Independent Thinking®

Year-End Wealth Planning Review

October 27, 2015

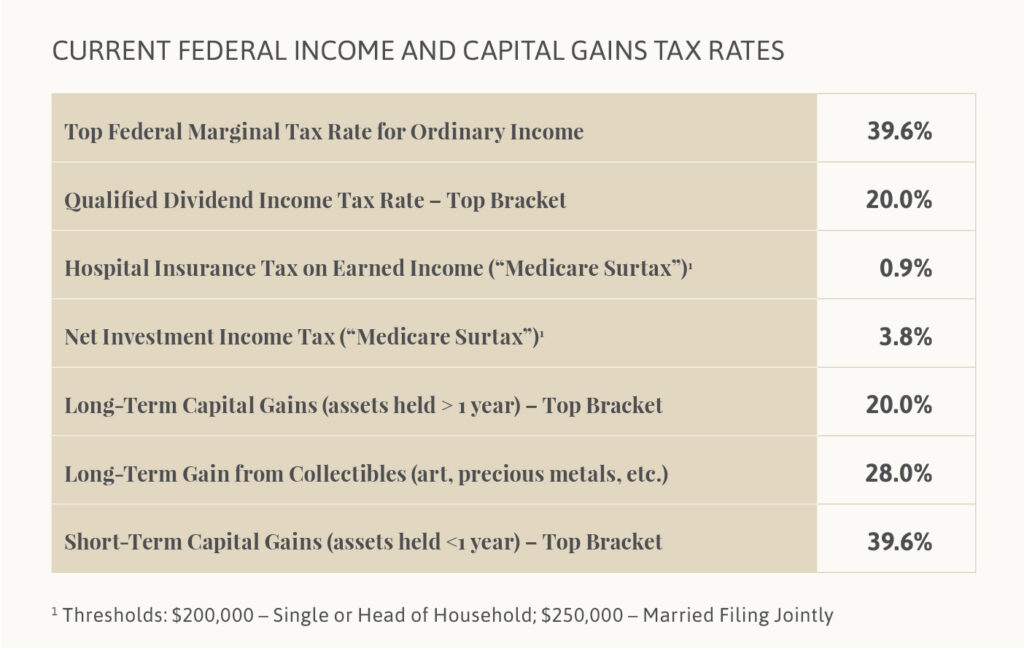

Capital Gains/Losses

While it may be beneficial to harvest capital losses within an individual portfolio by December 31, it is important to review capital gains and losses across all investment portfolios, including business assets, LLC or partnership interests, and gains on the sale of any real estate. By realizing capital losses and reinvesting the proceeds into the same general asset class, investors can use the capital losses this year but still remain invested in the market. These capital losses can be used to offset gains taken earlier in the year or carried forward to future years. One caveat: Investors must not reinvest in what the IRS deems “substantially identical securities” within the next 31 days, which would result in a wash sale and a disallowance of the loss for income tax purposes.

For portfolios inherited from recently deceased individuals, it is possible that the securities inherited may now have an unrealized capital loss since the decedent may have received a step-up in income tax basis at death (which resets the cost basis for tax purposes at the fair market value on the date of death).

Charitable Giving

Specific recordkeeping requirements must be satisfied to deduct any donations made to a charity. Donations made by check must be mailed by year-end to secure a federal income tax deduction for the fiscal year.

Given current income tax rates, individuals should consider charitable contributions using qualified appreciated stock. If the shares have been held for more than one year, the current fair market value of the securities contributed (subject to certain AGI limitations) can be deducted while avoiding the capital gains tax due on the appreciation if the asset was otherwise sold.

Investors with longer-term philanthropic objectives who would also benefit from a larger charitable deduction for the year may want to consider establishing a private foundation or donor advised fund. These vehicles allow donors to make a larger gift today and achieve current income tax planning objectives while deferring identification of the ultimate charity. Charitable remainder trusts may also be a solution for those who would like to diversify an appreciated stock position, receive a charitable income tax deduction, and retain a tax-efficient income stream for life while providing for a charity at death. However, with recent declines in equity prices, investors may wish to consider the timing of their contribution.

