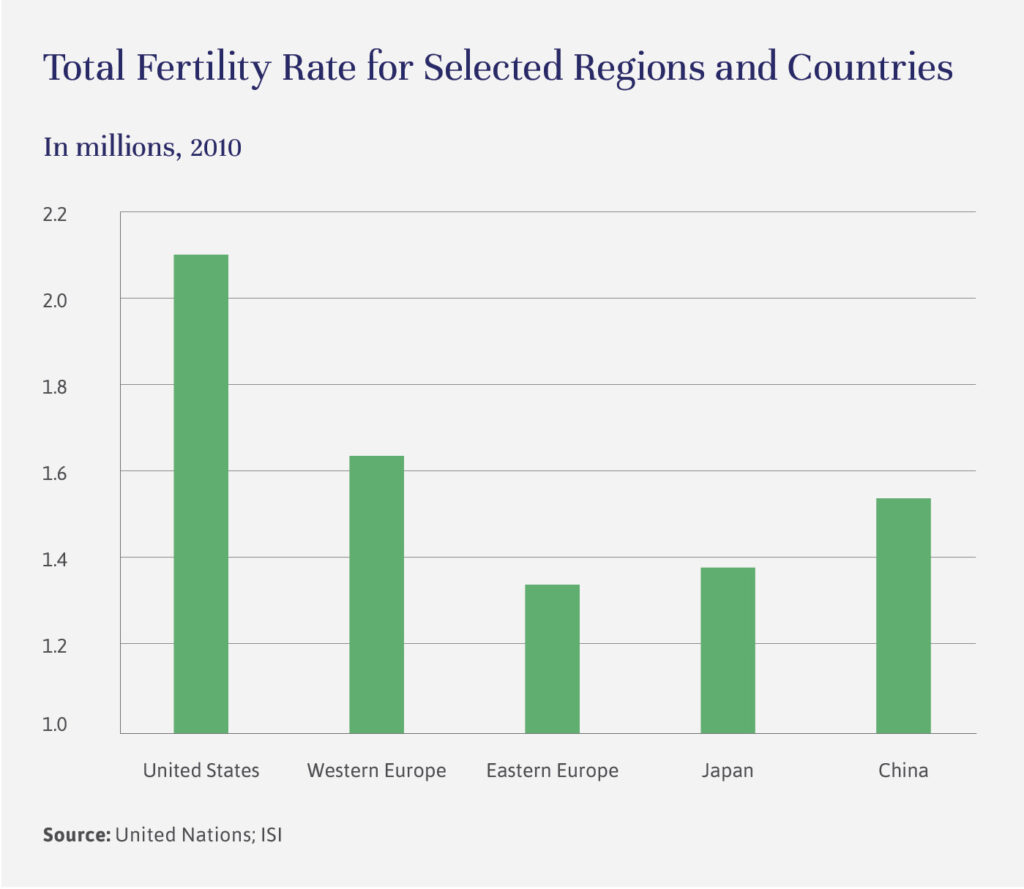

By virtue of its high birth rate, the United States possesses the most positive demographic profile in the developed world. Demand is firing on all cylinders. Aging baby boomers are shifting their consumption from goods toward experiences. That benefits the financial services and health care sectors, as well as our favorite global industry, international travel. There is an explosion in the number of people who will have the time and the money to travel outside their country of residence.

All developed countries will see a similar shift as populations age. But, unlike most of continental Europe, which faces declining demand for manufactured consumer goods because of a lack of young adults, the maturation of American Millennials is a huge positive for goods consumption. It is also a gigantic positive for housing. A lack of jobs was keeping Millennials from establishing living arrangements separate from their parents. That changed dramatically last year, and the very strong job growth recorded by Millennials is now translating into strong household formations. We are increasingly positive that housing will now begin to make a sustained contribution to U.S. economic growth this year and for many more years to come.

We remain very bullish on real growth in the United States. We expect real GDP growth to average 2.75% per year, comprised of labor force growth of 0.75% and increases in productivity of 2.0% per annum. That translates into a rising real standard of living for Americans.

Editor’s note: Richard (Dick) Hokenson is the Head of Global Demographic Research at Evercore ISI and the pioneer of the application of demographics to economic and financial market forecasting.