Independent Thinking®

Time to Plan for Progressive Tax Changes

February 26, 2021

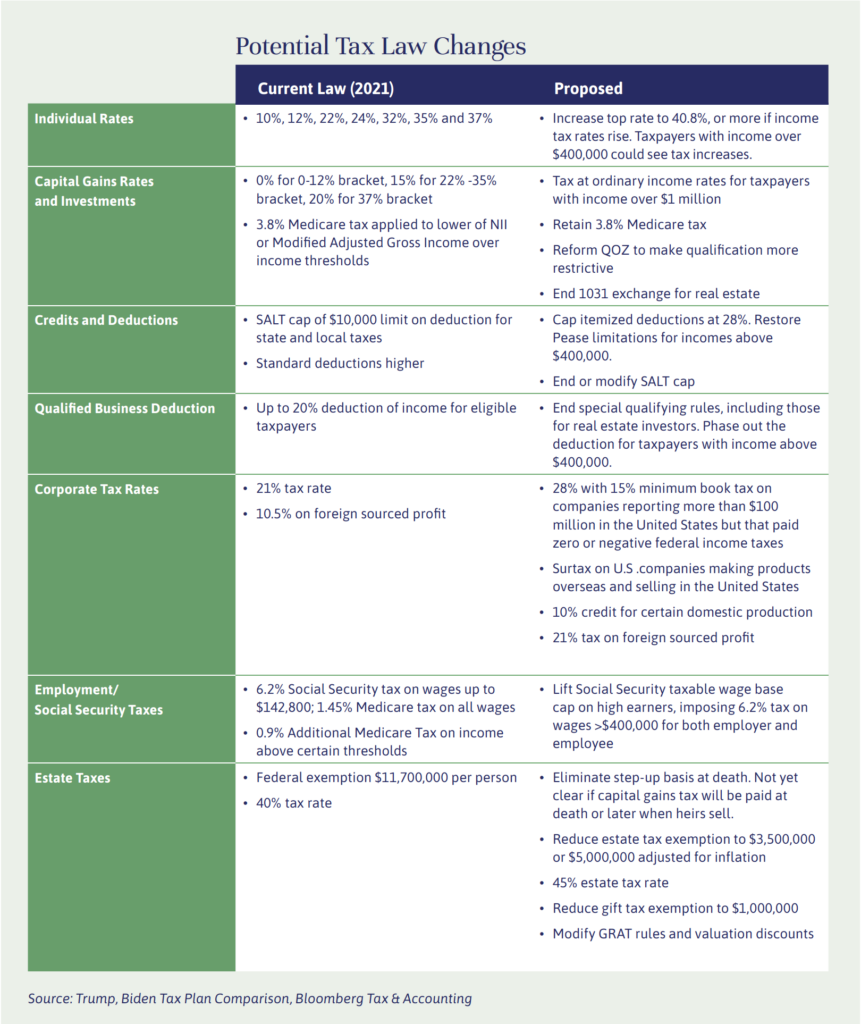

The Biden Administration’s majority in both the House and the Senate, while slim, could result in tax legislation aimed at high net worth individuals and at corporations. Negotiations will require compromise and perhaps budget reconciliation, which allows passage with just a simple majority. Other priorities, such as managing the COVID-19 response and Cabinet appointments, will probably take time. But President Biden’s message is clear, and planning now for a progressive tax code is prudent. President Biden’s proposals, as illustrated below, include raising taxes on taxpayers making more than $400,000 and expanding Social Security tax on earned income over $400,000. For individuals, the highest marginal tax rate would rise to 39.6% from 37% at present.

And for taxpayers with over $1 million in income, capital gains and qualified dividends could be subject to ordinary income tax rates, in addition to the current 3.8% net investment income tax. This would equate to a federal tax rate of 40.8% as compared to 23.8% currently.

The Administration has also proposed doing away with the popular 1031 like-kind exchange, which for almost 100 years has allowed taxpayers to defer capital gains tax on the sale of property held in a trade or business or held for investment if the proceeds were reinvested in a similar property. Examples include land, residential, commercial and rental properties.

Other proposals include capping itemized deductions at 28% and restoring the Pease limitation, which applies a 3% reduction of some deductions based on excess income over certain income thresholds. Repeal of the $10,000 SALT cap (deduction for state and local tax) has also been proposed, which could be beneficial for some taxpayers, if they are not also subject to the alternative minimum tax.

Income tax planning in a time of flux can be tricky. Acceleration of income to avoid potential future higher rates can backfire, and we believe investments in securities as well as a business or real estate should only be sold in the context of broader investment considerations. Tax-deferral strategies such as maximizing retirement plan funding and deferred compensation continue to make sense in this environment. For property sales, accelerating a 1031 like-kind exchange could be prudent, and using the installment sale method would allow for tax deferral. Further, if charitably inclined, charitable remainder trusts, or CRTs, provide stock diversification with gain recognition over a term of years while providing a stream of income for the duration of the trust as well as an upfront charitable deduction. Finally, a disciplined tax loss harvesting approach could offset gains.

Estate plans should also be reviewed now. President Biden has indicated his support for returning the estate, gift and generation-skipping transfer, or GST, exemptions to the levels in place before the Tax Cuts and Jobs Act of 2017, or TCJA. The top tax rate could increase to 45% from 40%; the gift exemption could be limited to $1 million; and the estate and GST exemptions could be reduced to either $3.5 or $5 million, adjusted for inflation, down significantly from the current exemption of $11.7 million per person. The Biden plan would also eliminate the step-up in basis at death, although it’s not yet clear whether the tax on the unrealized gain would be due at death or when an heir later sells the asset. However, previous attempts to eliminate the basis step-up have been ultimately unsuccessful.

Anyone who wishes to utilize their remaining estate, gift and GST exemptions before the TCJA sunsets at the end of 2025, or new legislation reduces the levels, should consider accelerating planning now, focusing on certain strategies in particular. Spousal Limited Access Trusts, or SLATs, can utilize exemptions while providing support to a spouse if needed. Grantor Retained Annuity Trusts, or GRATs, are also attractive, especially in this low interest rate environment, as are strategies that freeze gift values or take advantage of discounts. And, as always, we believe that taking advantage of the $15,000 annual exclusion gift and the gift exclusion for payment of qualified medical and education expenses makes good sense. If appropriate, consider using the larger generation-skipping transfer tax exemption amount to fund Dynasty or “Perpetual” Trusts in favorable jurisdictions like Delaware.

So plan now, and thoughtfully consider implementation. Of course, any aggressive gifting plans should never come at the expense of lifestyle funds, a healthy sense of control over your own affairs and/or family legacy objectives. Your Evercore team will be pleased to help you model likely outcomes and incorporate proper governance preparing for change.

Pam Lundell is a Partner and Wealth & Fiduciary Advisor at Evercore Wealth Management in Minneapolis. She can be contacted at [email protected].