Gifts And Wealth Transfer

The lifetime federal gift, estate and generation-skipping tax exemption increased to $5,430,000 in 2015 from $5,340,000 per individual. Individuals who utilized all of their exemption in 2014 can make a gift of an additional $90,000 exempt from federal estate, gift, and generation-skipping tax.

Annual exclusion gifts allow individuals to give up to $14,000 per year to anyone without incurring gift tax (married couples may give up to $28,000). Parents or grandparents may also want to consider additional tax-free gifts in the form of direct payments for health insurance premiums, medical expenses or school tuition. These payments must be made directly to the applicable institution.

For those who have fully utilized the above exclusions (or are only interested in transferring the future appreciation on their assets and not the principal), low interest rates and recent declines in asset values make this a still opportune time to implement certain estate freeze planning strategies. Intra-family loans, grantor retained annuity trusts, or GRATs, and charitable lead annuity trusts, or CLATs, are all popular strategies that may be particularly attractive in today’s low interest rate environment, depending upon the overall wealth planning objectives.

Educational Planning

529 College Savings Plans may be an effective strategy for setting aside funds for college expenses for children, grandchildren or other potential beneficiaries. 529 Plan limits are set by individual states, and the federal gift tax rules apply to contributions. Contributions are not deductible for federal income-tax purposes (although they may be deductible from state income tax). Distributions used to pay qualified tuition expenses are tax-free. By filing a gift tax return, individuals can accelerate giving, use annual exclusion gifts for the next five years, and make up to a $70,000 contribution (or a joint $140,000 contribution with his or her spouse). The owner, or contributor, of the 529 Plan may also change beneficiaries or withdraw assets (subject to a penalty) in the future, should circumstances change.

Trust Distributions

Non-grantor trusts are subject to the highest income tax rates and Medicare surtax income above the threshold amount of $12,300. For discretionary trusts, trustees (or their advisors) will need to determine if the income should be paid out or accumulated for tax reasons, while taking into consideration the purpose of the trust and the needs of the current and future beneficiaries.

Ira Required Minimum Distributions

IRA owners who turn age 70½ during 2015 have until April 1, 2016 to take their first required minimum distribution and must take the second by December 31, 2016. Owners already taking distributions must take their annual required minimum distributions by December 31, 2015.

Ira And Retirement Plan Contributions

The maximum contribution amount for both traditional IRAs and Roth IRAs is $5,500 for 2015 (subject to eligibility requirements). Contributions may be made until April 15, 2016 and still be counted for the 2015 tax year. Individuals age 50 and over are eligible to make an additional $1,000 catch-up contribution.

The maximum salary deferral limit for 401(k), 403(b), and 457 plans in 2015 is $18,000. Individuals age 50 and over may contribute an additional $6,000 per year.

Individuals with self-employment income may also consider establishing a SEP-IRA or Defined Benefit Pension Plan, which may permit a higher tax-deferred contribution level.

Beneficiary Designations

This is an excellent time to review beneficiary designations for IRAs, qualified plans, and life insurance policies. The distribution of these accounts is determined by the beneficiary form, not by the individual’s will. Beneficiary designations should generally be individuals, not an estate, and should include primary and successor beneficiaries. There may be reasons to consider trusts, though careful drafting is essential. Individuals with testamentary charitable bequests should consider using IRAs or qualified plan beneficiary designations to appoint these assets to charity, for both income and estate tax savings. Finally, life changes such as birth, divorce, and death also necessitate modifications to beneficiary designations.

Please contact your wealth advisor to discuss these topics.

Editor’s note: This is an extract from a briefing sent in early October to Evercore Wealth Management clients. Wealth planning is tailored to the unique circumstances of each individual and family.