Independent Thinking®

Wading into Troubled Waters: China and the United States

November 1, 2018

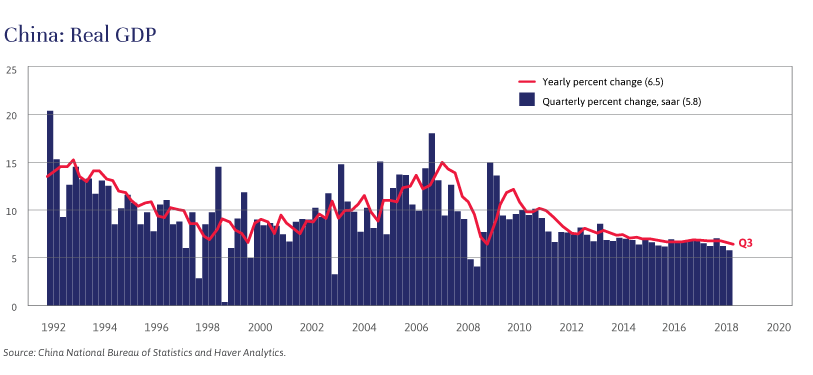

China’s exceptionally fast economic growth over the last 30 years has created the world’s second-largest economy, and it is on track to surpass the size of the U.S. economy in the next decade. But the pace of growth in China is slowing markedly, and that has broad implications across the financial markets.

There are three main reasons for the slowdown, which, as illustrated below, has taken gross domestic product growth from persistent double-digit annual rates to less than seven percent, and is likely to cause further deceleration of China’s economic growth rate.

First, China’s government realizes that the economy needs to become less dependent on investment, including export-oriented manufacturing capacity financed by extraordinary amounts of debt. Despite considerable progress in shifting the economic base toward domestic consumption, each economic slowdown creates panic that compels Beijing to permit substantial increases in borrowing. As the total amount of outstanding debt rises, the boost to GDP from each new amount of borrowing diminishes.

Second, the one-child policy, aimed at stemming overpopulation, has worked too well. China’s working-age population, once growing rapidly, is shrinking, and taking growth in economic output down with it. The one-child policy has been modified – it is now a two-child policy for many families – but demographics are likely to remain unfavorable for many years.

Third, the Trump administration is determined to eliminate the advantages that China has enjoyed from being treated as an emerging economy and a member of the World Trade Organization. The administration is also calling China out far more forcefully than past administrations have on the various ways it attempts to illicitly acquire technology and intellectual property. All warfare, said the Chinese general Sun Tzu about 2,500 years ago, is based on deception; a view that appears to be shared by the administration in this rapidly developing trade war.

President Trump’s rhetoric is focused on the U.S. trade deficit with China and what he sees as the resulting loss of manufacturing jobs, but there is more to the strategy. A recent, remarkably aggressive speech by Vice President Pence; the writings and comments of Peter Navarro, an economic adviser to the president who takes a particularly hawkish line on trade issues; and new Treasury Department regulations regarding foreign involvement in U.S. technology suggest that the administration is going to do everything it can to slow China’s economic development. It considers the Middle Kingdom as the only serious long-term economic and military rival to the United States and a threat to its view of the global order.

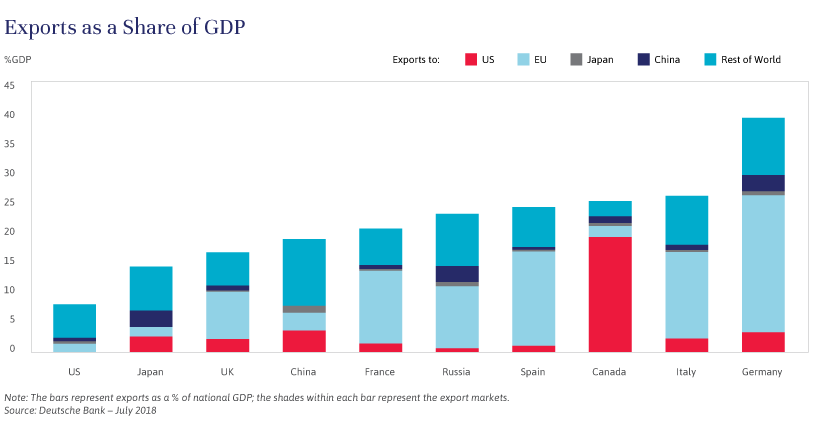

After the recent successful renegotiation of North American Free Trade Agreement with Mexico and Canada, the United States is likely to conclude trade deals with our other major trading partners, but not with China. Instead, the trade war with China is likely to intensify, curtailing China’s economic growth and putting a drag on U.S. and global growth, too, at least in the short-term. Foreign direct investment that would have gone to China may eventually be redirected to India, Vietnam and other emerging manufacturing hubs. Some manufacturing might even come back to the United States, but the real point of the administration’s policies is to retard foreign investment in China, and growth could slow substantially in the interim.

The global markets are rapidly adjusting to this new realpolitik. The U.S. economy has strong momentum and relatively low exposure to exports, as illustrated below, so the ongoing trade conflict should have a much smaller impact here than it does in China. But American corporations with large foreign operations have greatly benefited from subsidiaries in China that sell products and services to the Chinese. As tensions increase, it is uncertain whether China’s government will make life difficult for those subsidiaries because doing so would hurt Chinese employees and consumers.

A tactic the government could employ would be to devalue the Yuan and tighten capital controls, making it difficult or impossible for U.S. corporations to extract profits. We will monitor the situation closely.

A related issue is China’s foreign reserves and the status of the dollar as the premier global reserve currency. China has $3 trillion of foreign reserves, of which about $1 trillion is invested in U.S. Treasuries, which helps to fund the federal deficit. In fact, half of the total Treasury debt held by the public is in the form of foreign reserves held by foreign central banks. These reserves roughly represent the cumulative trade deficit the United States has been running with China and the rest of the world. These dollar assets continue to be held because the alternatives are not that attractive. The Euro is only 20 years old and still an experiment. The Yen cannot replace the dollar because the Japanese economy is too small, and the Yuan does not trade freely on international markets.

The lack of acceptable alternatives has allowed the dollar to maintain its global reserve currency status. But it has also allowed the United States to run up massive trade and fiscal deficits, as we discuss here. Although there has yet to be any noticeable impact, the expansion of these deficits leaves the dollar vulnerable to a diminution of its status as the world’s indispensable currency, in turn exposing the U.S. economy and financial system to various risks, including slower growth and higher interest rates.

Adjustments to our investment portfolios will be made, if necessary, as the significant changes to the U.S.-China relationship come into focus and in expectation of further developments in the continuing economic slowdown in China.

John Apruzzese is the Chief Investment Officer at Evercore Wealth Management. He can be contacted at [email protected].