Independent Thinking®

Who’s Afraid of Inflation?

June 24, 2021

Editor’s note: Evercore Wealth Management hosted an investment webinar on June 22 focusing on the prospects for – and potential impact of – rising inflation on portfolios, in addition to the firm’s current market outlook. Please contact your advisor for replay details.

Investors are right to fear rising inflation: It erodes real capital returns. But much of the market and media chatter around a resurgence of inflation after an almost 40-year lull misses a few key points that add up to one big point: The 2020s are nothing like the 1970s.

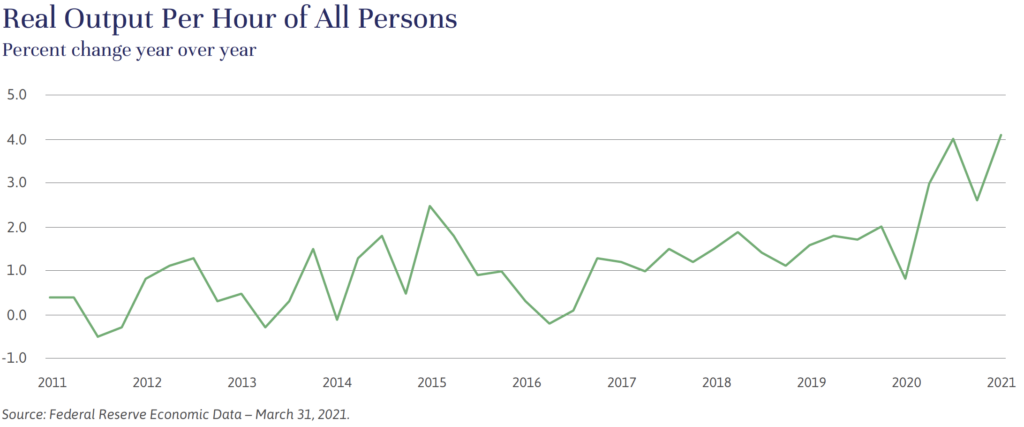

First and most important, productivity is accelerating. Productivity growth stalled in the 1970s due to low levels of innovation and the wave of Baby Boomers entering the workforce. Today, it’s growing at a rate of about 4% a year, as illustrated by the chart below, helping to neutralize the impact of rising wages and other input prices, and allowing companies to maintain or even cut prices.

Think of the time we are saving, as the pandemic forced consumers and companies to embrace digitalization more quickly than anyone could have expected.

Mobile banking, scanning and electronic signatures have relegated paper processes to the history tablets; doctors are communicating more efficiently with their patients and colleagues; and big business is exploiting big data to drive more efficient inventory management, product design and delivery.

Innovation propels further, faster innovation. New software code is written on top of previous code to achieve ever greater user-friendliness and new capabilities. System engineers are in turn continually increasing the productivity of software coders, which further compounds the productivity potential of the entire system.

Second, the U.S. dollar is reasonably stable, a far cry from the extreme volatility and 29% overall drop in the currency’s value in the 1970s, a decade marked by the abandonment of the gold standard, price controls, and the oil crises of 1973 and 1979. U.S. government deficits are high now, but so are those of most other developed countries, leaving the dollar reasonably secure as the global reserve currency. A stable dollar keeps the prices of imported goods from pressing the inflation rate higher.

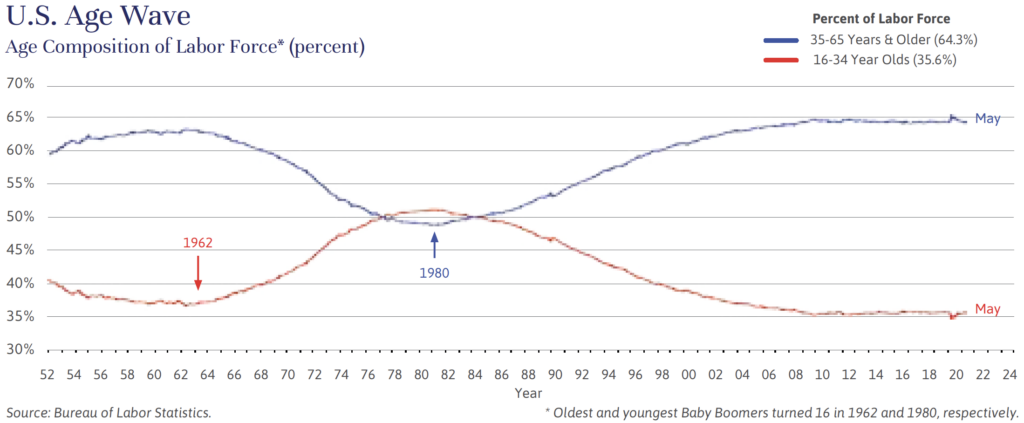

Third, the demographic trends are now almost the opposite of the 1970s, as illustrated by the chart below. The average age of workers is increasing as skilled Baby Boomers delay retirement in anticipation of longer, healthier lives. Experienced workers are more productive and do not increase spending as quickly as younger workers forming households.

But what about all the current headlines on inflation, up 5% at the CPI’s last count? There is good reason to think that this current burst is a temporary consequence of the pandemic. Both wages and prices may prove more stable than they look at present. Any inflation number looks dramatic in comparison with the spring and summer of 2020 when the economy was at a near standstill. And supply disruptions caused by the rapid shutdown of businesses and management misjudgments about how rapidly the economy would improve will be ironed out over the rest of the year. For example, the current extreme shortages of lumber will be addressed as construction projects are delayed and sawmill capacity is increased. Finally, wage pressure exacerbated by unemployment benefits will ease when the benefits dry up in the next few months.

On balance, we expect inflation to return to a sub 3% growth rate by next year and productivity to continue growing at an annual clip of 4% or more. That will protect consumers’ purchasing power and support stock valuations. But we are mindful of the risks, notably that the Federal Reserve could keep interest rates low for too long and productivity could encounter some yet unforeseen challenges. We will continue to balance portfolios between investments that do well during periods of accelerating inflation, such as real estate and businesses that have hard assets and pricing power, and assets that benefit from a return to low and stable inflations, such as various fixed income instruments.

The 2020s are not the 1970s. But some things don’t change. Now is always the hardest time to invest, and thoughtful asset allocation to diversified portfolios remains the best way to protect and grow investment portfolios.

John Apruzzese is the Chief Investment Officer of Evercore Wealth Management. He can be contacted at [email protected].